Are you ready to take control of your financial future? It’s time to break free from the constraints of living paycheck to paycheck and start building wealth. And what better way to begin your journey to financial freedom than through the pages of a book? In this article, we’ve curated a list of the top 10 must-read financial freedom books that have the power to transform your life.

Don’t miss out on the opportunity to learn from the best. Dive into these must-read financial freedom books and embark on your journey towards wealth and prosperity today.

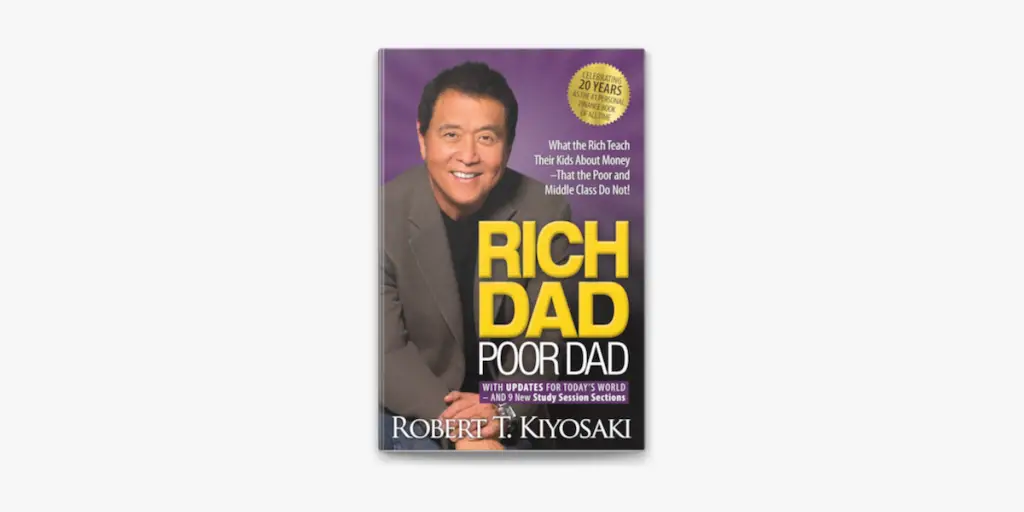

- #1- “Rich Dad Poor Dad” by Robert Kiyosaki

- #2- “The Total Money Makeover” by Dave Ramsey

- #3- “Think and Grow Rich” by Napoleon Hill

- #4- The Four-Hour Workweek” by Timothy Ferriss

- #5- “The Intelligent Investor” by Benjamin Graham

- #6- “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

- #7- “The Richest Man in Babylon” by George S. Clason

- #8- “The Magic of Thinking Big” by David J. Schwartz

- #9- “The Automatic Millionaire” by David Bach

- #10- “The Psychology of Money” by Morgan Housel

#1- “Rich Dad Poor Dad” by Robert Kiyosaki

One of the most influential books in the personal finance genre, “Rich Dad Poor Dad” by Robert Kiyosaki challenges conventional wisdom about money and offers a fresh perspective on wealth creation. Kiyosaki recounts his childhood experiences of having two fathers – his own, who struggled financially, and the father of his best friend, who was a successful entrepreneur. Through these contrasting stories, Kiyosaki teaches valuable lessons about the importance of financial literacy, investing, and building assets.

Related: Check out our “Rich Dad Poor Dad Summary” by clicking here!

Kiyosaki’s book also emphasizes the mindset required for financial success. He encourages readers to adopt an entrepreneurial mindset, take calculated risks, and think outside the box. Whether you’re just starting your financial journey or looking to improve your money management skills, “Rich Dad Poor Dad” is an essential read that will inspire and empower you to take control of your financial future.

#2- “The Total Money Makeover” by Dave Ramsey

The Total Money Makeover is a timeless classic, written by the acclaimed author Dave Ramsey. This book serves as a roadmap for individuals seeking a profound transformation in their financial lives. Ramsey’s straightforward and actionable advice has resonated with millions, making it a must-read for anyone looking to take control of their financial destiny.

In this well-crafted guide, Ramsey takes a no-nonsense approach to financial fitness. The book is not just about managing money; it’s a holistic approach to transforming your financial habits. Ramsey advocates for a debt-free lifestyle and provides a step-by-step plan to achieve it. The Total Money Makeover isn’t just a book; it’s a proven method that has empowered countless individuals to break free from the shackles of debt and build lasting wealth.

#3- “Think and Grow Rich” by Napoleon Hill

First published in 1937, “Think and Grow Rich” by Napoleon Hill is a timeless classic that has inspired generations of readers to achieve success and financial abundance. Hill spent over 20 years studying the lives and philosophies of successful individuals, including Henry Ford, Thomas Edison, and Andrew Carnegie, to distill the principles of success.

