Are you a savvy investor looking to unlock financial success? Understanding the debt yield formula is key to making smart investment decisions. In this article, we will dive deep into this important financial metric and explore how it can help you assess the risk and profitability of a real estate investment.

The debt yield formula is a simple yet powerful tool that measures a property’s ability to generate sufficient cash flow to cover its debt obligations. By calculating the debt yield ratio, investors can determine whether a property’s income is enough to cover its debt payments. This allows them to evaluate the level of risk associated with a particular investment and make informed decisions.

Whether you are a seasoned real estate investor or just starting out, mastering the debt yield formula is important for making sound financial choices. It provides valuable insights into a property’s financial health and can help you assess its potential return on investment.

In this article, we will walk you through the steps to calculate the debt yield ratio and explain its significance in the investment world. Why understanding the debt yield formula is crucial for investors.

- Why Understanding The Debt Yield Formula Is Crucial For Investors

- How The Debt Yield Formula Is Calculated

- Factors That Affect The Debt Yield Ratio

- Examples of How The Debt Yield Formula Is Used In Real Estate Investment

- Strategies For Maximizing The Debt Yield Ratio

- Common Misconceptions About The Debt Yield Formula

- Resources For Further Learning About The Debt Yield Formula

- The Role of The Debt Yield Formula In Investment Decision-Making

- Conclusion

Why Understanding The Debt Yield Formula Is Crucial For Investors

The debt yield formula is a simple yet powerful tool that measures a property’s ability to generate sufficient cash flow to cover its debt obligations. By calculating the debt yield ratio, investors can determine whether a property’s income is enough to cover its debt payments. This allows them to evaluate the level of risk associated with a particular investment and make informed decisions.

The debt yield ratio is especially important for investors in the real estate market, where properties are commonly financed through loans. It provides a clear picture of a property’s financial health and helps investors assess its potential for generating returns. Without a thorough understanding of the debt yield formula, investors may find themselves investing in properties that are financially unstable and have a higher risk of default.

