Do you have a check in hand but find yourself uncertain about the process of cashing it? Alternatively, you may have a check but are close by to your bank.

Luckily, there are multiple ways available for cashing a check, and many of them may involve a straightforward visit to a nearby business.

Typically, when you receive payment via a check, you have two choices for accessing your funds: you can either cash the check or deposit it. If immediate access to the money is crucial, determining where to cash a check in your vicinity is essential. Naturally, you’ll also want to identify a location with minimal fees for cashing your check.

Listed below are some of our preferred locations for check cashing.

The Best Options Available For Check Cashing

#1. Bank Listed On The Check

Usually, people choose to cash a check at their bank, following a procedure that involves depositing the check into their bank account and then immediately withdrawing the funds. However, there may be instances where a nearby bank branch is not available to you. In such cases, the alternative is to check if there is a branch of the bank that issued the check within reach. At one of these branches, a bank teller can facilitate a cash withdrawal, provided the check is legitimate.

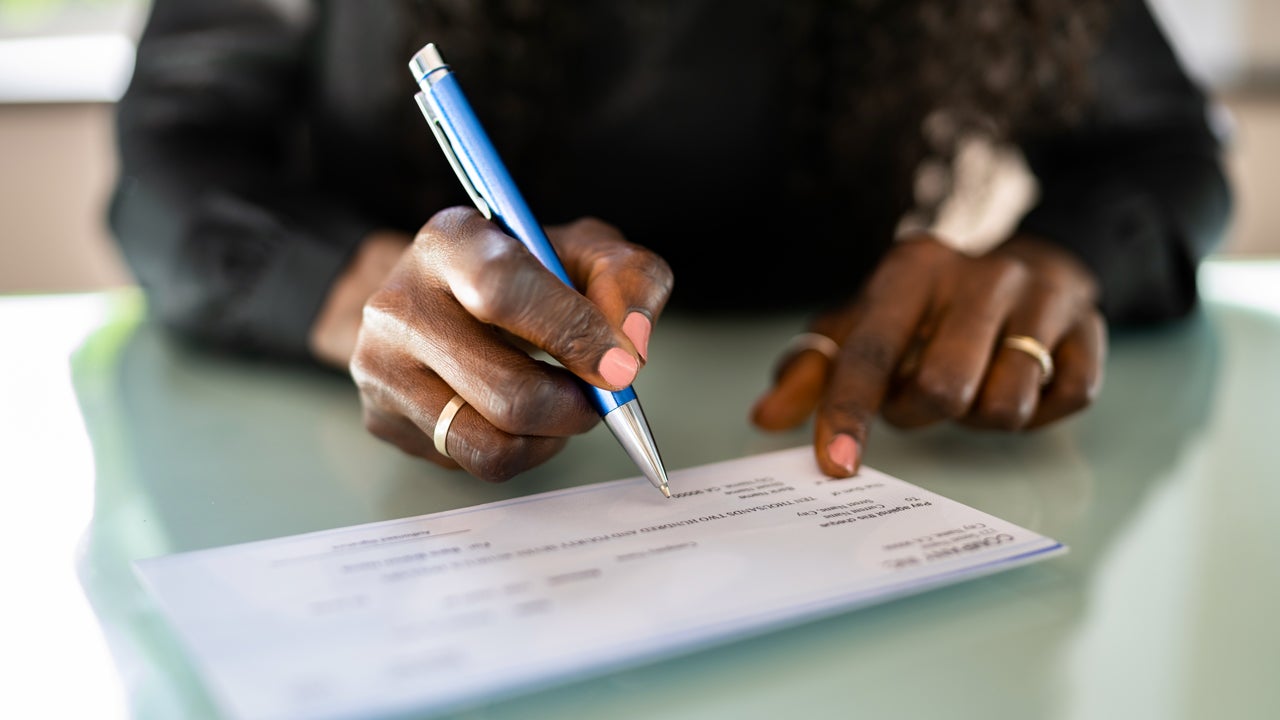

To identify the bank of the check issuer, examine the bottom left corner of the check. The numbers printed in this location represent where the bank account was opened.

