Few personal finance books have achieved the level of Rich Dad Poor Dad. This Rich Dad Poor Dad Summary explores the key lessons from Robert Kiyosaki’s bestselling book, which has reshaped how people approach wealth, financial education, and financial independence.

Since its debut in 1997, this book has transformed the way people perceive money and investing. Its unconventional insights challenge traditional beliefs about earning, saving, and building wealth.

If you haven’t had a chance to read it but want a clear breakdown of its core principles, this in-depth summary covers all the key lessons. You’ll also find some of the most impactful quotes and actionable strategies to apply its teachings in real life.

Rich Dad Poor Dad Book Summary at a Glance

Robert T. Kiyosaki’s Rich Dad Poor Dad is one of the most influential personal finance books, offering a fresh perspective on wealth building and financial management.

Kiyosaki illustrates key financial principles by contrasting the money mindsets of his two father figures—his “rich dad” and his “poor dad.”

His poor dad, a well-educated salaried professional, valued hard work, job security, and higher education as the path to success. In contrast, his rich dad, a self-made entrepreneur, prioritized financial literacy over formal education. He believed wealth was built by owning businesses and investing in income-generating assets rather than relying on a paycheck.

One of the book’s most groundbreaking ideas is the distinction between assets and liabilities. Kiyosaki emphasizes that true assets put money in your pocket, while liabilities take money out. While many consider homes and cars as assets, he argues they are actually liabilities. Instead, he highlights income-producing investments—such as rental properties—as real assets.

At its core, Rich Dad Poor Dad is about financial education, smart money decisions, and breaking free from the cycle of working for money to instead have money work for you.

7 Key Takeaways from Rich Dad Poor Dad by Robert T. Kiyosaki

This book is packed with valuable insights, but here are the seven most important lessons it teaches about building wealth and achieving financial independence.

1. Focus on Assets, Not Liabilities

One of the book’s core lessons is the importance of financial independence through asset-building.

Kiyosaki explains that most people fail to distinguish between assets and liabilities:

- Assets generate income, such as real estate, stocks, and businesses.

- Liabilities drain money, including mortgages, car loans, and credit card debt.

For instance, while many consider their home an asset, Kiyosaki argues that if it doesn’t generate income, it’s actually a liability. On the other hand, rental properties that bring in steady cash flow are true assets. The key is to accumulate income-generating assets rather than liabilities that create expenses.

2. Get a Financial Education

Kiyosaki stresses that financial literacy is essential for achieving financial success.

He argues that traditional education focuses on academic and professional skills but often neglects financial management. He contrasts his two father figures:

- His poor dad was highly educated but relied on a paycheck.

- His rich dad prioritized financial literacy, investing, and entrepreneurship.

Understanding money, managing risk, and making informed financial decisions are crucial skills that can lead to wealth accumulation.

3. Own a Business Instead of Working a Job

Another major takeaway is that working for a salary won’t make you rich—owning a business will.

Kiyosaki explains that wealthy individuals acquire assets that generate income rather than exchanging time for money. Instead of working to make someone else rich, he advocates for entrepreneurship, investing, and leveraging passive income to build wealth over time.

