Are you worried about your retirement savings? Are you looking for tips to help you boost your retirement savings? Look no further because we’ve got you covered! In this article, we will share 5 powerful strategies that will put you on the path to a financially secure retirement.

One of the key aspects we will explore is the importance of starting early. Time is your greatest ally when it comes to retirement savings, and we will show you how to make the most of it. Additionally, we will cover the benefits of diversification and discuss how it can protect your retirement portfolio from potential market fluctuations.

Whether you have just started your career or are nearing retirement age, these expert tips will empower you to boost your retirement savings. With a little discipline and the right strategies, you can pave the way for a financially secure future. So let’s get started on your journey to supercharge your retirement savings!

- The Importance of Retirement Savings

- Understanding Your Retirement Goals

- Tip #1: Start Saving Early

- Tip #2: Maximize Your Employer-sponsored Retirement Plan

- Tip #3: Diversify Your Investment Portfolio

- Tip #4: Take Advantage of Tax-advantaged Retirement Accounts

- Tip #5: Continuously Monitor and Adjust Your Retirement Savings Strategy

- Retirement Savings Calculators and Tools

The Importance of Retirement Savings

Retirement is a phase of life that we all look forward to. It’s a time when we can relax, pursue our passions, and enjoy the fruits of our labor. But to truly enjoy our golden years, it’s important to have a solid foundation in place. This is where retirement savings come into play.

Retirement savings are crucial because they provide us with the means to maintain our desired lifestyle after we stop working. Whether you dream of traveling the world, indulging in hobbies, or simply enjoying a comfortable retirement, having enough savings is key.

Understanding Your Retirement Goals

Before diving into the specifics of supercharging your retirement savings, it’s important to take a step back and assess your retirement goals. What do you envision for your retirement? Do you have a clear idea of the lifestyle you want to lead? Understanding your goals will help you determine how much you need to save and how to allocate your resources.

Take some time to reflect on your retirement dreams. Consider factors such as where you want to live, the activities you want to pursue, and any healthcare expenses you may incur. By having a clear picture of your retirement goals, you can set realistic savings targets and make informed financial decisions.

Tip #1: Start Saving Early

When it comes to retirement savings, time is your greatest asset. The earlier you start saving, the more time your money has to grow through the power of compound interest. Even if retirement seems far away, it’s never too early to start building your nest egg.

Starting early allows you to take advantage of the magic of compounding. In simple terms, compounding is when you earn interest not only on your initial investment but also on the interest that your investment earns over time. This compounding effect can significantly boost your savings in the long run.

To illustrate the power of starting early, let’s consider two individuals. Emma begins saving for retirement at the age of 25, while Sarah starts at 35. Assuming they both save $500 per month and achieve an average annual return of 8%, Emma will have approximately $1.2 million by the time she reaches 65, while Sarah will have around $540,000. Starting early can make a massive difference in the size of your nest egg.

Tip #2: Maximize Your Employer-sponsored Retirement Plan

If your employer offers a retirement plan, such as a 401(k) or 403(b), make sure you take full advantage of it. Employer-sponsored plans are a fantastic way to boost your retirement savings because they offer several benefits.

One significant advantage of these plans is the option for employer matching contributions. This means that your employer will match a portion of your contributions, effectively giving you free money. For example, if your employer offers a 50% match on contributions up to 6% of your salary and you earn $60,000 per year, your employer will contribute $1,800 annually if you contribute $3,600. That’s an instant 50% return on your investment!

Another benefit of employer-sponsored plans is the ability to contribute pre-tax dollars. This reduces your taxable income, allowing you to keep more of your hard-earned money. Additionally, contributions to these plans are automatic, making it easier to save consistently.

Tip #3: Diversify Your Investment Portfolio

When it comes to retirement savings, diversification is key. Diversifying your investment portfolio means spreading your money across different asset classes, such as stocks, bonds, and real estate. This strategy helps reduce the risk of losing all your savings if one investment performs poorly.

Diversification is important because it allows you to benefit from the potential growth of multiple investments while minimizing the impact of any individual investment’s downturn. By diversifying, you can create a well-balanced portfolio that aligns with your risk tolerance and investment goals.

To diversify effectively, consider investing in a mix of stocks, bonds, mutual funds, and other investment vehicles. It’s also important to periodically review and rebalance your portfolio to ensure it remains aligned with your objectives.

Tip #4: Take Advantage of Tax-advantaged Retirement Accounts

Tax-advantaged retirement accounts are a powerful tool for maximizing your retirement savings. These accounts offer tax benefits that can significantly boost your nest egg over time. Two popular tax-advantaged accounts are Traditional IRAs and Roth IRAs.

Traditional IRAs allow you to contribute pre-tax dollars, reducing your taxable income in the year of contribution. Your contributions grow tax-deferred until you withdraw them in retirement, at which point they are subject to income tax. This can provide immediate tax savings and the potential for tax-deferred growth.

On the other hand, Roth IRAs offer tax-free growth and tax-free withdrawals in retirement. While contributions to Roth IRAs are made with after-tax dollars, the earnings can grow tax-free. This can be advantageous if you expect your tax rate to be higher in retirement.

