Are you tired of living paycheck to paycheck, constantly burdened by debt and struggling to save? It’s time to take control of your financial future. In this article, we will explore the art of saving money while paying off debt, and discuss how you can achieve true financial freedom.

Managing debt can be overwhelming, but with a strategic plan and discipline, it is absolutely possible to climb out debt while building your savings. We’ll show you how to prioritize your debt payments, create a budget that allows for saving, and implement practical strategies to cut back on expenses. By adopting these habits, you’ll not only become debt-free sooner, but also establish a solid financial foundation for the future.

Financial freedom is not just about paying off your debts – it’s about gaining control over your finances and living a life free from financial stress.

Understanding Financial Freedom

Financial freedom is more than just being debt-free. It’s about gaining control over your finances and living a life free from financial stress. It’s about having enough money to cover your needs, save for the future, and pursue the things that truly matter to you. To achieve financial freedom, you need to strike a balance between paying off your debts and saving money.

The Importance of Saving Money

Saving money is a crucial step towards financial freedom. It provides a safety net for unexpected expenses, helps you achieve your financial goals, and gives you peace of mind. When you’re focused on paying off debt, saving money may seem like a challenge, but it’s not impossible. With the right strategies in place, you can save while still making progress on your debt repayment journey.

Strategies For Saving Money While Paying Off Debt

1. Creating a Budget and Sticking to It

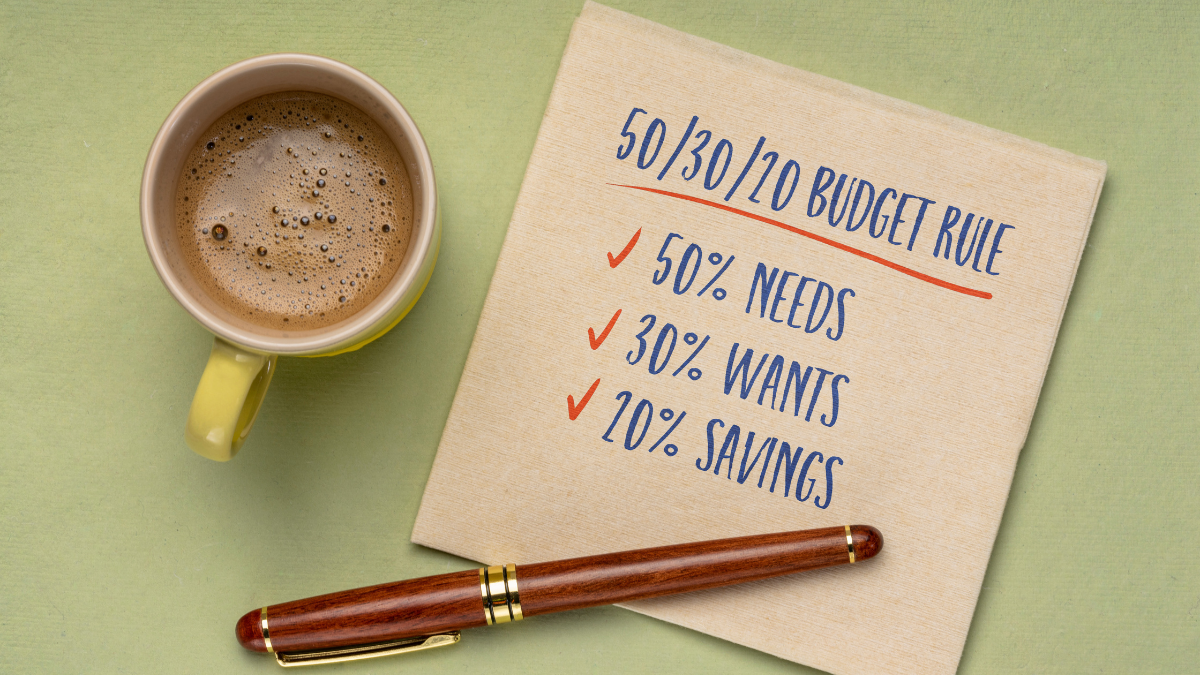

One of the first steps towards saving money while paying off debt is creating a budget. A budget helps you track your income and expenses, allowing you to identify areas where you can cut back and save.

Start by listing all your sources of income and your fixed expenses such as rent, utilities, and debt payments. Then, allocate a portion of your income towards savings.

Be realistic about your expenses and make sure to leave room for discretionary spending, but try to keep it to a minimum.

2. Cutting Expenses and Finding Ways to Save

To save money while paying off debt, you’ll need to cut back on expenses. Look for areas where you can reduce costs, such as ordering out less frequently, canceling unused subscriptions, and shopping for deals and discounts.

Consider negotiating bills, switching to cheaper alternatives, and embracing a more minimalist lifestyle. Small changes can add up to significant savings over time.

3. Increasing Income to Accelerate Debt Repayment

Another way to save money while paying off debt is by increasing your income. Explore opportunities for side hustles, freelancing, or taking on additional shifts at work. Use the extra income to make larger debt payments and build your savings faster.

Remember to be intentional about how you allocate your additional earnings, prioritizing debt repayment and saving over discretionary spending.

4. Utilizing Debt Repayment Strategies

To optimize your debt repayment journey, consider utilizing debt repayment strategies such as the debt snowball or debt avalanche method. The debt snowball method involves paying off your smallest debts first, while the debt avalanche method focuses on paying off debts with the highest interest rates first. Both methods have their benefits, so choose the one that aligns with your financial goals and motivates you to stay on track.

