In an era where technology and finance intersect, the emergence of money-saving apps has revolutionized the way we manage our finances. Navigating through the myriad of options can be overwhelming, don’t worry! This guide will cover some of the best money saving apps, offering insights into how these digital tools can enhance your financial health.

#1. Empower (Formally Personal Capital)

Empower stands out as a comprehensive financial management tool. This app offers a holistic view of your finances, from net worth tracking to retirement planning. Its investment fee analyzer is particularly noteworthy, ensuring your earnings aren’t eroded by hidden costs.

#2. Capital One Shopping

Capital One Shopping revolutionizes online shopping with its automatic coupon application. This browser extension seamlessly integrates with your shopping experience, ensuring you always secure the best deals without the hassle of manual coupon searches.

#3. Upside

Upside brings a unique twist to saving, offering cash back on ordinary purchases like gas and groceries. With its user-friendly interface, Upside is a must-have for anyone looking to offset daily expenses in a high-inflation environment.

4. Fetch Rewards

Fetch Rewards is your go-to app for effortless savings on groceries. By scanning receipts, you earn points redeemable for gift cards, making it a rewarding addition to your shopping routine.

5. Ibotta

Ibotta redefines cashback shopping. With options for both in-store and online rebates across hundreds of retailers, it offers a versatile platform for earning cash on your regular purchases.

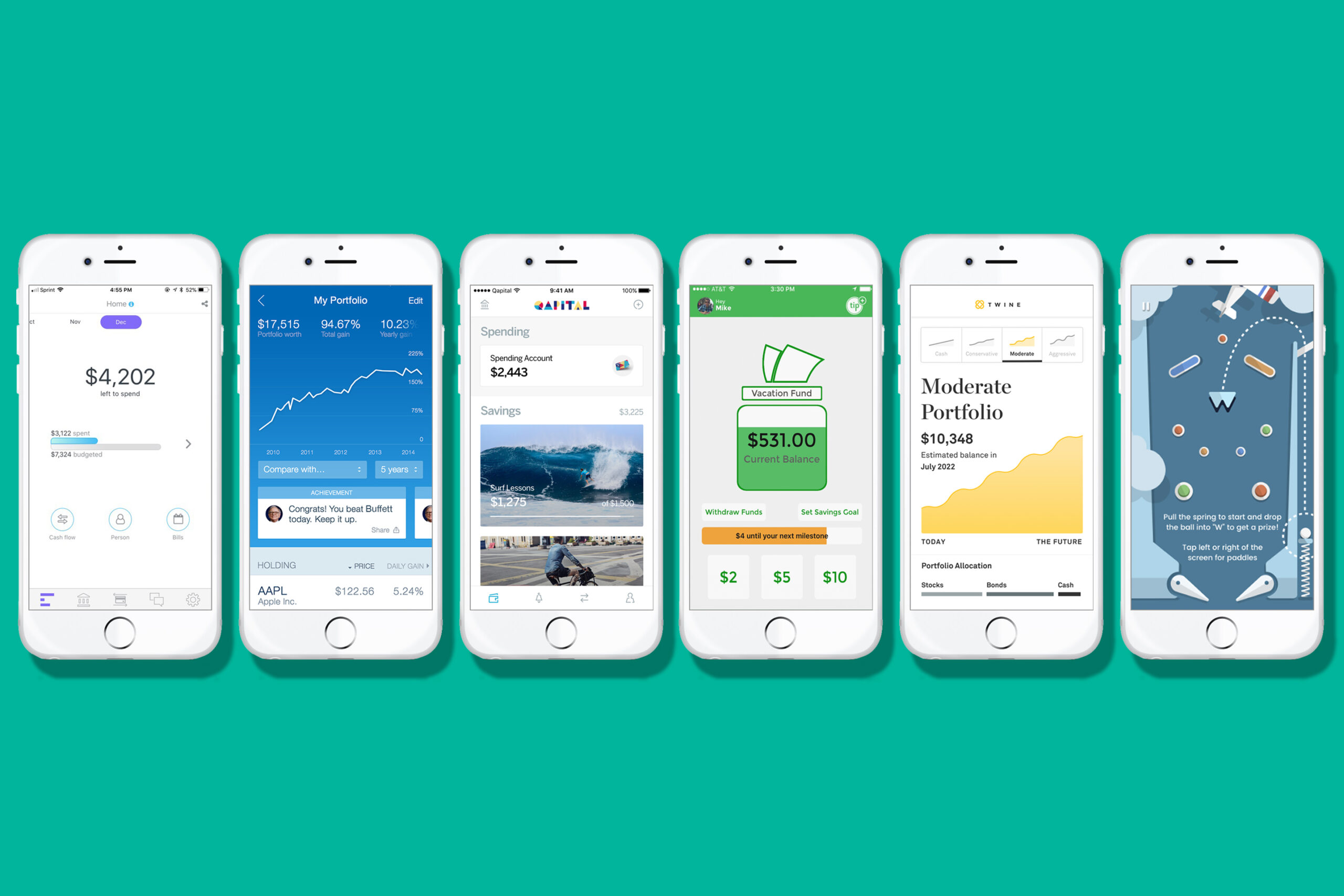

6. Qapital

Qapital introduces a gamified approach to saving. Whether it’s saving a few cents every time you tweet or rounding up your purchases, Qapital makes saving both fun and effortless.

7. Yotta Savings

Yotta Savings blends saving with the excitement of a lottery. Each $25 saved gives you a chance to win up to $10 million weekly, offering both financial prudence and the thrill of potential big wins.

8. Swagbucks

Swagbucks offers a plethora of ways to earn extra cash, from watching videos to online surveys. It’s an excellent choice for those looking to monetize their spare time.

9. Rakuten

Rakuten, formerly Ebates, is a powerhouse in the cashback world. Its simple model of earning money for normal online shopping makes it a staple in the savvy saver’s arsenal.

10. Acorns

Acorns makes investing accessible. By rounding up your purchases and investing the difference, it’s an excellent tool for those new to investing or looking to save without thinking about it.

The Verdict: Are Money Saving Apps Worth It?

These apps not only offer convenience but also bring a level of efficiency and fun to personal finance management. From cashback on purchases to smart investing, the apps listed above provide a range of options to enhance your financial well-being.

Safety and Legitimacy: A Core Consideration

When it comes to financial apps, safety is paramount. Each app mentioned in this guide is verified for its security measures, ensuring your financial information remains protected.

Conclusion: Embracing Digital Financial Management

The evolution of money-saving apps marks a significant shift in personal finance management. By leveraging these tools, you can streamline your savings, optimize your spending, and take a proactive stance towards your financial future.

In summary, the integration of technology into personal finance has opened up a new realm of possibilities for saving and managing money. By selecting the right apps from this guide, you can embark on a journey of financial empowerment and security.