Are you ready to take control of your finances and reach your financial goals? Introducing the ultimate saving money planner – a powerful tool designed to help you manage your money, save smartly, and achieve your financial aspirations. This planner combines the best of budgeting and savings strategies to help you make the most of your hard-earned money.

With the ultimate saving money planner, you can track your income and expenses, set realistic budgets, and identify areas where you can cut back and save. It provides a comprehensive overview of your financial health and guides you towards making informed financial decisions.

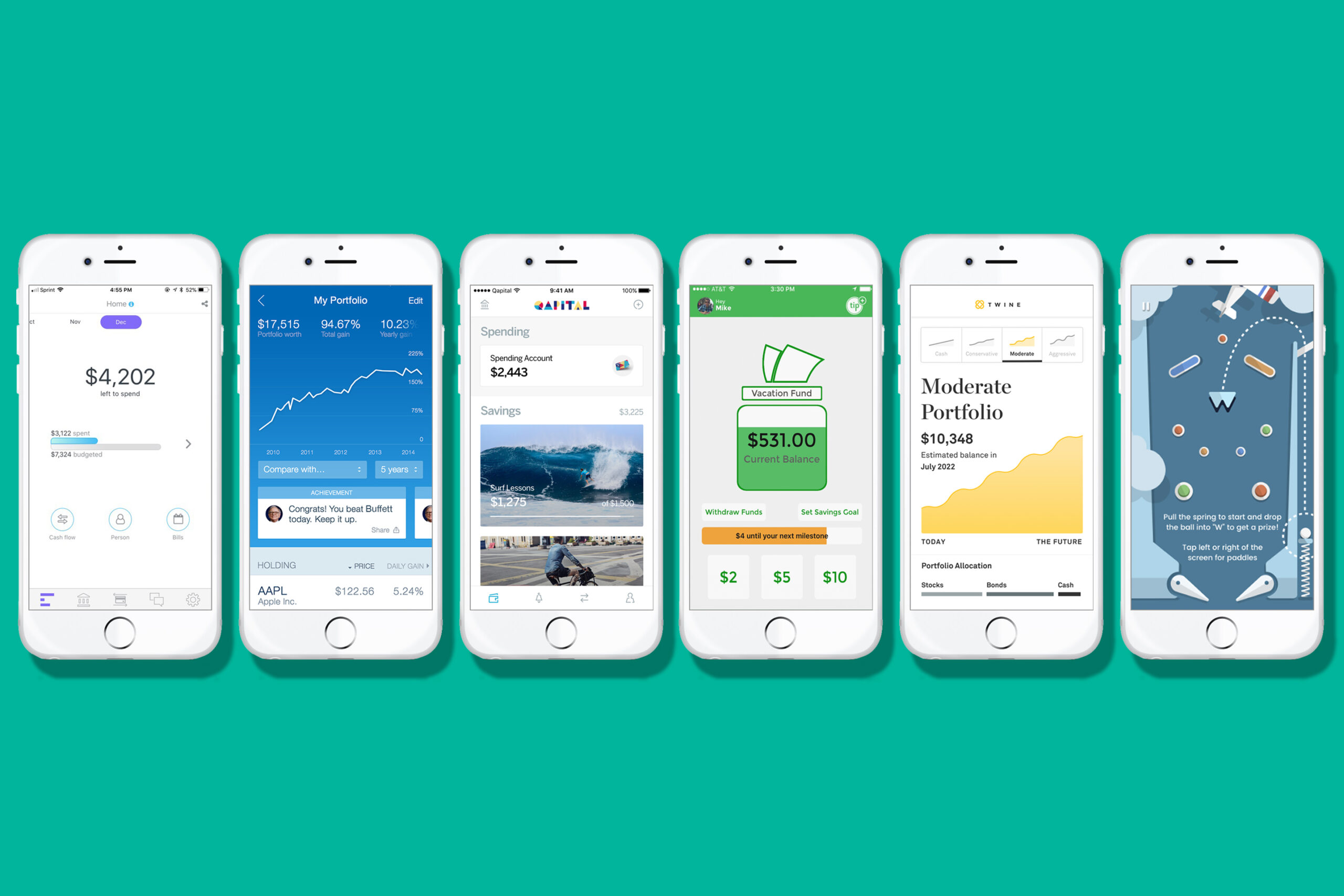

Designed with simplicity and effectiveness in mind, this planner offers a user-friendly interface and intuitive features that make managing your finances a breeze. Whether you are saving for a down payment on a house, planning for retirement, or paying off debts, this tool will empower you to take charge of your financial future.

Don’t let your financial goals remain elusive. Start your journey towards financial freedom today with the ultimate saving money planner.

- The Importance of Setting Financial Goals

- Understanding The Benefits of Saving Money

- Introducing The Ultimate Saving Money Planner

- How To Use The Saving Money Planner Effectively

- Tracking Your Expenses and Budgeting With The Planner

- Setting Short-term and Long-term Financial Goals

- Tips For Maximizing Your Savings With The Planner

- Conclusion

The Importance of Setting Financial Goals

Setting financial goals is crucial for achieving financial success. Without clear goals in mind, it’s easy to lose track of your financial progress and get caught in a cycle of spending and debt. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you give yourself a target to work towards and a roadmap to follow. It allows you to prioritize your spending, make informed financial decisions, and stay motivated throughout your financial journey.

Understanding The Benefits of Saving Money

Saving money is not just about accumulating wealth; it offers a multitude of benefits that can positively impact your life. Building an emergency fund provides a safety net for unexpected expenses, while saving for retirement ensures a comfortable future. Saving also enables you to achieve other financial milestones such as buying a house, starting a business, or funding your children’s education. Moreover, having savings allows you to enjoy peace of mind, reduce financial stress, and have more control over your financial well-being.