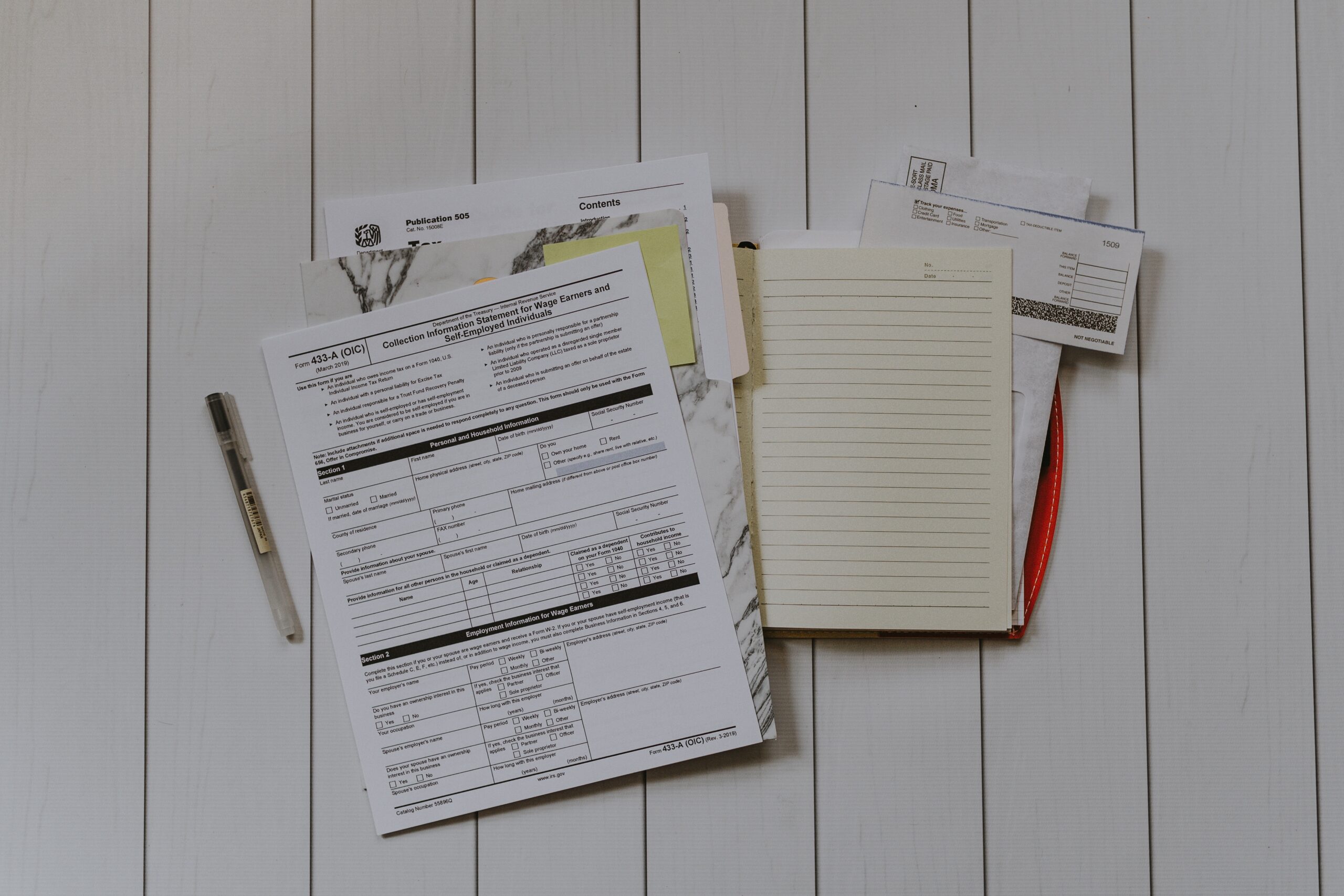

4. Master the Tax Code and Legal System

The rich use tax laws to their advantage, and Kiyosaki highlights the importance of understanding how to minimize tax liability.

Salaried employees often face high tax burdens, including income tax, Social Security, and Medicare taxes. In contrast, business owners benefit from tax write-offs, reinvestment opportunities, and lower tax rates on dividends. Structuring finances strategically can help keep more earnings and grow wealth efficiently.

5. Create Wealth by Making Money Work for You

Kiyosaki challenges the conventional belief that hard work alone leads to financial success. Instead, he argues that wealth comes from making smart financial decisions.

The rich don’t just earn money—they create it by investing in assets that generate passive income, such as:

- Businesses that operate without constant supervision

- Rental properties that provide steady cash flow

- Investments that yield dividends and long-term returns

Instead of working for money, he encourages people to acquire assets that make money work for them.

6. Work to Learn, Not Just for a Paycheck

Financial success isn’t about earning a higher salary—it’s about acquiring valuable skills.

Kiyosaki emphasizes that those who focus solely on earning a paycheck remain stuck in the “rat race.” Instead, he suggests working in roles that offer skill development and long-term opportunities.

For example, he highlights McDonald’s—not for its burgers, but for its business model. While many can cook a better burger, few can turn it into a billion-dollar franchise. Learning business, sales, and investing skills is more valuable than just earning a steady paycheck.

7. Take Smart Financial Risks

Building wealth requires stepping outside your comfort zone and seizing opportunities.

Kiyosaki explains that financial security is not the same as job security. A steady job may feel secure, but external factors can always change that. True financial security comes from having multiple income streams, such as investments, real estate, and businesses.

However, this doesn’t mean taking reckless risks. He stresses the importance of calculated risks—evaluating opportunities wisely and overcoming fear-driven decision-making. Those who take smart risks and invest strategically can escape the cycle of working for money and achieve financial freedom.

The Five Key Lessons In RIch Dad Poor Dad

These five key lessons from Rich Dad Poor Dad can help you build wealth and achieve financial success.

