Are you tired of living paycheck to paycheck, burdened by debt and unable to achieve financial freedom? If so, it’s time to take control of your financial future. One powerful way to do that is by educating yourself about personal finance and debt management. In this article, we will explore 6 must-read books that can help you tackle debt and pave the way to financial freedom.

These books have been carefully selected to provide you with practical tips, strategies, and inspiring stories from experts who have successfully overcome debt. From budgeting and saving techniques to investing and building wealth, each book offers unique insights and actionable steps to help you on your journey.

- The Importance of Financial Literacy

- Understanding Debt and Its Impact on Your Financial Freedom

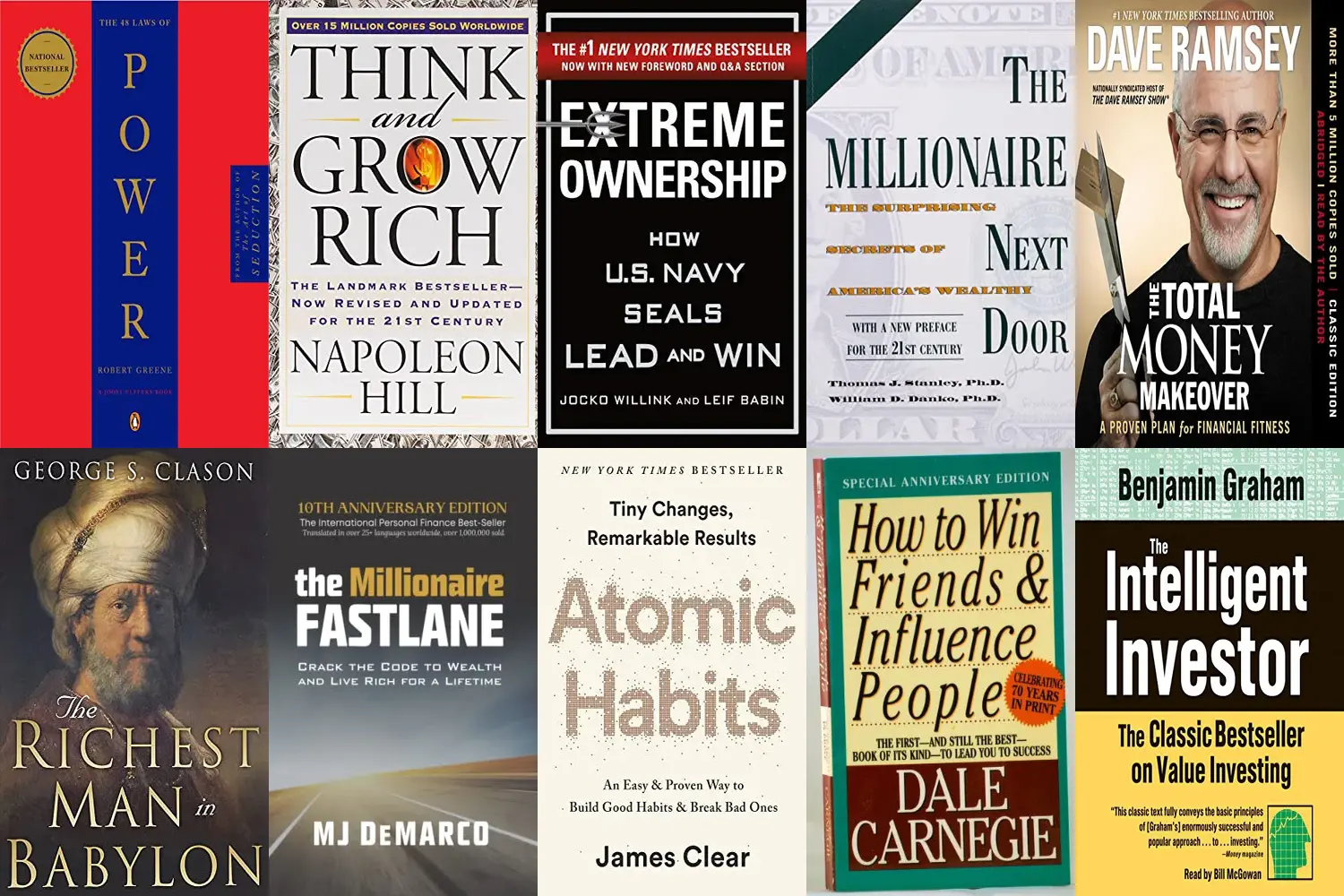

- Book Recommendation 1: “The Total Money Makeover” by Dave Ramsey

- Book Recommendation 2: “Debt-Free Forever” by Gail Vaz-Oxlade

- Book Recommendation 3: “Your Money or Your Life” by Vicki Robin and Joe Dominguez

- Book recommendation 4: “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

- Book Recommendation 5: “Rich Dad Poor Dad” by Robert Kiyosaki

- Book Recommendation 6: “The Automatic Millionaire” by David Bach

- Implementing The Lessons Learned From These Books

- Conclusion

The Importance of Financial Literacy

Financial literacy is the foundation of a healthy financial life. It involves understanding how money works, making informed decisions about personal finance, and having the knowledge and skills to manage your money effectively. Without financial literacy, it’s easy to fall into the trap of debt and struggle to achieve financial freedom.

Reading books on personal finance is one of the best ways to improve your financial literacy. These books provide valuable insights into money management, debt reduction, and wealth creation. They offer practical advice and real-life examples that can help you make better financial decisions and take control of your financial future.

Understanding Debt and Its Impact on Your Financial Freedom

Debt is a burden that can weigh you down and prevent you from achieving financial freedom. It can limit your options, increase your stress levels, and hinder your ability to build wealth. Understanding debt and its impact is crucial if you want to break free from its chains and start your journey towards financial independence.

Debt comes in many forms, including credit card debt, student loans, mortgages, and car loans. Each type of debt has its own set of challenges and requires a specific approach to pay off effectively. By understanding how debt works and the strategies for managing and eliminating it, you can take the necessary steps to free yourself from its grip.

