Planning for retirement can be overwhelming, especially when it comes to understanding the different types of retirement accounts available. Two popular options are Roth IRAs and Traditional IRAs, each with their own set of advantages and considerations. Deciding which one is right for you requires careful consideration of your individual financial goals and circumstances.

In this article, we will explore the differences between Roth IRAs and Traditional IRAs, helping you make an informed decision about which retirement account best suits your needs.

A Roth IRA offers tax-free withdrawals in retirement, making it an appealing option for those expecting to be in a higher tax bracket in the future. On the other hand, a Traditional IRA provides potential tax deductions in the year contributions are made, which can be advantageous for those seeking to lower their current tax liability.

By examining the pros and cons of each type of retirement account, we aim to provide you with the information you need to navigate the complex world of retirement planning. Join us as we get into the details and help you determine which option aligns with your financial goals and aspirations.

- Understanding the Differences Between Roth IRA and Traditional IRA

- Eligibility and Contribution Limits for Roth IRA and Traditional IRA

- Tax Advantages of Roth IRA and Traditional IRA

- Withdrawal Rules and Penalties for Roth IRA and Traditional IRA

- Factors To Consider When Choosing Between Roth IRA and Traditional IRA

- How To Open a Roth IRA or Traditional IRA account

- Converting From Traditional IRA to Roth IRA

- Conclusion

Understanding the Differences Between Roth IRA and Traditional IRA

When it comes to retirement planning, understanding the differences between Roth IRAs and Traditional IRAs is crucial. Both accounts offer tax advantages, but they differ in terms of taxation at the time of contributions and withdrawals.

A Roth IRA is funded with after-tax dollars, meaning contributions are made with money that has already been taxed. This allows for tax-free withdrawals in retirement, as the contributions have already been taxed. In contrast, a Traditional IRA is funded with pre-tax dollars, which can provide a tax deduction in the year contributions are made. However, withdrawals from a Traditional IRA are subject to income tax.

It’s important to note that Roth IRAs have income eligibility limits, while Traditional IRAs do not. This means that not everyone may be eligible to contribute to a Roth IRA, depending on their income level. Additionally, both types of accounts have contribution limits that may change from year to year.

Understanding these fundamental differences is key to determining which type of retirement account is best suited for your individual needs and financial goals.

Eligibility and Contribution Limits for Roth IRA and Traditional IRA

Eligibility and contribution limits are important factors to consider when deciding between a Roth IRA and a Traditional IRA.

For a Roth IRA, there are income limits that determine eligibility. In 2021, the income limit for single filers is $140,000, and for married couples filing jointly, it is $208,000. If your income exceeds these limits, you may not be eligible to contribute directly to a Roth IRA. However, there is a workaround known as a “backdoor” Roth IRA, which involves making a non-deductible contribution to a Traditional IRA and then converting it to a Roth IRA.

The contribution limits for both Roth IRAs and Traditional IRAs are determined by the IRS and may change from year to year. In 2021, the maximum contribution limit for both types of accounts is $6,000 for individuals under the age of 50, and $7,000 for individuals aged 50 and older. It’s important to note that these limits are per person, not per account. This means that if you have both a Roth IRA and a Traditional IRA, the combined total contributions cannot exceed the annual limit.

Understanding the eligibility requirements and contribution limits for both types of retirement accounts is essential to ensure you make the most of your retirement savings.

Tax Advantages of Roth IRA and Traditional IRA

One of the key considerations when choosing between a Roth IRA and a Traditional IRA is the tax advantages they offer.

With a Roth IRA, contributions are made with after-tax dollars, meaning the money has already been taxed. This allows for tax-free withdrawals in retirement. Since the contributions have already been taxed, any qualified distributions, including earnings, are not subject to income tax. This can be advantageous for individuals who anticipate being in a higher tax bracket in the future. Additionally, Roth IRAs do not have required minimum distributions (RMDs) during the account holder’s lifetime, allowing for more flexibility in managing retirement income.

On the other hand, a Traditional IRA offers potential tax deductions in the year contributions are made. Contributions to a Traditional IRA are made with pre-tax dollars, which can lower your current tax liability. However, withdrawals from a Traditional IRA are subject to income tax in retirement. Additionally, Traditional IRAs have required minimum distributions (RMDs) starting at age 72, which means you must withdraw a certain amount each year, regardless of whether you need the funds.

