Are you tired of being hit with hefty bank overdraft fees? It’s time to take control of your finances and avoid these unnecessary expenses. In this article, we will share 7 foolproof tips to avoid bank overdraft fees.

From tracking your spending to setting up alerts, we have you covered with practical strategies that anyone can implement. By following these tips, you can ensure that you never have to worry about overdrawing your account again. Say goodbye to the stress of unexpected fees and hello to a healthier financial future.

Whether you’re a college student on a tight budget or a seasoned professional, these tips will help you stay on top of your finances and save money in the long run. Don’t let bank overdraft fees drain your hard-earned cash – start implementing these tips today and enjoy the peace of mind that comes with financial stability.

- The Problem With Bank Overdraft Fees

- Understanding How Bank Overdraft Fees work

- Tip 1: Track Your Spending and Set a Budget

- Tip 2: Set Up Alerts and Notifications

- Tip 3: Use a Separate Account for Bill Payments

- Tip 4: Opt Out of Overdraft Protection

- Tip 5: Link Your Accounts for Overdraft Protection

- Tip 6: Use Cash Or a Prepaid Card for Certain Expenses

- Tip 7: Negotiate With Your Bank

- Conclusion

The Problem With Bank Overdraft Fees

Bank overdraft fees can be a major headache for many people. These fees occur when you withdraw more money from your bank account than you actually have available. The bank covers the shortfall, but they charge you a fee for doing so. While overdraft protection can seem like a helpful service, it often comes with high fees that can quickly add up. This can be especially problematic if you’re living paycheck to paycheck or on a tight budget.

Understanding How Bank Overdraft Fees work

Before we dive into the tips, it’s important to understand how bank overdraft fees work. When you make a purchase or withdrawal that exceeds your account balance, the bank has the option to cover the transaction and charge you a fee.

The fee can range anywhere from $20 to $40 or more, depending on your bank’s policies. If you don’t have overdraft protection, the transaction will simply be declined.

However, if you do have overdraft protection, the bank will cover the transaction but charge you a fee for the service. It’s important to note that not all banks charge overdraft fees, so it’s worth exploring your options and finding a bank that aligns with your financial goals.

Tip 1: Track Your Spending and Set a Budget

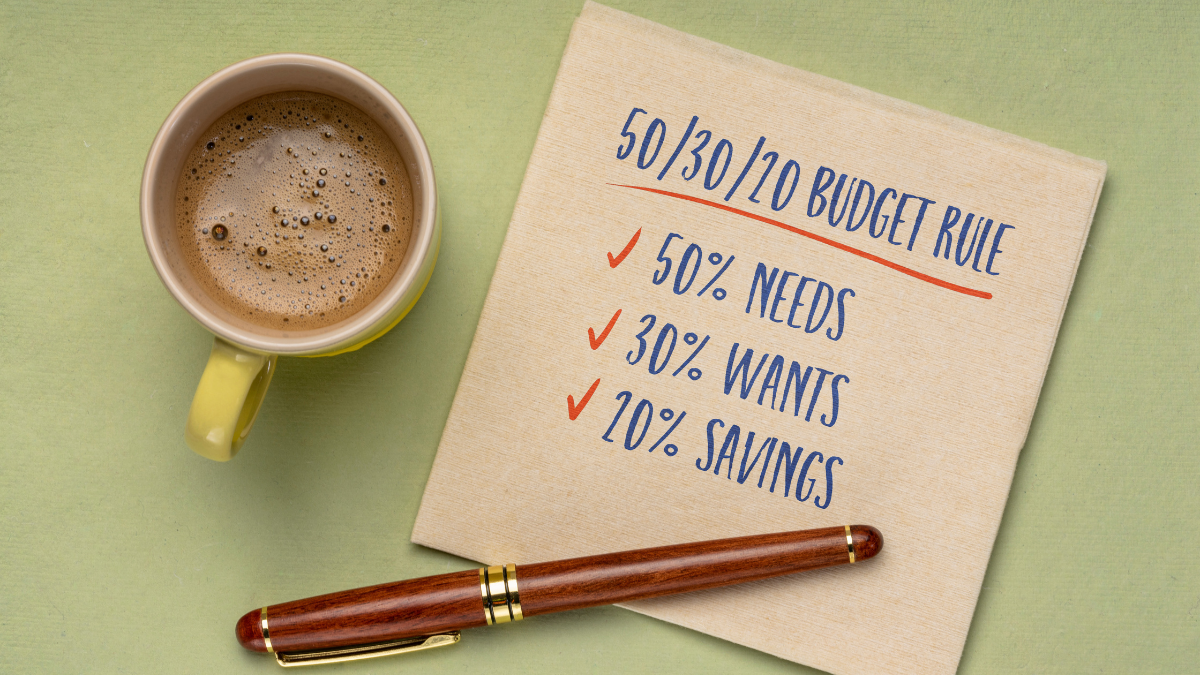

One of the most effective ways to avoid bank overdraft fees is to track your spending and set a budget. By knowing exactly how much money is coming in and going out, you can make informed decisions about your finances.

