Are you ready to take control of your finances and achieve true financial freedom? Look no further! In this article, we will share with you 10 money saving habits that will help you pave the way to a brighter financial future. From cutting unnecessary expenses to developing a disciplined savings plan, these tried-and-true strategies will put you on the path to financial success.

Our brand is all about empowering individuals like you to make smart financial decisions and live their best lives. With our expertise in personal finance, we’ve curated a list of practical and actionable habits that will make a real difference in your financial journey. Whether you’re just starting out or looking to make some adjustments to your current habits, these tips will set you on the right track.

Join us as we dive into the world of budgeting, saving, and investing. Learn how to prioritize your spending, trim your expenses, and create a sustainable financial plan. With these 10 savvy money-saving habits, you’ll soon be well on your way to achieving the financial freedom you’ve always dreamed of.

- 1. The Importance of Saving Money

- 2. Setting Financial Goals

- 3. Tracking Your Expenses

- 4. Creating a Budget

- 5. Cutting Back on Unnecessary Expenses

- 6. Saving on Groceries and Household Items

- 7. Automating Your Savings

- 8. Investing For The Future

- 9. Seeking Out Money Saving Resources and Tools

- 10. Celebrating Milestones and Staying Motivated

- Conclusion

1. The Importance of Saving Money

Saving money is the foundation of financial stability and achieving long-term goals. It provides a safety net for unexpected expenses and allows you to take advantage of opportunities when they arise. By cultivating a savings mindset, you are taking a proactive step towards securing your financial future. Saving money not only provides you with peace of mind but also empowers you to build wealth and achieve your dreams.

2. Setting Financial Goals

Setting financial goals is crucial for staying motivated and focused on your savings journey. Whether it’s saving for a down payment on a house, starting a business, or retiring early, having concrete goals gives purpose to your saving efforts. Begin by identifying your short-term, medium-term, and long-term financial goals. This will help you prioritize your savings and allocate your resources accordingly.

3. Tracking Your Expenses

Tracking your expenses is a fundamental step in managing your finances effectively. It allows you to identify areas where you can cut back and make smarter spending decisions. Start by keeping a record of all your expenses for at least a month. Categorize them into essential and non-essential expenses. This will give you a clear picture of where your money is going and help you identify potential areas for savings.

4. Creating a Budget

Creating a budget is a powerful tool that allows you to take control of your finances. It helps you prioritize your spending, allocate your income wisely, and avoid unnecessary debt. Start by listing all your sources of income and categorizing your expenses. Allocate a set amount for each category, ensuring that your income exceeds your expenses. Be realistic and flexible with your budget, adjusting it as needed to accommodate unexpected expenses or income fluctuations.

5. Cutting Back on Unnecessary Expenses

Cutting back on unnecessary expenses is a key money-saving habit that can have a significant impact on your financial well-being. Take a close look at your spending habits and identify areas where you can trim the fat. This might mean cutting back on dining out, canceling unused subscriptions, or finding more affordable alternatives for your everyday expenses. Small changes in your spending habits can add up over time and free up funds for more important financial goals.

6. Saving on Groceries and Household Items

Groceries and household items can take a big chunk out of your budget if not managed wisely. To save money in this area, start by planning your meals and creating a shopping list before heading to the store. Stick to your list and avoid impulse purchases. Look for sales, coupons, and discounts to maximize your savings. Consider buying in bulk and opting for store brands instead of name brands. Making small changes to your shopping habits can lead to substantial savings in the long run.

7. Automating Your Savings

Automating your savings is a simple yet powerful way to ensure that you consistently set aside money for your goals. Set up automatic transfers from your checking account to your savings account on a regular basis. This way, you won’t be tempted to spend the money before you save it. By making saving an automated habit, you’ll effortlessly build your savings over time without having to think about it.

8. Investing For The Future

Investing is a crucial step towards achieving long-term financial freedom. It allows your money to work for you and grow over time. Start by educating yourself about different investment options and their associated risks and returns. Consider working with a financial advisor to develop an investment strategy that aligns with your goals and risk tolerance. Remember, investing is a long-term game, and patience and consistency are key.