Introducing The Ultimate Saving Money Planner

The ultimate saving money planner is a game-changer when it comes to managing your finances effectively. This comprehensive tool is designed to simplify the process of tracking your income and expenses, creating budgets, and identifying areas where you can cut back and save. With its user-friendly interface and intuitive features, the planner makes financial management a breeze, even for those who are not naturally inclined towards numbers.

How To Use The Saving Money Planner Effectively

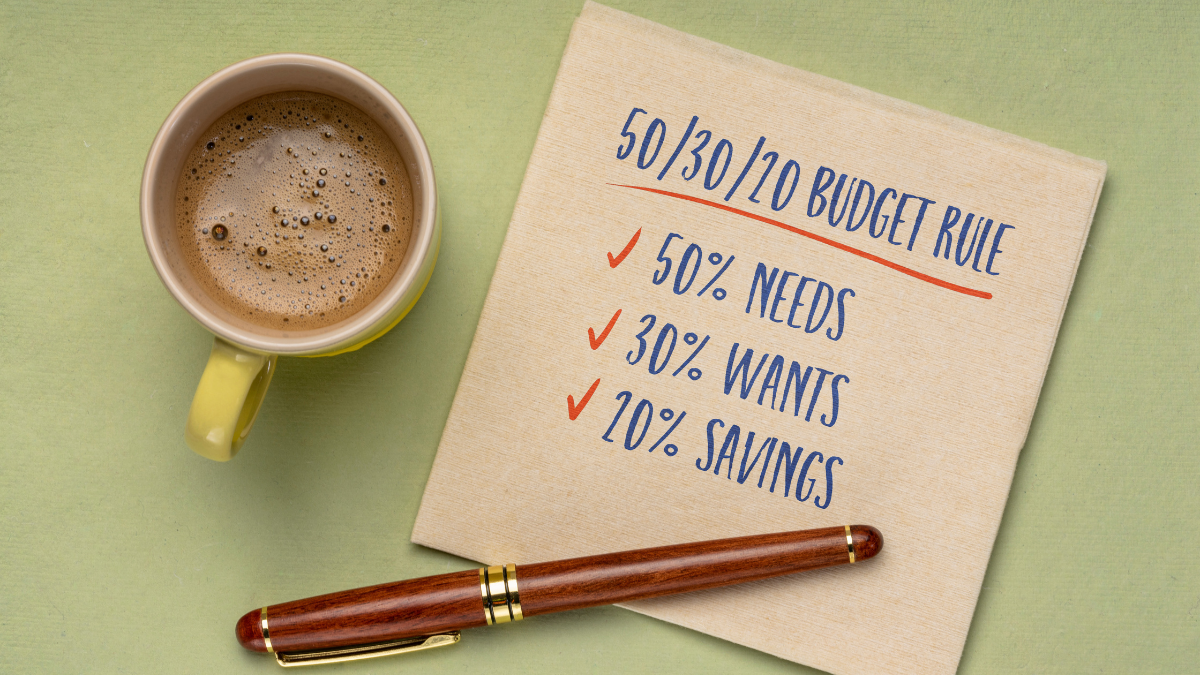

To make the most of the saving money planner, it’s essential to understand its key features and how to use them effectively. Start by inputting your income and expenses accurately to get a clear picture of your financial situation. The planner will automatically calculate your savings rate, helping you monitor your progress towards your financial goals. Use the budgeting feature to allocate funds to different categories and track your spending. Regularly reviewing your budget will help you identify areas where you can cut back and save more.

Tracking Your Expenses and Budgeting With The Planner

Tracking your expenses is a crucial step towards financial success. The saving money planner allows you to categorize your expenses and monitor where your money goes. It provides visual representations of your spending patterns, making it easier to identify areas where you can make adjustments. By setting realistic budgets and sticking to them, you can ensure that your spending aligns with your financial goals. The planner also offers alerts and reminders to help you stay on track and avoid overspending.

Setting Short-term and Long-term Financial Goals

The ultimate saving money planner encourages you to set both short-term and long-term financial goals. Short-term goals can be achieved within a year or less, such as paying off credit card debt or saving for a vacation. Long-term goals, on the other hand, take longer to achieve and often require significant financial commitment, such as buying a home or retiring comfortably. By setting a combination of short-term and long-term goals, you have a clear roadmap towards financial success.

Tips For Maximizing Your Savings With The Planner

To maximize your savings and accelerate your progress towards your financial goals, here are some tips to keep in mind:

1. Automate your savings: Set up automatic transfers from your checking account to your savings account to ensure consistent savings.

2. Cut back on unnecessary expenses: Use the planner to identify areas where you can reduce spending, such as dining out or subscriptions you no longer use.

3. Prioritize debt repayment: Allocate a portion of your budget towards paying off high-interest debt to save on interest charges.

4. Take advantage of discounts and coupons: Use the planner to plan your purchases strategically and take advantage of discounts and coupons.

5. Review your progress regularly: Check in on your financial goals and adjust your strategies as needed. Celebrate milestones along the way to stay motivated.

Conclusion

Don’t let your financial goals remain elusive. With the ultimate saving money planner, you can take control of your finances and pave the way towards financial freedom. By setting clear goals, tracking your expenses, and maximizing your savings, you can achieve your financial aspirations and create a brighter future for yourself and your loved ones. Start your journey towards financial success today with the ultimate saving money planner.