Tax season is upon us, and it’s time to seize all the opportunities to boost your tax return and maximize your refund. Wouldn’t it be great to find some smart strategies that could potentially put more money back in your pocket? Well, look no further. In this article, we will unveil 10 tried-and-true techniques to help you do just that.

Whether you’re a seasoned taxpayer or a newcomer to the world of filing taxes, these strategies are designed to ensure you’re making the most of every deduction, credit, and loophole available. From utilizing tax-advantaged retirement accounts to taking advantage of education-related tax breaks, we’ve got you covered.

Don’t let tax season become a stressful ordeal. With these 10 smart strategies, you’ll be well on your way to boosting your tax return and maximizing your refund. So let’s dive in and uncover the keys to financial success this tax season.

- #1- Understanding The Tax Return Process

- #2- Smart Strategies For Tax Deductions

- #3- Maximizing Your Tax Credits

- #4- Taking Advantage of Tax-Fee Savings Accounts

- #5- Utilizing Tax-Efficient Investment Strategies

- #6- Planning for Retirement Contributions

- #7- Charitable Donations and Tax Benefits

- #8- Hiring a Professional Tax Preparer

- Conclusion

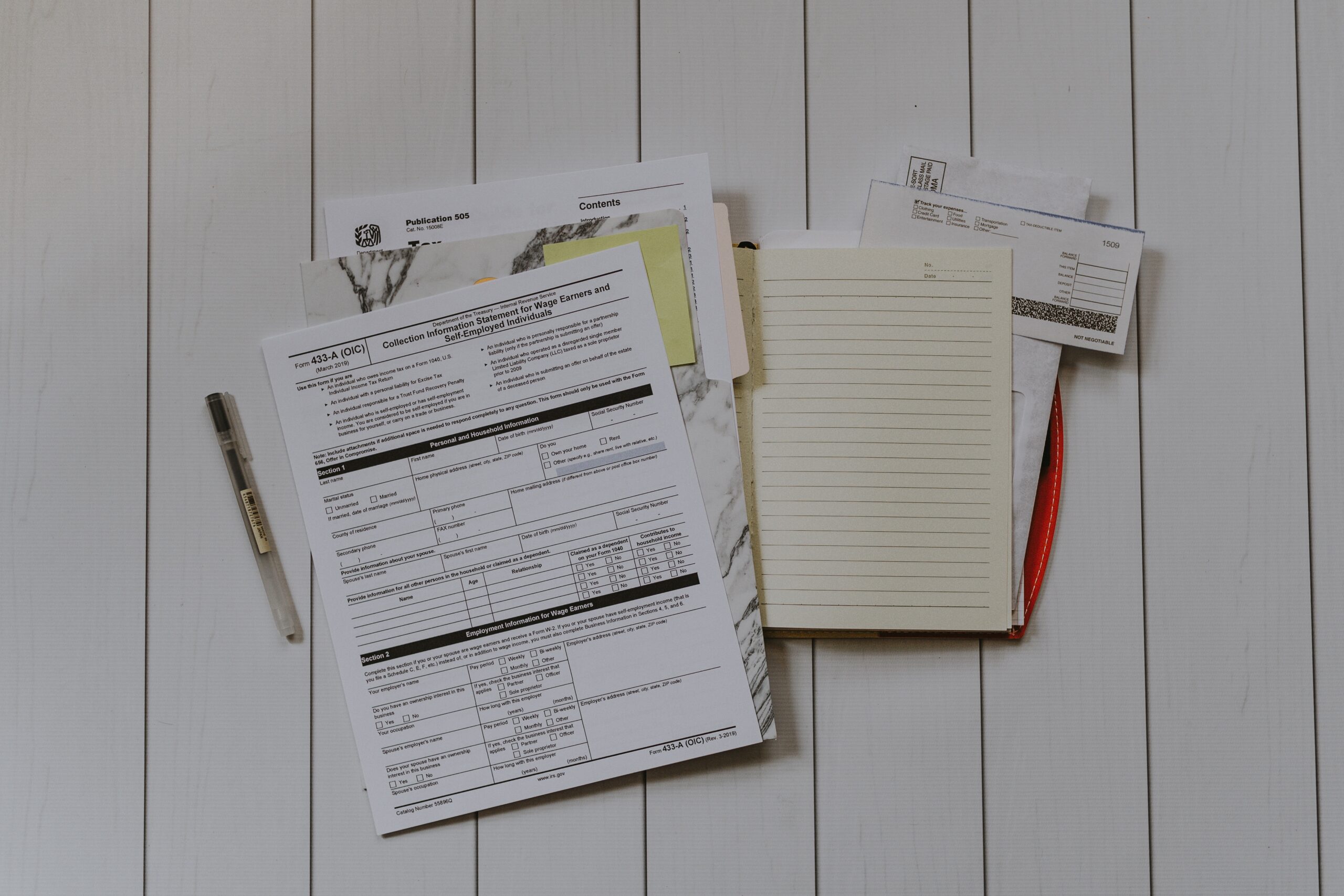

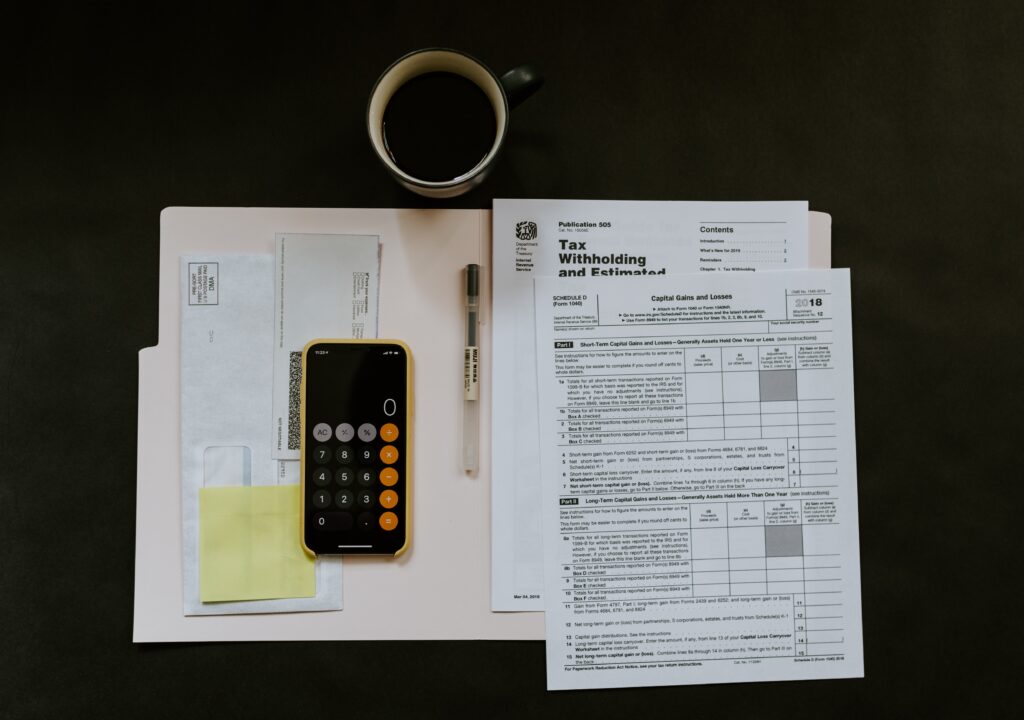

#1- Understanding The Tax Return Process

Filing taxes can be a daunting task, but understanding the process is the first step to maximizing your tax return. The tax return is a document that summarizes your income, deductions, and credits for the previous year. It determines whether you owe taxes or are eligible for a refund. To ensure accuracy, it’s essential to gather all the necessary documents, such as W-2s, 1099s, and receipts for deductions.

Once you have all your documents in order, you can choose to file your taxes yourself using tax software or hire a professional tax preparer. Tax software can guide you through the process and help you find deductions and credits you may have missed. On the other hand, a professional tax preparer can provide expert advice and ensure your taxes are filed correctly.