In this book, Hill explores the power of the mind and the importance of having a burning desire to achieve your goals. He also discusses the role of persistence, positive thinking, and visualization in manifesting wealth. “Think and Grow Rich” is a must-read for anyone looking to harness the power of their thoughts and unlock their full potential.

#4- The Four-Hour Workweek” by Timothy Ferriss

If you’re tired of the traditional 9-to-5 grind and looking for a way to escape the rat race, “The Four-Hour Workweek” by Timothy Ferriss is a must-read. Ferriss challenges the conventional notion of retirement and introduces the concept of lifestyle design. He shares his own experiences of building businesses that generate passive income and allow for a flexible lifestyle.

Ferriss provides practical tips for automating and outsourcing tasks, allowing readers to focus on what truly matters to them. He also explores the concept of “mini-retirements,” where individuals take extended breaks throughout their lives to pursue their passions. “The Four-Hour Workweek” is a game-changer for anyone seeking a more fulfilling and financially independent life.

#5- “The Intelligent Investor” by Benjamin Graham

The Intelligent Investor by Benjamin Graham stands as a timeless masterpiece in the realm of investing literature. This definitive guide, first published in 1949, continues to be a beacon for both novice and seasoned investors seeking to navigate the complex world of finance. Graham’s insights, distilled through decades of experience, provide a solid foundation for anyone aspiring to achieve lasting success in the stock market.

In this meticulously crafted edition, the author’s principles are presented with clarity and relevance, ensuring that even contemporary readers can grasp the essence of intelligent investing. The book covers a spectrum of topics, ranging from the psychology of market behavior to the concept of value investing. Graham’s emphasis on a disciplined and rational approach to investment sets the tone for a comprehensive exploration of strategies that stand the test of time.

#6- “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Have you ever wondered what separates the wealthy from the rest of us? In “The Millionaire Next Door,” authors Thomas J. Stanley and William D. Danko reveal the surprising habits and characteristics of America’s millionaires. Contrary to popular belief, they discovered that most millionaires are not flashy spenders but rather frugal individuals who live below their means.

Stanley and Danko provide insights into the mindset and behaviors that lead to financial success. They discuss the importance of hard work, discipline, and financial independence. By understanding the habits of millionaires, readers can gain valuable lessons and apply them to their own financial journey.

#7- “The Richest Man in Babylon” by George S. Clason

Set in ancient Babylon, “The Richest Man in Babylon” by George S. Clason offers timeless lessons on wealth accumulation and financial management. Through a series of parables, Clason teaches principles such as saving, investing, and avoiding debt.

One of the key lessons from the book is the concept of paying yourself first. Clason emphasizes the importance of saving a portion of your income before paying any bills or expenses. By following this principle and making wise investment decisions, readers can build a solid financial foundation and achieve long-term prosperity.

#8- “The Magic of Thinking Big” by David J. Schwartz

This timeless classic is not just a book; it’s a roadmap to unlocking your full potential and achieving unprecedented success. The author, with his insightful wisdom, guides readers on a transformative journey towards realizing the power of their thoughts and aspirations.

In this compelling narrative, Schwartz dives into the psychology of success, offering practical strategies to overcome self-imposed limitations. The book is a beacon of motivation for those seeking personal and professional growth. From setting ambitious goals to cultivating a positive mindset, each chapter is a treasure trove of actionable insights.

#9- “The Automatic Millionaire” by David Bach

In “The Automatic Millionaire,” David Bach introduces the concept of “pay yourself first” and demonstrates how small, consistent actions can lead to significant wealth accumulation. Bach argues that automating your finances is the key to financial success.

He provides practical strategies for saving, investing, and eliminating debt. Bach also emphasizes the importance of setting clear financial goals and creating a plan to achieve them. By implementing the principles outlined in the book, readers can take control of their financial future and become automatic millionaires.

#10- “The Psychology of Money” by Morgan Housel

Few books manage to stand out as true game-changers. “The Psychology of Money” by Morgan Housel is undeniably one such gem. This book transcends the conventional boundaries of financial advice, delving into the intricate realms of human behavior, decision-making, and the profound interplay between emotions and money.

Housel’s masterpiece doesn’t simply offer a rigid set of rules for financial success; instead, it serves as a captivating exploration of the psychological nuances that underpin our relationship with money. The author, known for his insightful perspectives, employs a writing style that effortlessly combines wisdom and accessibility. Readers will find themselves drawn into a narrative that goes beyond mere numbers, unraveling the mysteries of wealth accumulation with a refreshing and engaging approach.