Are you struggling with debt and longing for financial freedom? Don’t worry, there’s a valuable asset right at your fingertips that could hold the key to your financial transformation. It’s your 401k. In this article, we will get into the journey from debt to wealth and explore how you can harness the potential of your 401k to turn your financial situation around.

With the right knowledge and strategies, your 401k can become a powerful tool in building long-term wealth and securing your future. We will break down the steps you need to take to maximize its benefits and guide you through the process of taking control of your financial destiny.

Don’t let debt hold you back any longer. It’s time to unlock the potential of your 401k and pave the way to a brighter financial future. Let’s dive in and embark on this transformative journey together.

- Understanding 401k and Its Potential For Wealth Creation

- The Importance of Managing Debt Before Investing In 401k

- Steps To Take To Maximize Your 401k’s Potential

- Common Mistakes To Avoid When Handling Your 401k

- Investment Options In a 401k Plan

- Analyzing The Performance of Your 401k Investments

- Strategies For Accelerating Your 401k Growth

- How To Make The Most of Employer Contributions To Your 401k

- Retirement Planning With Your 401k

- Conclusion

Understanding 401k and Its Potential For Wealth Creation

Your 401k is a retirement savings plan sponsored by your employer. It allows you to contribute a portion of your salary on a pre-tax basis, meaning you don’t pay taxes on that money until you withdraw it during retirement. One of the key advantages of a 401k is the potential for tax-deferred growth, which can significantly increase the value of your investments over time.

To harness the potential of your 401k, it’s important to understand the various features and options available to you. This includes knowing the contribution limits, investment choices, and any employer matching programs. By having a solid grasp of the fundamentals, you can make informed decisions that will maximize the growth of your retirement savings.

The Importance of Managing Debt Before Investing In 401k

Before diving headfirst into investing in your 401k, it’s crucial to address any outstanding debts you may have. While the allure of long-term wealth creation through your retirement account may be tempting, it’s important to remember that debt can be a major obstacle to financial stability.

High-interest debts, such as credit card debt or personal loans, can eat away at your finances and hinder your ability to build wealth. By prioritizing debt repayment and adopting a strategic approach to managing your loans, you can lay a solid foundation for your financial future. Once your debts are under control, you can then focus on maximizing the benefits of your 401k.

Steps To Take To Maximize Your 401k’s Potential

Now that you have a solid understanding of your 401k and have addressed your debts, it’s time to take the necessary steps to maximize its potential. Here are some key strategies to consider:

- Contribute consistently: Regular contributions to your 401k can have a significant impact on its growth. Aim to contribute the maximum amount allowed by law, or at least enough to take advantage of your employer’s matching contributions.

- Diversify your investments: A well-diversified portfolio can help mitigate risk and optimize returns. Consider allocating your investments across different asset classes, such as stocks, bonds, and mutual funds, to ensure a balanced and diversified approach.

- Review and rebalance: Regularly review the performance of your investments and make necessary adjustments. Rebalancing your portfolio ensures that your asset allocation stays in line with your long-term goals and risk tolerance.

Common Mistakes To Avoid When Handling Your 401k

While your 401k can be a powerful wealth-building tool, it’s important to avoid common mistakes that can hinder its growth. Here are some mistakes to watch out for:

- Failure to contribute enough: Contributing the bare minimum may not be enough to achieve your retirement goals. Strive to contribute as much as you can, especially if your employer offers matching contributions.

- Ignoring investment options: Many employees fail to take advantage of the investment options available within their 401k plan. Take the time to research and understand the choices available to you, and consider seeking professional advice if needed.

- Withdrawing funds prematurely: Withdrawing funds from your 401k before retirement can have serious consequences. Not only will you incur penalties and taxes, but you will also miss out on the potential growth that could have been achieved over time.

Investment Options In a 401k Plan

When it comes to investing your 401k funds, you have a range of options to choose from. These options typically include:

- Stocks: Investing in individual company stocks can offer the potential for high returns, but it also comes with increased risk. It’s important to carefully research and diversify your stock investments to minimize risk.

- Bonds: Bonds are considered safer investments as they offer fixed interest payments over a specified period. They can provide stability to your portfolio, especially as you near retirement.

- Mutual funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities. They are managed by professional fund managers and offer a convenient way to access a variety of investments.

- Target-date funds: These funds automatically adjust their asset allocation based on your retirement date. They start with a higher proportion of stocks when you are younger and gradually shift towards more conservative investments as you approach retirement.

Choosing the right investment options for your 401k requires careful consideration of your risk tolerance, time horizon, and financial goals. It’s advisable to consult with a financial advisor who can provide personalized guidance based on your individual circumstances.