Book Recommendation 1: “The Total Money Makeover” by Dave Ramsey

- Dave Ramsey (Author)

- English (Publication Language)

- 09/30/2021 (Publication Date)

Dave Ramsey is a renowned personal finance expert and bestselling author. In “The Total Money Makeover,” Ramsey presents a step-by-step plan to help readers get out of debt, save money, and achieve financial freedom. He emphasizes the importance of budgeting, living within your means, and getting rid of debt as quickly as possible.

Ramsey’s book provides practical advice on how to create a budget, save for emergencies, and pay off debt using his debt snowball method. He also shares inspiring success stories of individuals who have followed his plan and transformed their financial lives. “The Total Money Makeover” is a must-read for anyone looking to take control of their finances and break free from the cycle of debt.

Book Recommendation 2: “Debt-Free Forever” by Gail Vaz-Oxlade

- Used Book in Good Condition

- Vaz-Oxlade, Gail (Author)

- English (Publication Language)

- 320 Pages – 04/15/2010 (Publication Date) – The Experiment (Publisher)

Gail Vaz-Oxlade is a personal finance expert and television personality known for her no-nonsense approach to money management. In “Debt-Free Forever,” she offers a comprehensive guide to getting out of debt and staying debt-free for life. Vaz-Oxlade provides practical strategies for budgeting, saving, and paying off debt, along with valuable tips for changing your mindset and behavior around money.

One of the key concepts in Vaz-Oxlade’s book is the “Debt Repayment Plan,” which helps readers prioritize their debts and develop a plan to pay them off systematically. She also addresses common financial pitfalls and offers advice on how to avoid them. “Debt-Free Forever” is an empowering book that will motivate you to take control of your finances and become debt-free.

Book Recommendation 3: “Your Money or Your Life” by Vicki Robin and Joe Dominguez

- Robin, Vicki (Author)

- English (Publication Language)

- 368 Pages – 12/10/2008 (Publication Date) – Penguin Books (Publisher)

In “Your Money or Your Life,” Vicki Robin and Joe Dominguez challenge conventional ideas about money and offer a new perspective on achieving financial independence. The book emphasizes the relationship between money and life energy, encouraging readers to evaluate their spending habits and align their financial goals with their values.