Start by keeping a record of all your expenses, whether it’s through a spreadsheet, a budgeting app, or even a pen and paper. Categorize your expenses into different categories such as groceries, bills, entertainment, and transportation. This will give you a clear picture of where your money is going and help you identify areas where you can cut back.

Once you have a good grasp of your spending habits, set a realistic budget that aligns with your income and financial goals. Stick to your budget and track your progress regularly to ensure that you’re staying on track. By being mindful of your spending and having a budget in place, you’ll be less likely to overspend and incur bank overdraft fees.

Tip 2: Set Up Alerts and Notifications

Most banks offer the option to set up alerts and notifications for your accounts. This can be a valuable tool in avoiding bank overdraft fees. By setting up alerts, you can receive notifications when your account balance falls below a certain threshold or when a large transaction is made. This will allow you to take immediate action and prevent overdrawing your account.

To set up alerts, log in to your online banking portal or contact your bank’s customer service. Choose the types of alerts you want to receive and the method of delivery, whether it’s through email, text message, or push notification.

It’s also a good idea to set up alerts for any automatic payments or direct deposits to ensure that you have sufficient funds in your account. By staying informed about your account activity, you can catch any potential issues before they result in costly bank overdraft fees.

Tip 3: Use a Separate Account for Bill Payments

Another effective strategy to avoid bank overdraft fees is to use a separate account for bill payments. This can help you keep track of your essential expenses and ensure that you have enough funds to cover them.

Open a dedicated account specifically for bill payments and transfer the necessary amount of money into it each month. This way, you can be confident that your bills are covered and avoid the risk of overdrawing your main account.

By separating your bill payments from your everyday spending, you can better manage your finances and minimize the chances of incurring bank overdraft fees. Remember to regularly review your bill payment account to make sure you have enough funds to cover all upcoming expenses.

Tip 4: Opt Out of Overdraft Protection

While overdraft protection may seem like a helpful service, it’s often accompanied by high fees. Opting out of overdraft protection can be a smart move to avoid bank overdraft fees altogether. Without overdraft protection, your transactions will simply be declined if you don’t have enough funds in your account.

This may seem inconvenient at first, but it’s a small price to pay compared to the hefty fees associated with overdraft protection. Contact your bank and request to opt out of overdraft protection. They may try to convince you otherwise, but stay firm in your decision and emphasize that you want to avoid unnecessary fees.

By opting out of overdraft protection, you’ll have better control over your spending and won’t have to worry about unexpected bank overdraft fees.

Tip 5: Link Your Accounts for Overdraft Protection

If you’re concerned about the possibility of overdrawing your account, linking your accounts for overdraft protection can provide an additional layer of security. Many banks offer the option to link your checking account to another account, such as a savings account or a line of credit.

This way, if your checking account is running low on funds, the bank will automatically transfer money from the linked account to cover the shortfall. While there may be a small fee associated with this service, it’s usually much lower than the fees charged for overdraft protection.

Contact your bank to inquire about linking your accounts for overdraft protection and explore the options available to you. By taking advantage of this service, you can avoid bank overdraft fees and have peace of mind knowing that you have a safety net in place.

Tip 6: Use Cash Or a Prepaid Card for Certain Expenses

It’s easy to rely on debit or credit cards for all our expenses. However, using cash or a prepaid card for certain expenses can help you avoid bank overdraft fees. Cash is a foolproof way to ensure that you’re only spending the money you have.

Withdraw a set amount of cash each week or month and use it for everyday expenses such as groceries, dining out, and entertainment. This can help you stick to your budget and avoid overspending. Alternatively, consider using a prepaid card for specific expenses. Prepaid cards are loaded with a set amount of money, so you can’t spend more than what’s available on the card.

This can be a great option for online shopping or travel expenses. By using cash or a prepaid card for certain expenses, you can eliminate the risk of overdrawing your account and incurring costly bank overdraft fees.

Tip 7: Negotiate With Your Bank

Lastly, don’t be afraid to negotiate with your bank to avoid bank overdraft fees. Many banks are willing to work with their customers to find a solution that benefits both parties. If you’ve been hit with overdraft fees in the past or are concerned about potential fees, schedule a meeting with a bank representative or contact their customer service.

Explain your situation and express your desire to avoid bank overdraft fees. They may be able to waive certain fees, lower the overdraft fee amount, or offer alternative solutions.

Remember, it’s in the bank’s best interest to retain customers, so they may be more willing to work with you than you think. Be polite but firm in your negotiations and don’t be afraid to explore other banking options if your current bank is unwilling to accommodate your needs.

Conclusion

Bank overdraft fees can be a drain on your finances and a major source of stress. However, by implementing these 7 foolproof tips, you can avoid unnecessary fees and take control of your financial future. Track your spending, set a budget, and use alerts to stay informed about your account activity. Consider using a separate account for bill payments and opt out of overdraft protection to avoid costly fees.

Linking your accounts for overdraft protection and using cash or a prepaid card for certain expenses can provide added peace of mind. Finally, don’t hesitate to negotiate with your bank to find a solution that works for you.

By following these tips, you’ll be well on your way to saving money and avoiding the stress of bank overdraft fees. Take charge of your finances today and enjoy a healthier financial future.