Analyzing The Performance of Your 401k Investments

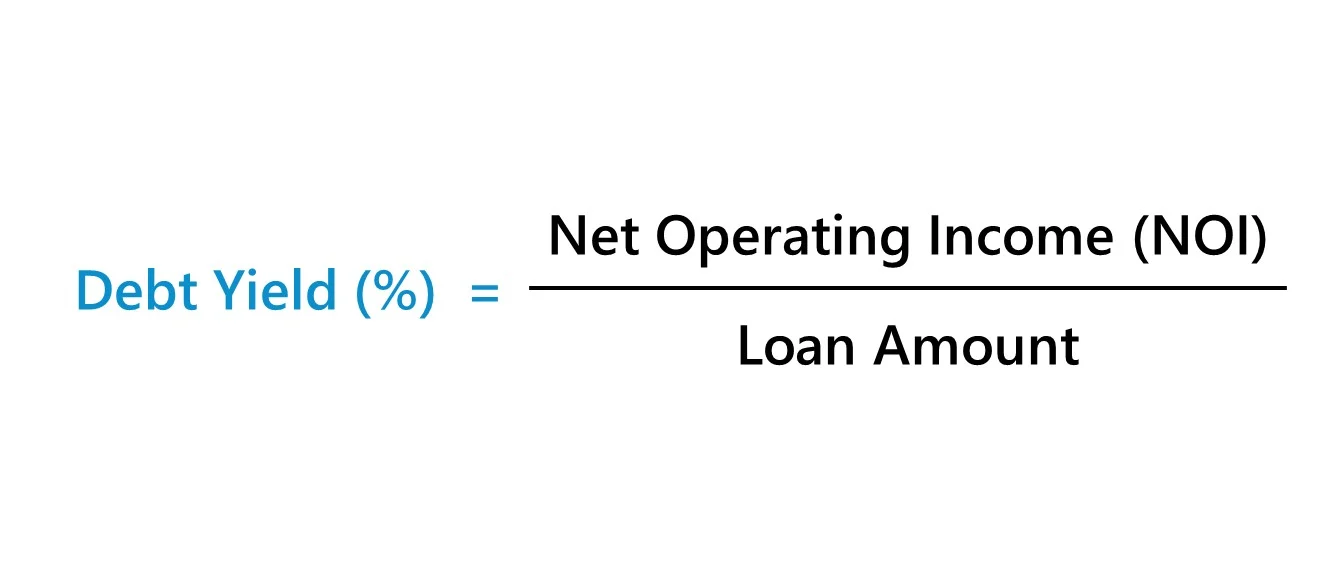

Regularly monitoring the performance of your 401k investments is essential to ensure they align with your financial goals. Here are a few key metrics to consider when analyzing your portfolio:

- Rate of return: This measures the percentage increase or decrease in the value of your investments over a specific period. A positive rate of return indicates growth, while a negative rate of return suggests a decline.

- Expense ratio: The expense ratio represents the percentage of your investment that goes towards covering the fund’s operating expenses. Lower expense ratios are generally favorable as they leave more of your investment to grow.

- Asset allocation: Reviewing your asset allocation helps ensure that your investments are appropriately diversified. Make adjustments if necessary to maintain a balance that aligns with your risk tolerance and investment objectives.

Strategies For Accelerating Your 401k Growth

While consistent contributions and smart investment choices are key to growing your 401k, there are additional strategies you can employ to accelerate its growth. Here are a few ideas to consider:

- Catch-up contributions: If you are 50 years or older, you have the option to make catch-up contributions to your 401k. This allows you to contribute additional funds beyond the regular contribution limits, giving your retirement savings an extra boost.

- Roth 401k: Some employers offer a Roth 401k option, which allows you to contribute after-tax dollars. While you won’t receive an immediate tax benefit, qualified distributions in retirement are tax-free, potentially providing significant tax advantages.

- Investment education: Take advantage of educational resources provided by your employer or consult with a financial advisor to enhance your investment knowledge. The more you understand about investing, the better equipped you will be to make informed decisions and maximize your 401k’s growth potential.

How To Make The Most of Employer Contributions To Your 401k

Many employers offer matching contributions as part of their 401k plans, which can significantly boost your retirement savings. Here’s how you can make the most of this valuable benefit:

- Contribute enough to maximize the match: Review your employer’s matching contribution policy and aim to contribute at least enough to receive the full match. Failing to do so means you’re leaving free money on the table.

- Understand vesting schedules: Some employers have vesting schedules that determine when you become entitled to the employer contributions. Familiarize yourself with these schedules to ensure you don’t miss out on any benefits if you leave your job before becoming fully vested.

- Take advantage of automatic escalation: Some employers offer automatic escalation programs that increase your contribution rate over time. Opting into this feature can help you gradually increase your savings without the need for constant manual adjustments.

Retirement Planning With Your 401k

As you approach retirement, it’s crucial to have a solid retirement plan in place. Your 401k will play a central role in funding your retirement, so it’s important to make informed decisions. Here are a few considerations for effective retirement planning with your 401k:

- Estimate your retirement income needs: Determine how much income you will need in retirement by considering factors such as living expenses, healthcare costs, and any additional sources of income.

- Assess your risk tolerance: As you near retirement, it’s prudent to adjust your investment strategy to reduce risk. Consider reallocating a portion of your 401k investments to more conservative options to protect your savings.

- Explore withdrawal options: Familiarize yourself with the withdrawal rules and options available for your 401k plan. This includes understanding required minimum distributions (RMDs) and potential penalties for early withdrawals.

Conclusion

Your 401k is more than just a retirement account – it’s an opportunity to take control of your financial future. By understanding the basics, managing your debts, and maximizing its potential, you can transform your financial situation and pave the way to long-term wealth creation.

From contributing consistently to diversifying your investments and taking advantage of employer matching, each step you take brings you closer to financial freedom. Stay informed, make smart decisions, and regularly review your progress to ensure your 401k remains a powerful tool in your journey from debt to wealth.

Don’t let debt hold you back any longer. It’s time to unlock the potential of your 401k and pave the way to a brighter financial future. Let’s dive in and embark on this transformative journey together.