How The Debt Yield Formula Is Calculated

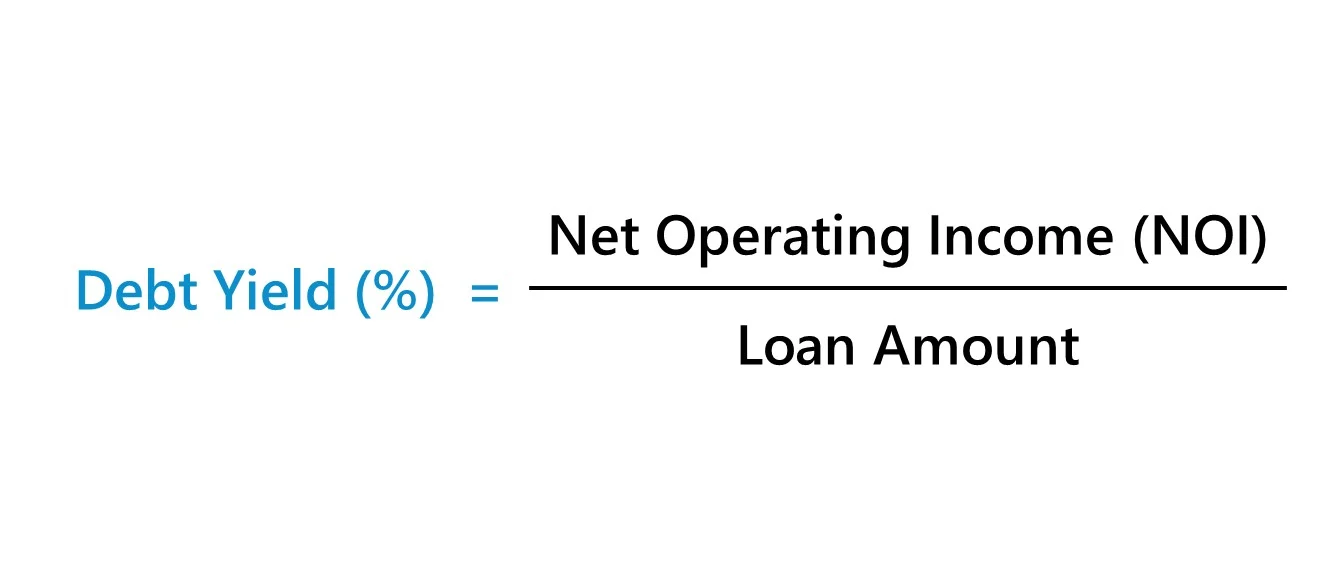

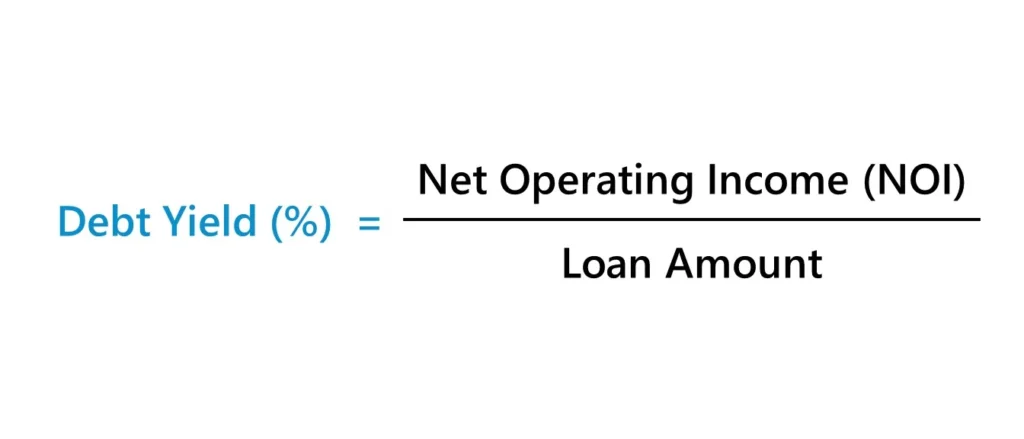

Calculating the debt yield ratio involves a straightforward formula:

Debt Yield Ratio = Net Operating Income / Loan Amount

The net operating income (NOI) represents the property’s income after deducting all operating expenses, such as property taxes, insurance, maintenance costs, and management fees. The loan amount refers to the total amount of debt used to finance the property.

For example, let’s say you are considering purchasing a commercial property with an NOI of $100,000 and a loan amount of $1,000,000. Using the formula, the debt yield ratio would be calculated as follows:

Debt Yield Ratio = $100,000 / $1,000,000 = 0.1 or 10%

This means that the property’s income is sufficient to cover 10% of its debt obligations. The higher the debt yield ratio, the better, as it indicates a lower risk of default and a higher likelihood of generating positive cash flow.

Factors That Affect The Debt Yield Ratio

Several factors can influence the debt yield ratio of a property. Understanding these factors is crucial for investors to make accurate assessments of the property’s financial health and potential return on investment.

The first factor is the property’s net operating income (NOI). A higher NOI will result in a higher debt yield ratio, indicating a stronger financial position. Investors should carefully analyze the property’s income-generating potential, taking into account factors such as rental rates, occupancy rates, and market demand.

Another factor to consider is the loan amount. The higher the loan amount, the lower the debt yield ratio will be. It’s important for investors to evaluate the terms of the loan, including interest rates and repayment periods, to ensure that the property’s income is sufficient to cover the debt payments.

Additionally, market conditions can affect the debt yield ratio. Changes in rental rates, property values, or economic factors can impact a property’s income and subsequently its debt yield ratio. Investors should stay informed about market trends and factors that may impact the property’s financial performance.

Examples of How The Debt Yield Formula Is Used In Real Estate Investment

To better understand how the debt yield formula is used in real estate investment, let’s consider a couple of examples:

Example 1: A residential property with an NOI of $50,000 and a loan amount of $500,000.

Debt Yield Ratio = $50,000 / $500,000 = 0.1 or 10%

Example 2: A commercial property with an NOI of $200,000 and a loan amount of $2,000,000.