Understanding the tax return process is crucial because it lays the foundation for implementing the smart strategies that will boost your tax return and maximize your refund.

#2- Smart Strategies For Tax Deductions

Tax deductions can significantly reduce your taxable income and, in turn, increase your tax refund. It’s essential to identify all the deductions you qualify for and ensure you’re claiming them correctly. Here are some smart strategies to consider when it comes to tax deductions:

- Itemizing vs. Standard Deduction: Determine whether itemizing your deductions or taking the standard deduction is more beneficial for you. Itemizing allows you to claim specific expenses, such as mortgage interest, medical expenses, and charitable contributions, while the standard deduction is a fixed amount based on your filing status.

- Maximize Your Homeownership Deductions: If you own a home, make sure you’re taking advantage of deductions such as mortgage interest, property taxes, and home office expenses. Additionally, if you’ve made energy-efficient upgrades to your home, you may qualify for energy-saving tax credits.

- Don’t Overlook Education-Related Deductions: If you or your dependents are pursuing higher education, there are several deductions you may be eligible for, such as the American Opportunity Credit and the Lifetime Learning Credit. Additionally, if you’re paying off student loans, you can deduct the interest paid.

#3- Maximizing Your Tax Credits

Unlike deductions, which reduce your taxable income, tax credits directly reduce your tax liability. They are a dollar-for-dollar reduction in the amount of tax you owe. Maximizing your tax credits is a crucial strategy to boost your tax return. Here are some strategies for maximizing your tax credits:

- Child Tax Credit: If you have dependent children, you may be eligible for the Child Tax Credit, which can provide a significant reduction in your tax liability. Ensure you meet the income requirements and claim this credit to maximize your refund.

- Earned Income Tax Credit: The Earned Income Tax Credit (EITC) is a refundable credit designed to help low to moderate-income individuals and families. It’s essential to understand the eligibility criteria and claim this credit if you qualify.