Considering your current and future tax situation is crucial when deciding between a Roth IRA and a Traditional IRA. If you expect your income to increase significantly in the future, a Roth IRA may be a better option. However, if you can benefit from the immediate tax deduction and anticipate being in a lower tax bracket in retirement, a Traditional IRA may be more advantageous.

Withdrawal Rules and Penalties for Roth IRA and Traditional IRA

Understanding the withdrawal rules and penalties associated with Roth IRAs and Traditional IRAs is essential to avoid costly mistakes.

With a Roth IRA, contributions can be withdrawn at any time and at any age without incurring taxes or penalties. However, withdrawing earnings before age 59½ may result in taxes and penalties, unless an exception applies. To qualify for tax-free and penalty-free withdrawals of earnings, the account must be open for at least five years and meet certain qualifying conditions, such as reaching age 59½, becoming disabled, or using the funds for a first-time home purchase.

In contrast, withdrawals from a Traditional IRA are generally subject to income tax in retirement. If you withdraw funds before age 59½, you may also incur a 10% early withdrawal penalty, unless an exception applies. Some exceptions include using the funds for qualified higher education expenses, medical expenses, or a first-time home purchase. Additionally, Traditional IRAs have required minimum distributions (RMDs) starting at age 72, which means you must withdraw a certain amount each year to avoid penalties.

Factors To Consider When Choosing Between Roth IRA and Traditional IRA

When deciding between a Roth IRA and a Traditional IRA, it’s important to consider various factors that can impact your retirement savings.

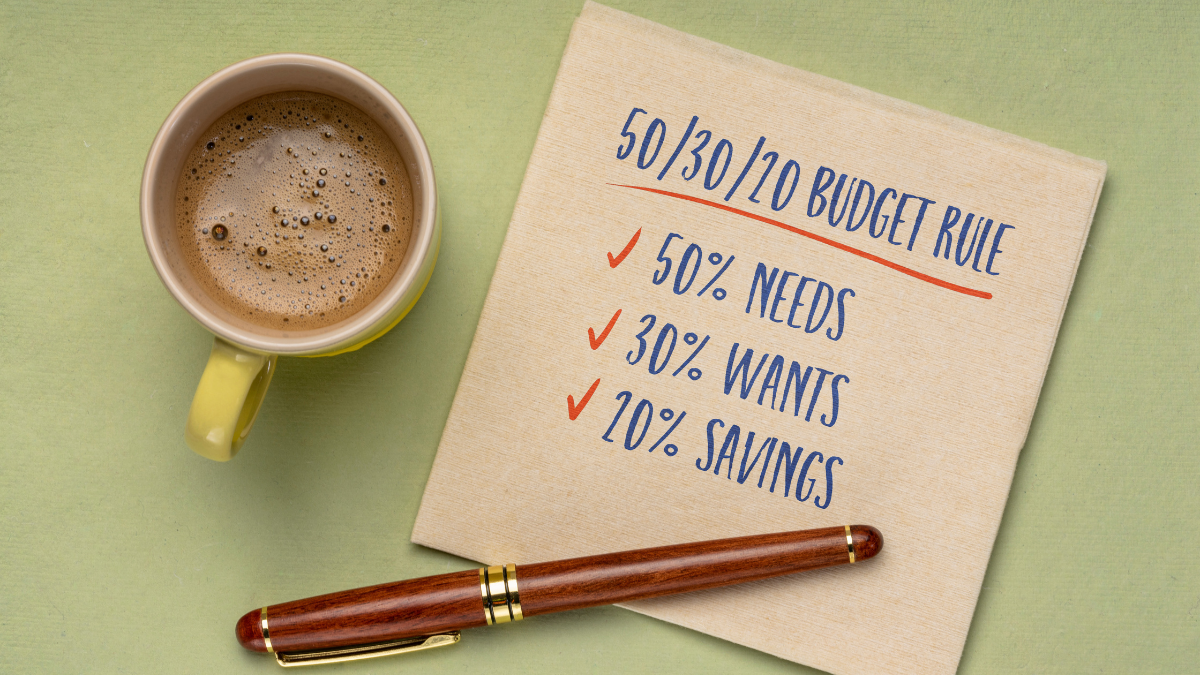

One factor to consider is your current and future tax situation. If you anticipate being in a higher tax bracket in retirement, a Roth IRA may be more advantageous, as it allows for tax-free withdrawals. On the other hand, if you can benefit from the immediate tax deduction and expect to be in a lower tax bracket in retirement, a Traditional IRA may be a better option.