5. Building an Emergency Fund

While paying off debt, it’s crucial to have an emergency fund. An emergency fund acts as a financial cushion, protecting you from unexpected expenses and preventing you from going further into debt. Aim to save three to six months’ worth of living expenses in your emergency fund. Start small and gradually build it up over time. Even a small emergency fund can make a big difference in your financial security.

6. Seeking Professional Help and Resources

If you’re feeling overwhelmed or struggling to make progress, don’t hesitate to seek professional help. Financial advisors can provide personalized guidance and help you create a tailored plan for saving money while paying off debt.

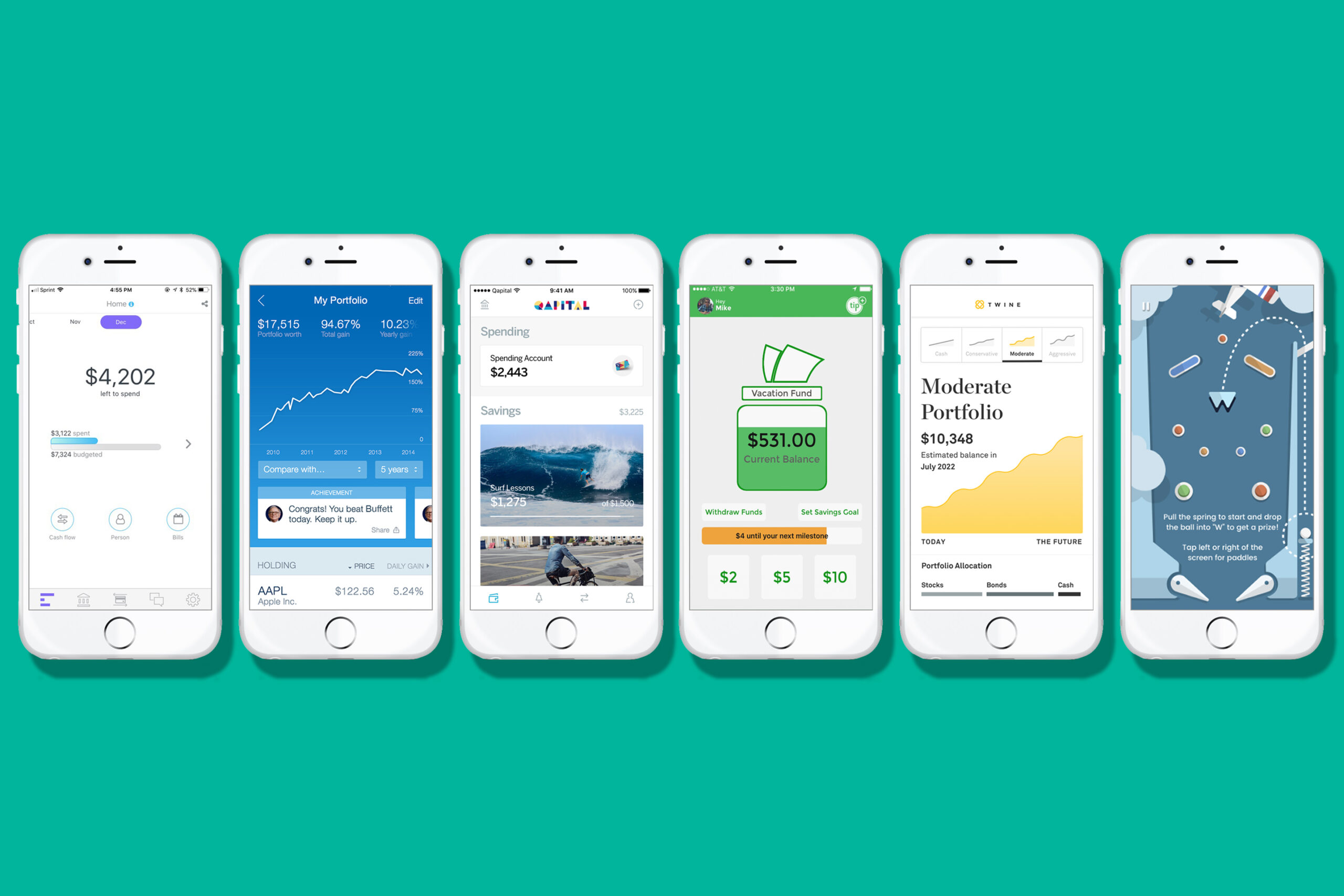

Additionally, there are numerous resources available online, such as budgeting apps, debt calculators, and personal finance blogs, that can provide valuable insights and tips to support your journey towards financial freedom.

Conclusion

While it may seem counterintuitive to focus on saving money while paying off debt, having an emergency fund is crucial for long-term financial stability. Without an emergency fund, unexpected expenses can derail your debt repayment progress and leave you in a cycle of borrowing more money.

Start by setting a savings goal for your emergency fund. Aim to save at least three to six months’ worth of living expenses. This will provide a cushion in case of job loss, medical emergencies, or any other unforeseen circumstances.

To build your emergency fund, automate your savings by setting up automatic transfers from your checking account to your savings account. Treat your savings like a bill that must be paid each month. Cut back on nonessential expenses and redirect that money towards your emergency fund. Consider selling items you no longer need or finding ways to save on everyday expenses, such as cooking at home instead of eating out.

Having an emergency fund not only provides financial security but also peace of mind. It allows you to handle unexpected expenses without resorting to credit cards or loans, ultimately helping you stay on track with your debt repayment journey.