Robin and Dominguez introduce the concept of “money life,” which measures the true cost of purchases in terms of the time and energy required to earn the money. They also provide a nine-step program for transforming your relationship with money, including tips for tracking expenses, calculating your real hourly wage, and achieving financial independence.

Book recommendation 4: “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

- The Surprising Secrets of America’s Wealthy

- Gift item

- This product will be an excellent pick for you

- Thomas J. Stanley (Author)

- English (Publication Language)

“The Millionaire Next Door” is a groundbreaking book that challenges common misconceptions about wealth and offers insights into the habits and behaviors of millionaires. Authors Thomas J. Stanley and William D. Danko conducted extensive research and interviews to identify the key factors that contribute to wealth accumulation.

The book reveals that most millionaires are not flashy spenders or inheritors of wealth but rather hardworking individuals who live frugally, save diligently, and invest wisely. Stanley and Danko provide practical advice on how to build wealth, including tips for controlling spending, choosing the right career, and investing for the long term. “The Millionaire Next Door” is a must-read for anyone looking to understand the mindset and habits of successful wealth builders.

Book Recommendation 5: “Rich Dad Poor Dad” by Robert Kiyosaki

- Kiyosaki, Robert T. (Author)

- English (Publication Language)

- 336 Pages – 04/05/2022 (Publication Date) – Plata Publishing (Publisher)

“Rich Dad Poor Dad” is a personal finance classic that challenges traditional thinking about money and offers a fresh perspective on wealth creation. In the book, Robert Kiyosaki shares his own experiences growing up with two dads – one who was financially successful and one who struggled financially.

Through engaging storytelling, Kiyosaki teaches valuable lessons about financial independence, the importance of financial education, and the power of passive income. He introduces the concept of assets and liabilities and encourages readers to focus on acquiring income-generating assets that can provide financial freedom. “Rich Dad Poor Dad” is an eye-opening book that will inspire you to think differently about money and take control of your financial destiny.

Book Recommendation 6: “The Automatic Millionaire” by David Bach

- Bach, David (Author)

- English (Publication Language)

- 288 Pages – 12/27/2016 (Publication Date) – Crown Currency (Publisher)

In “The Automatic Millionaire,” David Bach presents a simple and practical approach to building wealth. He emphasizes the power of automating your finances and making small changes that can have a big impact over time. Bach introduces concepts like the “Latte Factor” and the importance of paying yourself first.

The book offers a step-by-step plan for achieving financial security and becoming a millionaire, even on a modest income. Bach shares success stories of individuals who have implemented his strategies and achieved financial independence. “The Automatic Millionaire” is a motivating read that will show you how small, consistent actions can lead to significant financial success.

Implementing The Lessons Learned From These Books

Reading these books is just the first step towards achieving financial freedom. To truly benefit from the knowledge and insights they offer, you must take action and implement the lessons learned into your own financial journey.

Start by creating a budget and tracking your expenses. Identify areas where you can cut back and save more money. Set clear financial goals and develop a plan to achieve them, whether it’s paying off debt, saving for a down payment, or investing for retirement.

Stay motivated by regularly revisiting the books and reminding yourself of the principles and strategies they teach. Surround yourself with like-minded individuals who share your financial goals and can provide support and accountability.

Remember, achieving financial freedom is a journey that requires time, effort, and discipline. Stay committed, be patient, and celebrate small victories along the way. With the knowledge and inspiration from these books, you have the tools to transform your financial life and achieve the freedom you desire.

Conclusion

Dealing with debt and achieving financial freedom may seem overwhelming at times, but it is entirely possible with the right knowledge and mindset. The six books recommended in this article are powerful resources that can help you break free from the chains of debt and build a solid financial foundation.

By educating yourself about personal finance, understanding debt, and implementing the strategies outlined in these books, you can take control of your financial future and pave the way to financial freedom. Remember, it’s never too late to start, and every small step you take towards improving your financial situation is a step in the right direction.

So, pick up these must-read books, dive into their pages, and let them guide you on your journey to debt-free living and financial independence. Your future self will thank you for it.