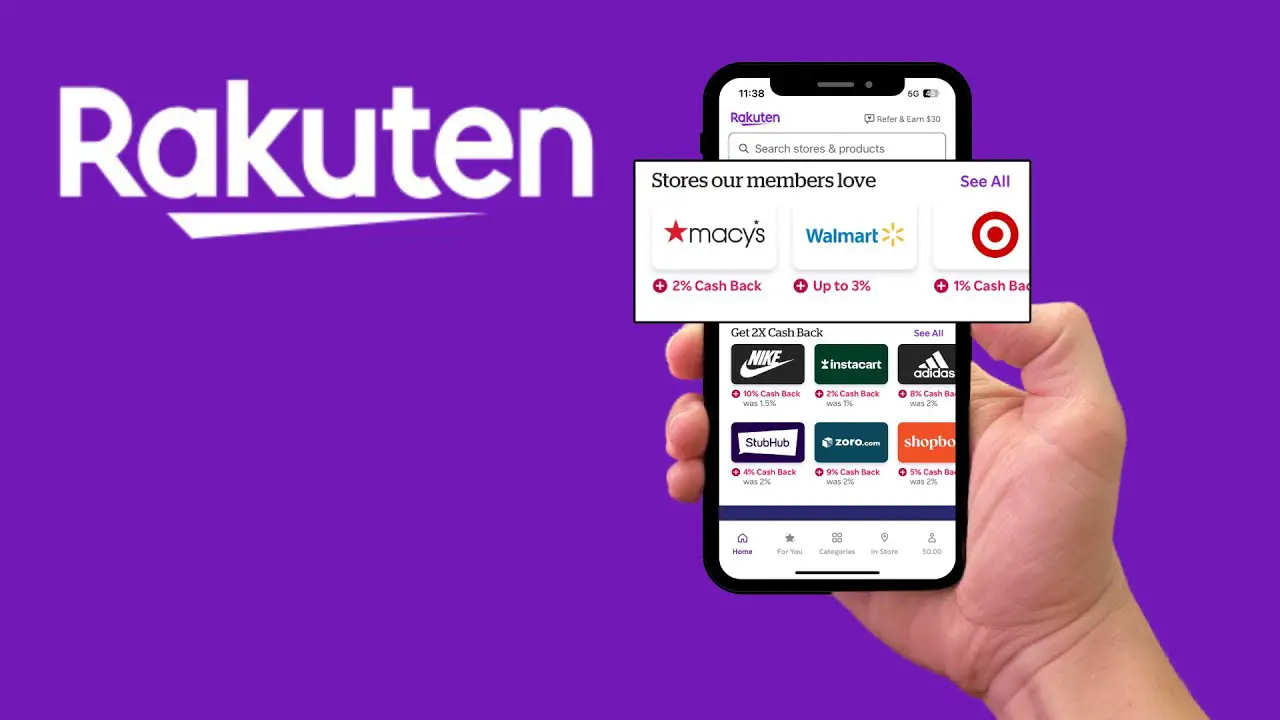

In today’s world where saving money is more important than ever, Rakuten offers a straightforward way to earn cash back on your everyday purchases. With its user-friendly platform, you can turn regular shopping into real savings. This article will guide you through how to make money with Rakuten in 2025, revealing tips and strategies to maximize your cash back and enjoy greater savings.

Understanding Rakuten’s Business Model

How Rakuten Generates Revenue

Rakuten makes money in several ways that might surprise you. The company earns most of its revenue when shoppers click through to partner retailers. Here’s how it breaks down:

- Rakuten gets a commission when a sale happens through its platform.

- It collects small fees when you click on a link to visit a store.

Below is a brief table that sums up these methods:

| Method | Description |

|---|---|

| Commission per Sale | Earned when a purchase is made through Rakuten’s portal |

| Click-Based Earnings | Small fee for every click leading to a partner site |

| Lead Generation | Payment for potential customers signing up for offers |

This revenue model keeps Rakuten growing steadily day by day.

The Role of Affiliate Marketing

Affiliate marketing is the heart of Rakuten’s revenue engine. In basic terms, when you use Rakuten, you help connect buyers with retailers, and the company gets a cut of the sale. This method works a lot like commission-based sales but in a digital format. It’s pretty straightforward: the more someone shops through their links, the more money flows in.

It’s interesting to note that this approach is similar to modern AI digital marketing techniques that many businesses now use. With affiliate marketing, everyone wins: retailers get extra traffic, Rakuten earns commissions, and shoppers receive cash back or discounts.

Benefits for Consumers

Consumers enjoy a range of advantages on Rakuten’s platform. Not only do they get cash back, but they also find engaging promotions and exclusive discounts which make every purchase feel a little like a win. Here are a few benefits they often mention:

- Cashback rewards on everyday purchases

- Access to time-sensitive promotions

- A secure system that tracks purchases for later rewards

Maximizing Cashback Opportunities

Identifying Partner Retailers

Finding the right stores is the first step. You want to make sure you shop at retailers that work with Rakuten because these sites often offer special cash-back rates. Start by checking the current list on the website and update your bookmarks when new partners show up. Here’s a quick list to help:

- Review Rakuten’s partner list regularly

- Compare offered cash-back percentages

- Stay alert for time-limited deals

A small tip: sometimes even local shops join in, so keep an eye out for partner offers that might give you more for the same purchase.