1. The Wealthy Make Money Work for Them

Rich people don’t trade time for money—they let their money work for them.

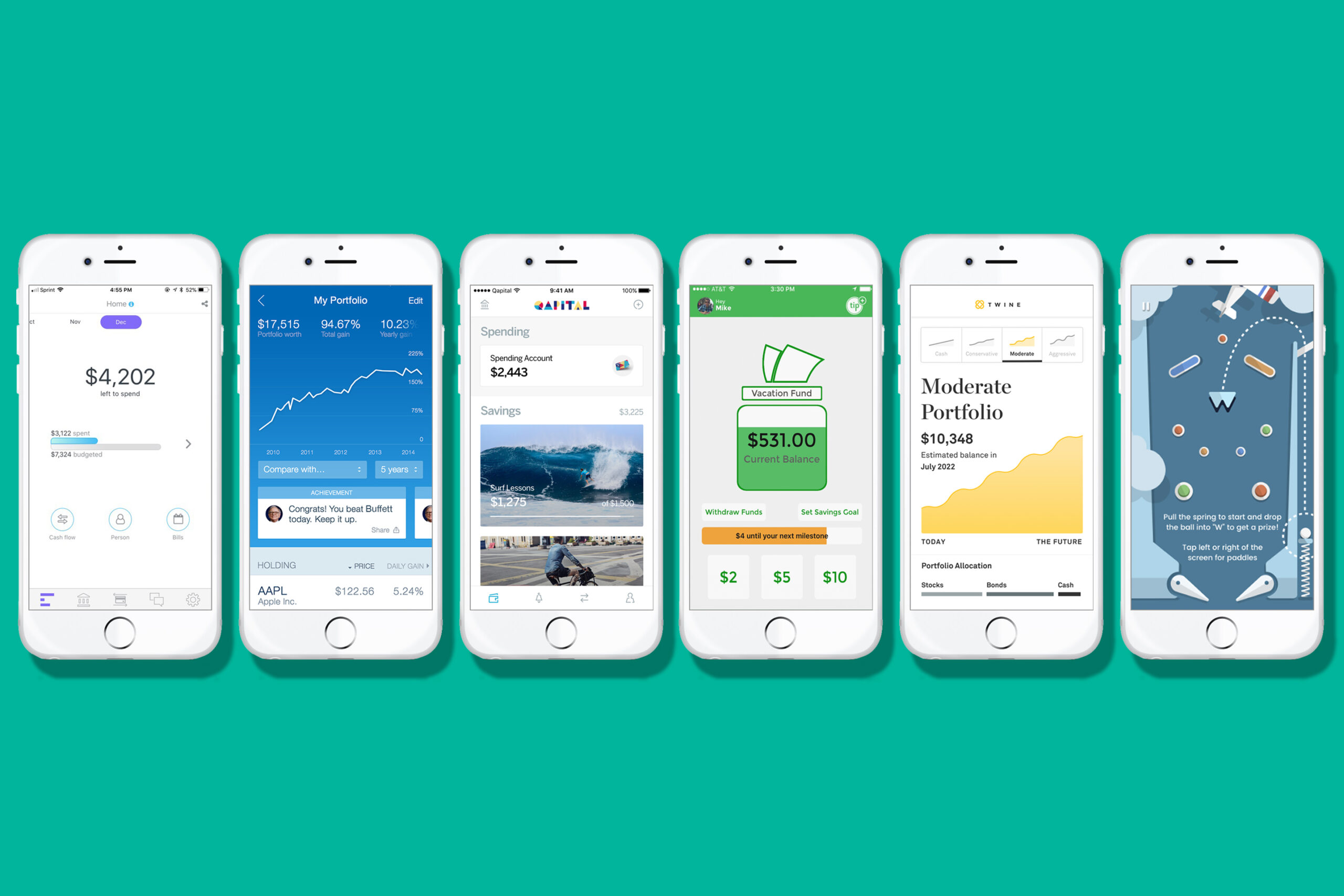

Instead of relying on a paycheck, they invest in income-generating assets that build wealth over time. Kiyosaki expands on this concept in The Cashflow Quadrant, explaining how passive income from investments, such as stocks or businesses, allows wealth to grow without active labor.

2. The Rich Buy Assets, While the Poor Accumulate Liabilities

Financial success comes from owning assets that produce income, like stocks, bonds, and real estate.

Many people mistakenly believe that homes and cars are assets, but if they don’t generate income, they’re actually liabilities. Wealthy individuals focus on acquiring assets that put money into their pockets rather than liabilities that drain their finances.