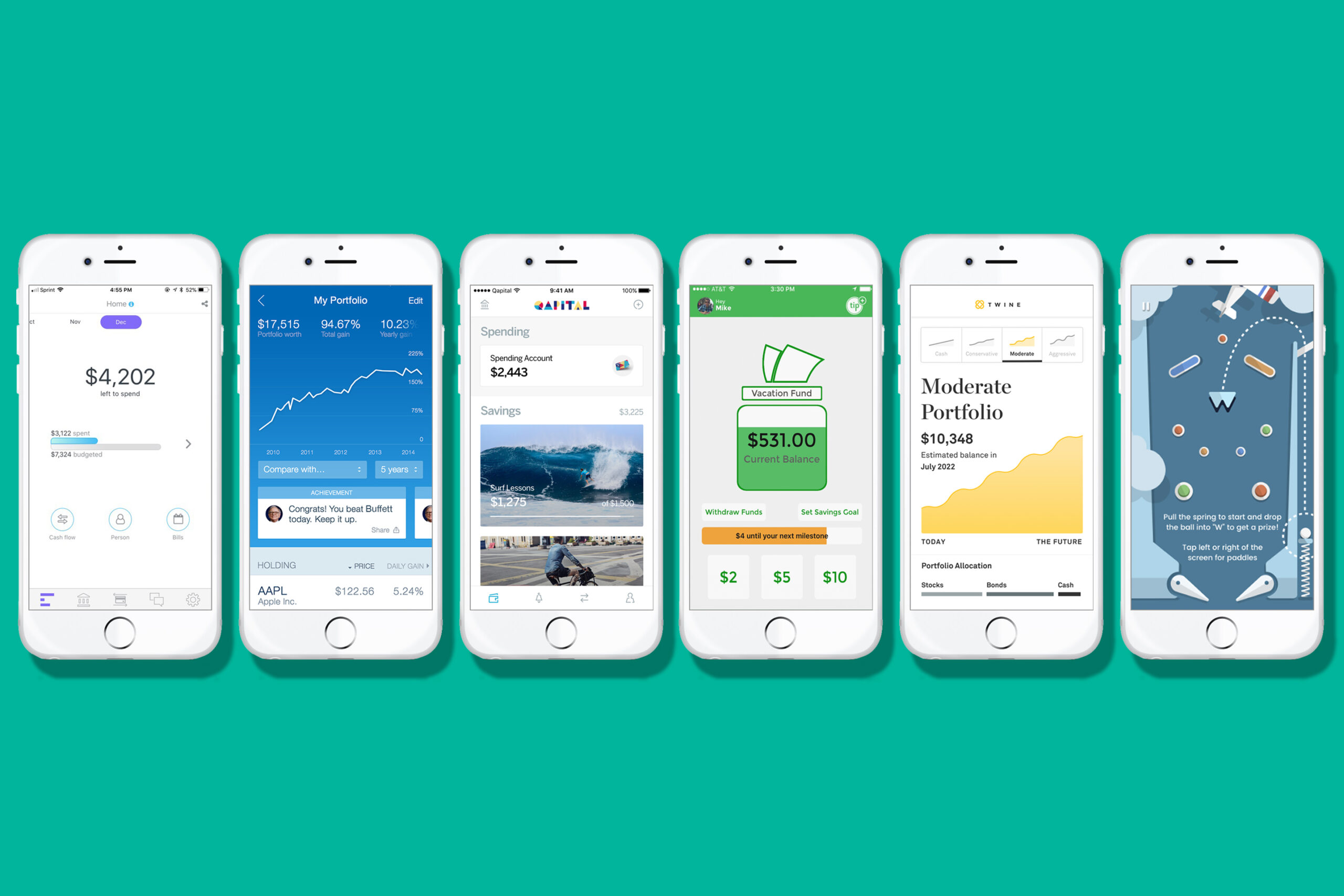

9. Seeking Out Money Saving Resources and Tools

There are plenty of resources and tools available to help you save money and make smarter financial decisions. From budgeting apps to online coupon websites, take advantage of these tools to maximize your savings. Look for free educational resources, such as personal finance blogs and podcasts, to expand your knowledge and stay updated on the latest money-saving strategies. The more you educate yourself, the better equipped you’ll be to make informed financial decisions.

10. Celebrating Milestones and Staying Motivated

Achieving financial freedom is a journey, and it’s important to celebrate your milestones along the way. Set mini-goals and reward yourself when you achieve them. This will help you stay motivated and committed to your savings habits. Remember, it’s not just about the destination; it’s about enjoying the process and learning from your financial journey.

Conclusion

By implementing these 10 savvy money-saving habits, you’ll be well on your way to achieving the financial freedom you’ve always dreamed of. Start by saving money, setting financial goals, and tracking your expenses.

Create a budget, cut back on unnecessary expenses, and save on groceries and household items. Automate your savings, invest for the future, and seek out money-saving resources and tools. Celebrate your milestones and stay motivated. With dedication and discipline, you can transform your financial life and create a brighter future for yourself and your loved ones.

So, are you ready to take the first step towards financial freedom? Start practicing these money-saving habits today and watch your financial future flourish!