Welcome to Stocks 101: A Beginner’s Guide to Understanding the Basics. Whether you’re a newbie to investing or simply looking to expand your financial knowledge, this article is your go-to resource for demystifying the world of stocks. In this comprehensive guide, we’ll walk you through the fundamental concepts, terminology, and strategies you need to know to confidently navigate the stock market.

From understanding what stocks are and how they work to exploring different types of stocks and investment strategies, this article will equip you with the knowledge to make informed decisions when it comes to investing in the stock market. We’ll cover topics like market trends, stock valuation, risk assessment, and more, providing you with a solid foundation to begin your investment journey.

So, whether you’re interested in building long-term wealth or simply want to dip your toes into the exciting world of trading, Stocks 101 will arm you with the information you need to get started. Buckle up and get ready to embark on your stock market adventure!

What Are Stocks?

Stocks, also known as shares or equities, represent ownership in a company. When you buy a stock, you become a partial owner of the company and have a claim on its assets and earnings. Stocks are typically bought and sold on stock exchanges, such as the New York Stock Exchange (NYSE) or the Nasdaq.

Investing in stocks allows individuals to participate in the growth and profitability of companies. As a shareholder, you have the potential to earn returns through capital appreciation (the increase in stock price) and dividends (a portion of the company’s profits distributed to shareholders).

Stocks can be categorized into different types, such as common stocks and preferred stocks. Common stocks are the most common type of stock and give shareholders voting rights and the opportunity to receive dividends. On the other hand, preferred stocks typically don’t offer voting rights but provide shareholders with a fixed dividend payment.

Why Invest In Stocks?

Investing in stocks offers several advantages compared to other investment options. Firstly, stocks have the potential for higher returns compared to traditional savings accounts or bonds. Over the long term, stocks tend to outperform other asset classes, such as bonds or real estate.

Secondly, investing in stocks allows you to participate in the growth of companies and industries you believe in. By buying shares of companies you believe will succeed, you can align your investments with your values and potentially benefit from their success.

Lastly, stocks provide the opportunity for diversification. By investing in a variety of stocks from different industries and sectors, you can spread your risk and reduce the impact of any single company’s performance on your portfolio.

Common Terms In Stock Investing

Before diving into the world of stock investing, it’s important to familiarize yourself with some common vocab:

- Ticker Symbol: A unique series of letters assigned to a stock to identify it on a stock exchange. For example, Apple Inc.’s ticker symbol is AAPL.

- Market Capitalization: The total value of a company’s outstanding shares. It is calculated by multiplying the stock price by the number of shares outstanding.

- Dividend: A portion of a company’s earnings that is distributed to shareholders on a regular basis.

- Price-to-Earnings (P/E) Ratio: A valuation ratio that compares the price of a stock to its earnings per share. It is used to assess whether a stock is overvalued or undervalued.

- Volume: The number of shares traded in a particular stock over a given period of time. High volume indicates increased investor interest.

How To Buy Stocks

Now that you have a basic understanding of stocks and their terminology, let’s explore how to buy stocks. Here are the steps to get started:

- Set Investment Goals: Determine your investment goals, whether it’s saving for retirement, funding your child’s education, or any other financial objective.

- Research and Analysis: Conduct thorough research on the companies you’re interested in. Look at their financial performance, competitive position, and industry trends. This will help you make informed investment decisions.