To understand the check cashing policy of the issuing bank, simply call or visit the local branch. Upon presenting the check to the bank, they will verify the amount in the issuer’s account and provide you with cash. Some banks may have an additional security measure, such as contacting the issuer to confirm the authenticity of the check before releasing the funds.

Opting for the issuing bank is generally a cost-effective way to obtain cash, comparable to cashing the check at your own bank. Each bank will have its own set of terms and requirements for check cashing, typically involving a flat rate or a percentage of the check. Additionally, you will need to bring at least one form of identification to establish that the check is made out to you.

#2. Cash It Online

If you don’t have a bank account but own a smartphone, there’s a possibility to cash a check online. By downloading apps such as PayPal, you can deposit money from both online and physical checks. Subsequently, you can endorse the check by signing the back and capturing photos of both sides. Once the check is approved, the funds are deposited into your account.

To access these funds, you have the option of using a prepaid card or collecting the money in person at a MoneyGram location. Furthermore, you can utilize the funds in the account to buy gift cards for personal use or resale, such as Amazon gift cards. Many individuals and businesses also accept payments online through your PayPal account, making it advantageous to keep the funds for future transactions.

There are fees associated with depositing a check online, typically involving a base fee of $5. Additionally, amounts exceeding $250 usually incur an extra 2% fee. Therefore, if you’re depositing a $1,000 check, only $980 will be reflected in your PayPal or Ingo account. If you opt to transfer the funds to a prepaid debit card, be aware that you might encounter ATM fees when converting the money to cash.

#3. Walmart Checks

If you lack access to a bank, Walmart could serve as a viable alternative. With over 5,000 locations, the majority of individuals reside within a short distance from a Walmart, making it convenient for check-cashing needs. Most Walmart stores host a check-cashing service that accepts various types of checks, including personal checks, government checks, tax checks, cashier’s checks, payroll checks, money orders, and more. You have the option to receive the funds in cash or load them onto a reloadable Walmart MoneyCard.

Walmart’s fees are relatively reasonable. For cashing a personal check, the minimum fee is $6, and the maximum cashable amount is $200.

Moreover, the cashback limit on a check is generally $5,000 for most of the year, increasing to $7,500 during tax season. Consequently, if you need to cash a larger check, it might be advisable to explore other options. Ensure you bring your government ID to verify that the check is issued to you.

#4. Gas Stations

Numerous gas stations and convenience stores provide exclusive check-cashing solutions. For instance, 7-Eleven collaborates with the Transact company, allowing users to download the app, upload check photos, and then collect their funds at a nearby 7-Eleven. Other convenience stores partner with Vcom to offer comparable services to their patrons. Typically, these options provide a prepaid cash card instead of cash, and it may take up to 48 hours for the funds to be accessible.

Check-cashing services are also commonly available at truck stops and travel centers. However, it’s important to note that not every location offers this service, so it’s advisable to call in advance or be prepared to visit multiple sites if you intend to cash a check at a travel center, gas station, or a similar establishment.

#5. Your Employer

If you possess a payroll check, it’s possible that your employer could facilitate the cashing process. However, due to specific regulations governing payroll, many employers do not provide this service.

The advantage is that if your employer does offer this option, there is no set limit on the dollar amount they can cash. Occasionally, they may even accommodate non-payroll checks, though the legal cap for such transactions is $1,000 per day.

To determine if this is a viable option for you, you can inquire with your Human Resources department or consult your direct supervisor.

Conclusion

When it comes to cashing a check, the most convenient and cost-effective choice is typically through a bank. In case you don’t have a bank account, an alternative could be endorsing the check to someone else who can then deposit the funds and withdraw them on your behalf. While local grocery stores, gas stations, or Walmart may offer check-cashing services, it’s important to note that fees will be incurred to access your funds.

There are various avenues for cashing a check, but it’s advisable to seek methods that minimize fees to maximize your funds. Regardless of the option you choose, exercise caution with your newly acquired cash to prevent any potential loss or theft.