Another factor to consider is your eligibility for each type of account. Roth IRAs have income eligibility limits, while Traditional IRAs do not. If your income exceeds the Roth IRA limits, you may need to consider alternative retirement savings options or explore the “backdoor” Roth IRA strategy.

Your risk tolerance is another important factor to consider. Roth IRAs offer tax-free withdrawals, but contributions are made with after-tax dollars. This means you are effectively locking in your tax rate at the time of contribution. If you believe tax rates will increase in the future, a Roth IRA may be a good choice. On the other hand, if you prefer to lower your current tax liability and are comfortable with paying taxes on withdrawals in retirement, a Traditional IRA may be a better fit.

Other factors to consider include your time horizon until retirement, your investment preferences, and your overall financial goals. It’s important to weigh these factors carefully and consult with a financial advisor if needed to make an informed decision about which retirement account is right for you.

How To Open a Roth IRA or Traditional IRA account

Opening a Roth IRA or Traditional IRA account is a straightforward process that can be done through various financial institutions.

To open a Roth IRA or Traditional IRA account, you will need to choose a financial institution that offers these types of accounts, such as a bank, brokerage firm, or mutual fund company. You can open an account online or visit a local branch if available.

When opening an account, you will need to provide personal information, such as your name, Social Security number, and contact information. You may also be required to provide proof of identity and address, such as a driver’s license or utility bill.

Once your account is open, you can begin making contributions according to the IRS guidelines. It’s important to keep track of your contributions and ensure you do not exceed the annual contribution limits.

If you already have a retirement account, such as a 401(k) or Traditional IRA, you may also have the option to convert it to a Roth IRA. This process is known as a Roth conversion and involves moving funds from a pre-tax retirement account to a post-tax Roth IRA. However, it’s important to consider the tax implications of a Roth conversion, as you will be required to pay taxes on the converted amount in the year of the conversion.

Converting From Traditional IRA to Roth IRA

Converting from a Traditional IRA to a Roth IRA can be a strategic move for some individuals. However, it’s important to carefully consider the tax implications before making the decision.

When you convert from a Traditional IRA to a Roth IRA, the amount converted is treated as taxable income in the year of the conversion. This means you will need to pay taxes on the converted amount at your current tax rate.

Converting to a Roth IRA can be advantageous if you expect your tax rate to be higher in the future. By paying taxes now, you can potentially benefit from tax-free withdrawals in retirement. Additionally, Roth IRAs do not have required minimum distributions (RMDs), allowing for more flexibility in managing your retirement income.

It’s important to note that the tax implications of a Roth conversion can be complex, and consulting with a tax advisor or financial planner is recommended. They can help you determine if a Roth conversion is right for your individual circumstances and provide guidance on minimizing the tax impact.

Conclusion

Choosing the right retirement account is a critical decision that can have a significant impact on your financial future. Roth IRAs and Traditional IRAs offer different tax advantages and considerations, and understanding the differences between the two is crucial.

A Roth IRA allows for tax-free withdrawals in retirement, making it a suitable choice for individuals expecting to be in a higher tax bracket in the future. On the other hand, a Traditional IRA provides potential tax deductions in the year contributions are made, which can be advantageous for those seeking to lower their current tax liability.

When deciding between a Roth IRA and a Traditional IRA, it’s important to consider factors such as your current and future tax situation, eligibility and contribution limits, withdrawal rules and penalties, and your overall financial goals. Consulting with a financial advisor can provide valuable guidance in making an informed decision.

Remember, retirement planning is a long-term endeavor, and regularly reviewing and adjusting your strategy is essential. By carefully considering your options and making informed decisions, you can set yourself on the path to a secure and comfortable retirement.