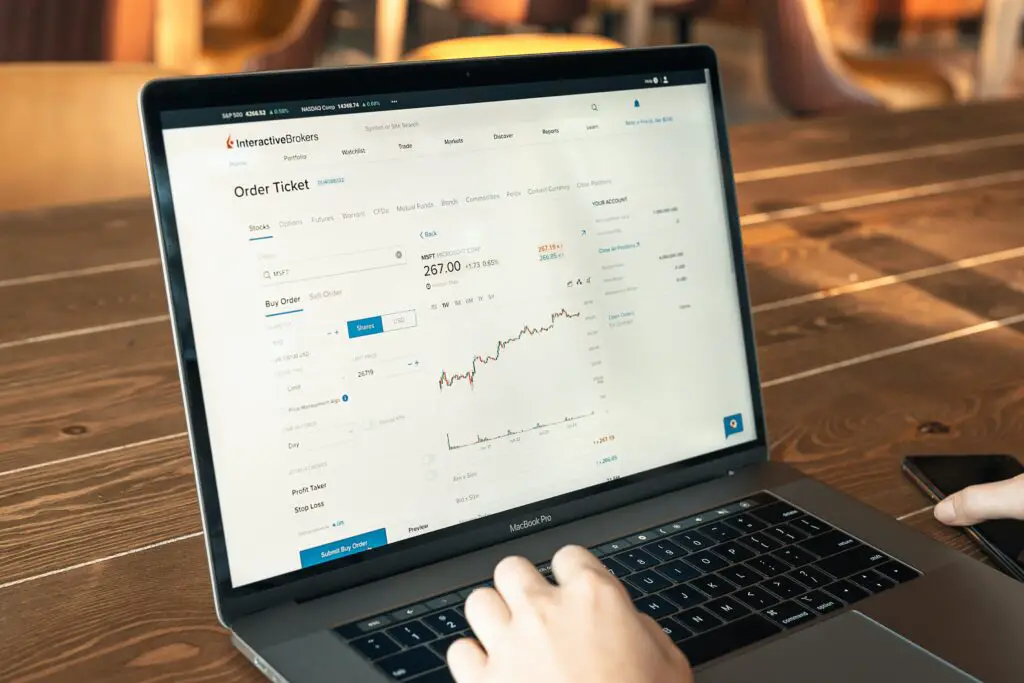

- Choose a Brokerage Account: Select a reputable brokerage account that suits your needs. Consider factors such as trading fees, account minimums, and available tools and resources.

- Fund Your Account: Deposit funds into your brokerage account to have capital available for investing.

- Place an Order: Use your brokerage account’s trading platform to place an order to buy stocks. Specify the number of shares you want to purchase and the price you’re willing to pay.

- Monitor and Review: Keep track of your investments and regularly review your portfolio to ensure it aligns with your investment goals.

Remember, investing in stocks involves risk, and it’s important to diversify your portfolio and invest in line with your risk tolerance.

Different Types of Stocks

Stocks can be classified into different types based on various factors. Here are some common types of stocks:

- Blue-Chip Stocks: Blue-chip stocks refer to shares of large, well-established companies with a long track record of stable earnings and dividends. These stocks are considered relatively safe and are often considered a core holding in a well-diversified portfolio.

- Growth Stocks: Growth stocks are shares of companies that are expected to grow at an above-average rate compared to the overall market. These companies typically reinvest their earnings into expanding their business rather than paying dividends, with the expectation that their stock price will appreciate over time.

- Value Stocks: Value stocks are stocks that are considered undervalued by the market. These stocks are often characterized by a low price-to-earnings ratio or other valuation metrics. Investors who follow a value investing strategy look for stocks that they believe are trading below their intrinsic value.

- Small-Cap, Mid-Cap, and Large-Cap Stocks: Stocks can also be categorized based on their market capitalization. Small-cap stocks have a market capitalization of less than $2 billion, mid-cap stocks have a market capitalization between $2 billion and $10 billion, and large-cap stocks have a market capitalization of over $10 billion.

Understanding Stock Market Indexes

Stock market indexes are used to track the performance of a group of stocks representing a specific market or sector. Here are some popular stock market indexes:

- S&P 500: The S&P 500 is a widely followed index that tracks the performance of the 500 largest publicly traded companies in the United States. It is considered a benchmark for the overall stock market performance.

