If you’re among the 80% of Americans grappling with various forms of debt, don’t worry – a path to financial freedom is within reach. Discover these 8 ways to pay off your debt and pave the way toward achieving your financial aspirations.

- Understanding Debt

- 1. Crafting a Financial Blueprint: The Power of Budgeting

- 2. Strategic Debt Prioritization: Maximizing Impact

- 3. Exceeding Minimum Payments: Elevating Financial Health

- 4. Halting Credit Card Expenses: A Pivotal Step

- 5. Monetize Unneeded Possessions: Transform Clutter into Cash

- 6. Emergency Fund Shield: Balancing Security and Debt Reduction

- 7. Windfalls as Catalysts: Capitalizing on Unexpected Gains

- 8. Freelancing for Extra Income: Expanding Financial Horizons

- Conclusion

Understanding Debt

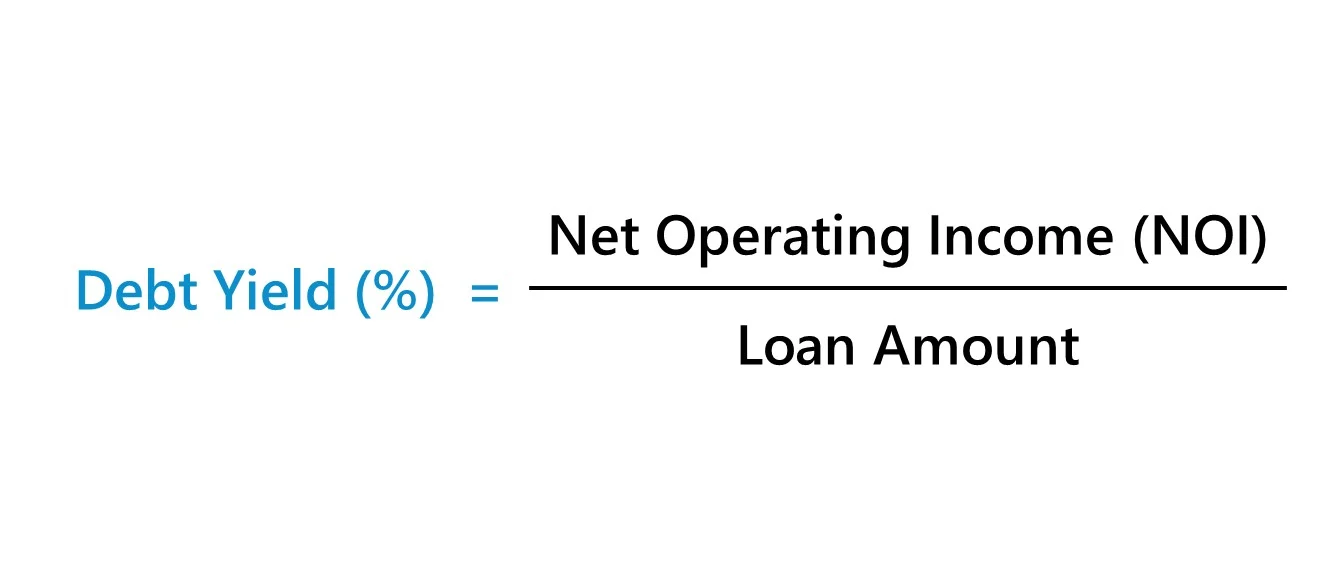

Debt, essentially borrowed funds, serves as a financial tool to cover expenses beyond immediate means. Whether it’s student loans, mortgages, auto loans, or credit card debt, each type carries distinct interest rates and repayment timelines. To unravel the intricacies of debt elimination, begin by meticulously recording all obligations, noting due dates, minimum payments, and interest rates.

1. Crafting a Financial Blueprint: The Power of Budgeting

Initiate your debt-free voyage by establishing a monthly budget. Document your expenditures, set limits for necessities like groceries, gas, personal care, and fitness. The surplus income determined unveils the pace at which you can retire your debt. Regularly tracking expenses can unveil potential areas for spending reduction, channeling more funds toward debt clearance.

2. Strategic Debt Prioritization: Maximizing Impact

Not all debts are equal – prioritize based on interest rates, due dates, or tax-deductibility. Address high-interest loans promptly to minimize accrued interest. However, factor in due dates to avoid late payment repercussions, which can harm your credit score. Tax-deductible loans, like those for home or education, may warrant a different approach, emphasizing the importance of tailored debt management.

3. Exceeding Minimum Payments: Elevating Financial Health

Surpassing minimum loan payments not only accelerates debt reduction but also enhances your credit utilization ratio – a pivotal credit score component. This ratio, comparing credit card balance to limit, influences your risk profile. Lenders view higher-than-required payments favorably, bolstering your eligibility for future loans.

4. Halting Credit Card Expenses: A Pivotal Step

Conquering credit card debt necessitates curbing or discontinuing credit card usage. Analyze recent expenditures to identify areas of restraint. Remove stored credit card details from online accounts and carry the card solely for essential purposes. This deliberate approach minimizes impulsive spending, reinforcing your debt-free pursuit.

5. Monetize Unneeded Possessions: Transform Clutter into Cash

Unearth hidden financial potential by selling unused items. Evaluate their worth on platforms like eBay or Amazon, refurbishing them if possible. The funds generated might pleasantly surprise you, injecting momentum into your debt settlement strategy.

6. Emergency Fund Shield: Balancing Security and Debt Reduction

While allocating income to debt repayment is crucial, securing an emergency fund remains equally vital. This financial safety net shields against unforeseen expenses, averting the need for high-interest debt in emergencies. Striking a balance between debt repayment and emergency preparedness ensures comprehensive financial stability.

7. Windfalls as Catalysts: Capitalizing on Unexpected Gains

Unexpected windfalls, be it work bonuses or inheritances, can significantly impact debt reduction. Allocating these windfalls judiciously strengthens your financial position, aligning with debt-free aspirations. Utilize such bonuses to forge a debt-free future rather than succumbing to impulse purchases.

8. Freelancing for Extra Income: Expanding Financial Horizons

Tap into your skills – whether in design, marketing, or data entry – through freelancing. Platforms like Fiverr, Freelancer and Upwork offer diverse opportunities. Augmenting your income stream expedites debt repayment, bringing you closer to financial freedom.

Conclusion

Mastering the art of debt repayment emerges as a pivotal journey. With strategic planning, disciplined budgeting, and intentional choices, you can navigate the complexities of debt and set the stage for a brighter financial future.