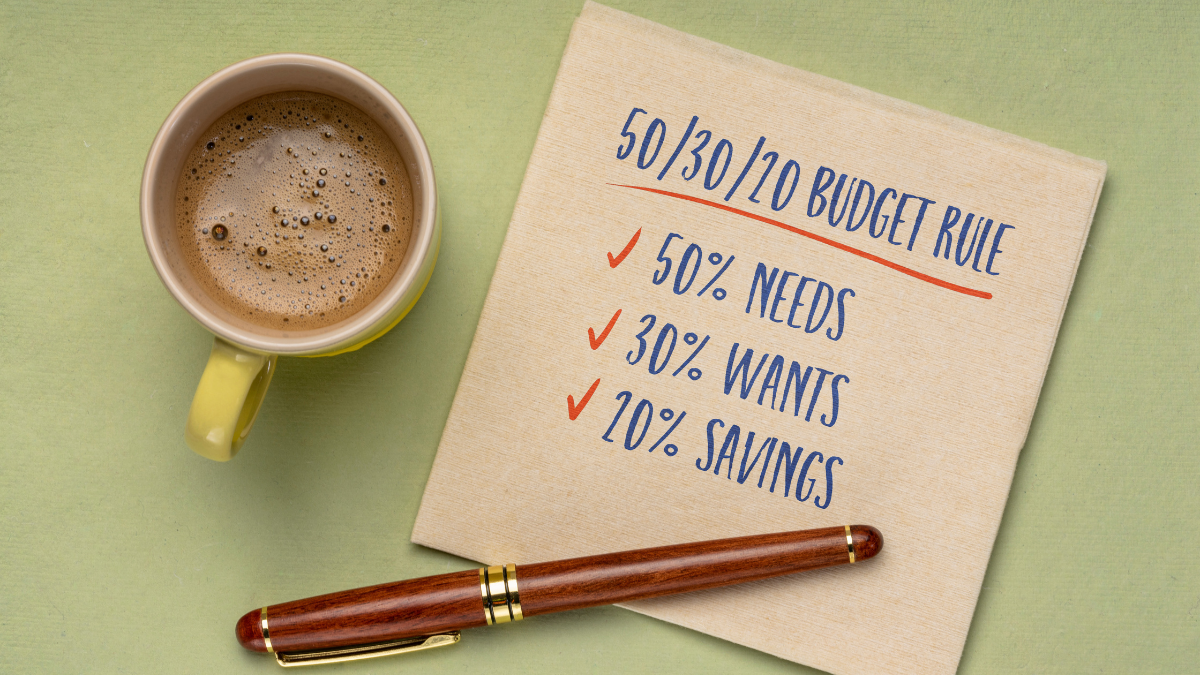

3. It’s Not About How Much You Earn, But How Much You Keep

Your financial stability depends on how much of your income you retain—not just how much you earn.

High earnings don’t automatically lead to wealth if most of that money is lost to taxes and expenses. To build financial security, you need to minimize unnecessary spending and optimize tax savings so that more of your income works for you.

4. Wealth Comes From Smart Money Management

Making money is just the first step—what truly matters is how you manage it.

Financial intelligence is key to building and preserving wealth. Investing in assets such as stocks, rental properties, or businesses ensures that your money continues to grow. A strong financial foundation requires literacy in budgeting, investing, and wealth-building strategies.

5. Your Mindset Is Your Greatest Asset

Above all, your greatest tool for wealth creation is your mindset.

Material possessions and money alone don’t make someone rich—financial intelligence does. Training your mind to think differently about earning, investing, and managing money can completely transform your financial future. Shifting your perspective and developing a strong financial IQ is the first step toward achieving long-term wealth.

Notable Quotes from Rich Dad Poor Dad

Rich Dad Poor Dad is packed with insightful quotes on personal finance and wealth-building. It challenges traditional views on money and offers valuable lessons on financial independence.

Here are seven powerful quotes from the book that can inspire a shift in your mindset about money.

- “In the real world, the smartest people are people who make mistakes and learn. In school, the smartest people don’t make mistakes.”

- “Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth.”

- “Winners are not afraid of losing. But losers are. Failure is part of the process of success. People who avoid failure also avoid success.”

- “The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.”

- “Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.”

- “It’s not what you say out your mouth that determines your life. It’s what you whisper to yourself that has the most power.”

- “Workers work hard enough to not be fired, and owners pay just enough so that workers won’t quit.”