- Dow Jones Industrial Average (DJIA): The DJIA is a price-weighted index that tracks the performance of 30 large, publicly traded companies in the United States. It is one of the oldest and most widely recognized stock market indices.

- Nasdaq Composite: The Nasdaq Composite index tracks the performance of over 3,000 stocks listed on the Nasdaq stock exchange. It is known for its heavy weighting towards technology and growth-oriented companies.

Stock market indexes provide a snapshot of the overall market or a specific sector and can be used to gauge market trends and investor sentiment.

Factors That Influence Stock Prices

Stock prices are influenced by a variety of factors, including:

- Earnings Reports: The financial performance of a company, as reflected in its earnings reports, can significantly impact its stock price. Positive earnings surprises often lead to stock price increases, while negative surprises can result in stock price declines.

- Economic Conditions: Economic indicators, such as GDP growth, inflation rates, and interest rates, can impact stock prices. A strong economy generally leads to higher stock prices, while a weak economy can result in lower stock prices.

- Industry Trends: The performance of an industry or sector can influence stock prices. Positive industry trends and outlooks can drive stock prices higher, while negative trends can lead to stock price declines.

- Company News and Events: Company-specific news, such as product launches, mergers and acquisitions, or legal issues, can impact stock prices. Positive news often leads to stock price increases, while negative news can result in stock price declines.

It’s important to stay informed about these factors and regularly monitor your investments to make informed decisions.

Risks and Rewards of Stock Investing

Investing in stocks offers both risks and rewards. It’s important to understand and manage these risks to make informed investment decisions. Here are some key risks and rewards of stock investing:

Risks:

1. Market Volatility: Stock prices can be volatile and subject to significant fluctuations, which can result in both gains and losses.

2. Company-Specific Risks: Individual companies may face risks such as poor management, competition, or regulatory changes that can impact their stock prices.

3. Economic Risks: Economic downturns or recessions can negatively impact stock prices across the market.

Rewards:

1. Potential for Capital Appreciation: Stocks have the potential for long-term capital appreciation, allowing investors to grow their wealth over time.

2. Dividend Income: Some stocks pay dividends, providing investors with a steady stream of income.

3. Diversification: Investing in stocks allows for diversification, spreading risk across different companies and sectors.

Stock Market Strategies For Beginners

As a beginner, it’s essential to have a strategy in place when investing in stocks. Here are some stock market strategies to consider:

- Dollar-Cost Averaging: Invest a fixed amount of money regularly, regardless of market conditions. This strategy allows you to buy more shares when prices are low and fewer shares when prices are high, potentially reducing the impact of market volatility.

- Long-Term Investing: Take a long-term approach and invest in stocks with solid fundamentals and growth potential. This strategy allows you to ride out short-term market fluctuations and benefit from the compounding effect over time.

- Index Fund Investing: Consider investing in low-cost index funds that track broad market indices. These funds provide instant diversification and are suitable for beginners who want exposure to the overall stock market.

- Research and Fundamental Analysis: Conduct thorough research on individual stocks and analyze their financials, competitive position, and industry trends. This strategy allows you to make informed investment decisions based on the fundamentals of the companies you’re interested in.

Conclusion

Congratulations! You’ve reached the end of Stocks 101: A Beginner’s Guide to Understanding the Basics. We hope this comprehensive guide has equipped you with the knowledge and confidence to navigate the world of stocks.

From understanding what stocks are and how they work to exploring different types of stocks and investment strategies, you now have a solid foundation to begin your investment journey. Remember to conduct thorough research, diversify your portfolio, and align your investments with your goals and risk tolerance.

Whether you’re interested in building long-term wealth or simply want to dip your toes into the exciting world of trading, Stocks 101 has provided you with the information you need to get started. Now, it’s time to take action, stay informed, and continuously educate yourself as you embark on your stock market adventure. Happy investing!

Note: This article is for informational purposes only and should not be considered as financial advice. Always consult with a qualified financial advisor before making any investment decisions.