- Education-Related Tax Credits: As mentioned earlier, education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit, can provide substantial tax savings. Ensure you meet the eligibility requirements and claim these credits to maximize your refund.

#4- Taking Advantage of Tax-Fee Savings Accounts

Tax-free savings accounts are a powerful tool to maximize your tax return and grow your wealth. These accounts allow you to contribute money on a tax-free basis, and any growth or withdrawals are also tax-free. Here are two tax-free savings accounts you should consider:

- Health Savings Account (HSA): An HSA is available to individuals with high-deductible health insurance plans. Contributions to an HSA are tax-deductible, and any withdrawals for qualified medical expenses are tax-free. This account provides a triple tax advantage and can be a valuable tool for saving on healthcare costs.

- Roth IRA: A Roth IRA is a retirement account that allows you to contribute after-tax dollars. The contributions grow tax-free, and qualified withdrawals in retirement are also tax-free. A Roth IRA provides tax diversification in retirement and can be an excellent way to maximize your tax return while saving for the future.

#5- Utilizing Tax-Efficient Investment Strategies

Investing wisely can have a significant impact on your tax return. By implementing tax-efficient investment strategies, you can minimize the taxes you owe and potentially increase your refund. Here are some strategies to consider:

- Tax Loss Harvesting: If you have investments that have declined in value, consider selling them to realize capital losses. These losses can be used to offset capital gains and potentially reduce your tax liability.

- Invest in Tax-Advantaged Accounts: Maximize your contributions to tax-advantaged accounts such as 401(k)s, IRAs, and Health Savings Accounts. These accounts offer tax benefits, such as tax-free growth or tax-deductible contributions, allowing you to keep more of your investment returns.

- Consider Municipal Bonds: Municipal bonds are issued by state and local governments and offer tax advantages. The interest earned from these bonds is typically tax-free, making them a tax-efficient investment for certain individuals.

#6- Planning for Retirement Contributions

Contributing to retirement accounts not only helps secure your financial future but can also have significant tax benefits. Here are some strategies to consider when planning for retirement contributions:

- Maximize Your 401(k) Contributions: Contribute the maximum amount allowed to your employer-sponsored 401(k) plan. Not only will you be saving for retirement, but your contributions are also tax-deductible, reducing your taxable income.

- Consider a Traditional IRA: If you’re not eligible for a 401(k) or want to save additional funds for retirement, consider contributing to a traditional IRA. Contributions may be tax-deductible, and your earnings grow tax-deferred until retirement.

- Explore Self-Employed Retirement Plans: If you’re self-employed or have a side gig, consider setting up a self-employed retirement plan, such as a SEP IRA or a Solo 401(k). These plans offer higher contribution limits and additional tax benefits.

#7- Charitable Donations and Tax Benefits

Making charitable donations not only allows you to give back to your community but can also provide tax benefits. Here are some strategies to maximize the tax benefits of your charitable contributions:

- Donate Appreciated Assets: If you have investments or property that have appreciated in value, consider donating them instead of cash. By doing so, you can avoid paying capital gains tax on the appreciation and receive a tax deduction for the fair market value of the asset.

- Keep Track of Your Donations: Ensure you keep detailed records of all your charitable contributions, including receipts, acknowledgment letters, and appraisals for high-value donations. These documents will be essential when it comes time to claim your tax deductions.

- Consider Donor-Advised Funds: Donor-Advised Funds (DAFs) allow you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants to charitable organizations over time. DAFs can be an effective tool for maximizing your tax benefits while strategically giving to causes you care about.

#8- Hiring a Professional Tax Preparer

While it’s possible to file your taxes on your own, hiring a professional tax preparer can provide valuable expertise and peace of mind. A professional can help you navigate the complex tax laws, identify deductions and credits you may have missed, and ensure your taxes are filed accurately. Here are some factors to consider when hiring a professional tax preparer:

- Qualifications: Look for a tax preparer who is a Certified Public Accountant (CPA), an Enrolled Agent (EA), or a tax attorney. These professionals have the knowledge and expertise to handle complex tax situations.

- Experience: Consider the tax preparer’s experience, especially if you have unique circumstances or complex tax issues. An experienced tax preparer is more likely to identify potential deductions and credits you may qualify for.

- Reputation: Research the tax preparer’s reputation by reading reviews, asking for references, or seeking recommendations from friends and family. A reputable tax preparer will have a track record of providing excellent service and maximizing their clients’ tax returns.

Conclusion

Tax season can be overwhelming, but with the right strategies, you can take control of your taxes and maximize your refund. By understanding the tax return process, utilizing smart strategies for tax deductions and credits, taking advantage of tax-free savings accounts, implementing tax-efficient investment strategies, planning for retirement contributions, making charitable donations, and considering the help of a professional tax preparer, you can significantly boost your tax return and keep more money in your pocket.

Don’t let tax season become a stressful ordeal. With these 10 smart strategies, you’ll be well on your way to boosting your tax return and maximizing your refund. So take charge of your finances this tax season and embrace the keys to financial success.