Debt Yield Ratio = $200,000 / $2,000,000 = 0.1 or 10%

In both examples, the debt yield ratio is 10%, indicating that the properties have the potential to generate sufficient income to cover their debt obligations. However, it’s important to note that the debt yield ratio should not be considered in isolation. Investors should also assess other factors, such as market conditions, property location, and potential rental growth, to make a comprehensive investment decision.

Strategies For Maximizing The Debt Yield Ratio

Investors can employ several strategies to maximize the debt yield ratio and enhance the profitability of their real estate investments.

One strategy is to increase the property’s net operating income (NOI) by optimizing rental rates, reducing operating expenses, or improving property management. Increasing rental rates in line with market demand can boost the property’s income, resulting in a higher debt yield ratio.

Another strategy is to negotiate favorable loan terms, such as lower interest rates or longer repayment periods. By doing so, investors can reduce the debt burden and increase the property’s ability to generate positive cash flow.

Additionally, diversifying the investment portfolio can help spread the risk and increase the overall debt yield ratio. By investing in properties with varying income streams and market exposure, investors can mitigate potential losses and increase their chances of achieving financial success.

Common Misconceptions About The Debt Yield Formula

While the debt yield formula is a valuable tool for investors, there are some common misconceptions that need to be addressed.

One misconception is that a higher debt yield ratio always indicates a better investment opportunity. While a higher ratio generally indicates a lower risk of default, it’s important to consider other factors, such as property location, market conditions, and potential rental growth. A high debt yield ratio alone does not guarantee a profitable investment.

Another misconception is that the debt yield ratio is the sole determinant of a property’s financial health. While it provides valuable insights into a property’s ability to cover its debt obligations, investors should also consider other financial metrics, such as cash-on-cash return, internal rate of return (IRR), and return on investment (ROI), to make a comprehensive assessment.

Resources For Further Learning About The Debt Yield Formula

To further your understanding of the debt yield formula and its application in real estate investment, here are some resources worth exploring:

1. Books: “Real Estate Finance and Investments” by William B. Brueggeman and Jeffrey Fisher, and “The Real Estate Game: The Intelligent Guide to Decision-Making and Investment” by William J. Poorvu.

2. Online courses: Websites like Udemy and Coursera offer courses on real estate investment and finance, where you can learn more about the debt yield formula and other essential concepts.

3. Industry publications: Stay updated with industry publications like Forbes, The Wall Street Journal, and The Real Estate Journal to gain insights from experts and stay informed about market trends.

The Role of The Debt Yield Formula In Investment Decision-Making

The debt yield formula plays a crucial role in investment decision-making, particularly in the real estate market. It provides investors with a clear understanding of a property’s financial health and its ability to generate positive cash flow.

By calculating the debt yield ratio, investors can evaluate the level of risk associated with a particular investment and make informed decisions. It helps them assess the property’s potential return on investment and identify opportunities for maximizing profitability.

Conclusion

Real estate investment is not for the faint-hearted. It requires careful analysis and evaluation of various factors to ensure a profitable venture. One such factor that plays a crucial role in investment decision-making is the debt yield formula.

The debt yield formula is a simple yet powerful tool that measures a property’s ability to generate sufficient cash flow to cover its debt obligations. By calculating the debt yield ratio, investors can determine whether a property’s income is enough to cover its debt payments. This allows them to evaluate the level of risk associated with a particular investment and make informed decisions.

To calculate the debt yield ratio, you need two key pieces of information: the property’s net operating income (NOI) and its loan amount. The formula is straightforward: debt yield ratio = NOI / loan amount. The resulting ratio is expressed as a percentage and indicates the property’s ability to generate income relative to its debt.

Understanding the debt yield formula is particularly important when evaluating properties with high leverage or those that rely heavily on debt financing. It helps investors gauge the risk associated with the investment and determine if the property’s income can cover its debt payments. A high debt yield ratio indicates a lower risk investment, while a low ratio suggests a higher risk investment.

By incorporating the debt yield formula into their investment analysis, savvy investors can gain a comprehensive understanding of a property’s financial health. This allows them to make informed decisions based on objective data rather than relying solely on gut feelings or market trends.