Tip #5: Continuously Monitor and Adjust Your Retirement Savings Strategy

Retirement savings is not a set-it-and-forget-it endeavor. It requires regular monitoring and adjustments to ensure you stay on track to meet your goals. As you progress through different stages of life, your financial situation and priorities may change, necessitating modifications to your savings strategy.

Regularly review your retirement savings plan to assess if you’re on target to meet your goals. If necessary, make adjustments such as increasing your contributions, rebalancing your portfolio, or exploring new investment opportunities. Additionally, stay informed about changes in tax laws and retirement regulations that may impact your savings strategy.

Remember, retirement planning is a lifelong journey, and it’s important to adapt your strategy as circumstances evolve. By staying engaged and proactive, you can maximize your retirement savings and ensure a financially secure future.

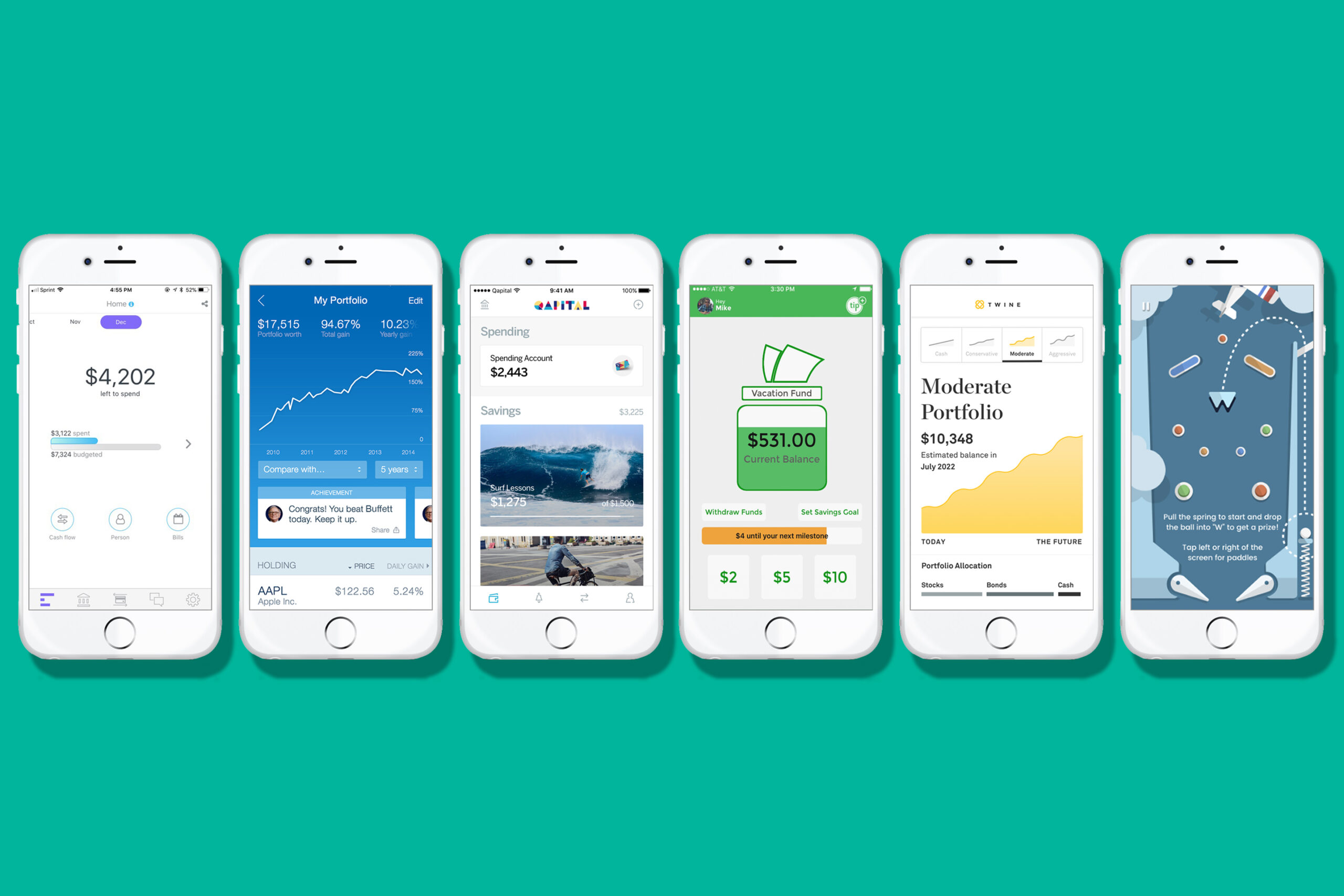

Retirement Savings Calculators and Tools

To assist you in your retirement savings journey, we offer numerous online calculators and tools are available. These tools can help you estimate the amount you need to save, determine the impact of different savings rates, and project your potential retirement income.

When using these calculators, input accurate information such as your current savings, expected rate of return, and desired retirement age. The results will provide valuable insights into your progress and help you make informed decisions.

Remember that our retirement calculators are just tools and should not be treated as definitive predictions. They are based on assumptions and projections, which may not reflect the actual performance of your investments. Use them as a starting point but consult with a financial advisor for personalized advice.