Timing Your Purchases

When you plan your buys, timing is everything. Special periods like holiday sales or seasonal promotions can boost your cash-back rate significantly. Think of your purchase calendar as a tool to get more for less. Below is an example of how rates might shift during the year:

| Season | Example Cash-Back Rate (%) |

|---|---|

| Summer Sales | 5 |

| Holiday Sales | 10 |

| Back-to-School | 7 |

By aligning your shopping with these times, you can see a nice bump in your returns. Plan your buys around promotion periods to earn more. Also, use a note or reminder to check special deals, like the ones available through smart shopping tips.

Using Browser Extensions

A browser extension serves as your safety net when you’re shopping online. It can automatically alert you to active offers and even apply coupon codes. This is an efficient way to ensure you never miss out on extra savings. Consider these steps:

- Install the Rakuten extension in your preferred browser.

- Activate it before starting your online shopping.

- Check the notifications for any last-minute deal updates.

Combining Rewards for Greater Savings

Using Cashback Credit Cards

Taking advantage of cashback credit cards is a great way to add another layer to your savings. When you pay with a card that offers extra back, you can see a small boost in each purchase. Mixing credit card rewards with Rakuten can turn everyday shopping into a fun savings challenge.

- Check for cards that reward specific spending categories.

- Monitor any bonus offers and rotating promotions on your credit card.

- Ensure you pay off your balance to avoid extra fees.

Stacking Promotions

Sometimes the best approach is to combine a few different deals together. By stacking promotions, you can maximize the savings in a single purchase. A few ideas include:

- Using store coupon codes together with Rakuten offers.

- Taking advantage of special promo periods where extra discounts are added.

- Organizing your shopping list to include items from retailers that often run multiple deals at once.

This method can give you a small bump with each purchase, making every transaction add up over time.

Leveraging Seasonal Offers

Seasonal deals offer another angle to add more savings to your total. These offers often step in during times like holiday seasons or back-to-school events, letting you save more than usual. Here’s a quick snapshot:

| Season | Extra Cashback Rate |

|---|---|

| Black Friday | 2% – 3% |

| Holiday Deals | 2% – 4% |

| Back-to-School | 1% – 2% |

- Plan your larger purchases around these times.

- Keep an eye on updates from Rakuten so you don’t miss out on any add-on deals.

- Compare the extra percentages offered to decide when to shop.

Strategies for Everyday Shopping

Everyday shopping doesn’t have to be a chore, especially when you mix in Rakuten savings. You can change your routine into a smart way to save more on the stuff you buy daily. Here are some practical tips segmented into three main areas:

Incorporating Rakuten into Daily Purchases

Make checking Rakuten part of your normal buying habit. Whether you’re buying a morning coffee maker or picking up dinner ingredients, switching to Rakuten for your deals can add up. Try these steps to include it in your routine:

- Open the app or website before each purchase.

- Look for bonus offers especially on familiar brands.

- Use the browser extension to get notified of active deals.

It might seem like one extra step, but small savings on everyday items can really add up over time.

Planning for Big Ticket Items

When you’re eyeing a higher-priced item, timing can be everything. Before making any large purchase, compare Rakuten’s bonus periods and special seasonal rates. Remember to break up orders if needed, so you catch all the available rewards without triggering any extra fees. Here are a few tips when planning big ticket buys:

- Research and note down upcoming promotional periods.

- Split your order if the store policy supports multiple transactions – that might uncover extra discounts.

- Monitor the app for limited-time offers that might boost your cashback percentage.

Using Rakuten daily can change your spending habits in a snap. This way, you do more than just shop; you plan your spending in a way that benefits you financially over the year.

Tracking Your Earnings

It’s not enough to just save money while shopping – keeping track of how much you gain is key. Simple record keeping can help you see patterns in saving and show you where slight tweaks can make a big difference. Consider these methods:

- Maintain a simple spreadsheet with columns for date, item cost, cashback earned, and store name.

- Review your monthly statements on Rakuten to catch any discrepancies or trends.

- Set a reminder once a month to check your total earnings against your spending.

Below is a quick sample of what your tracking table might look like:

| Month | Total Spend | Cashback Earned |

|---|---|---|

| January | $500 | $15 |

| February | $650 | $20 |

| March | $400 | $12 |

Using a mix of planning and consistent monitoring, you can see real-time benefits from even modest purchases. Remember, a little extra time spent managing your rewards goes a long way in bolstering your overall savings.

Navigating Rakuten’s Platform

Setting Up Your Account

Getting started with Rakuten is a breeze. First, head over to the sign-up page, where you simply provide your basic info and hit the register button. It sounds simple, but make sure you follow these steps:

- Fill in your personal details.

- Confirm your email via the link sent to you.

- Log in and complete your profile setup.

Your account setup is the first step to start earning back money.

Activating Cashback Offers

Once your account is ready, the next step is activating cashback deals. When you click through to a partner site, a cashback offer gets queued in the background. It doesn’t take long to see the offer flag on your screen. Here’s how you can stay on track:

- Always check that the offer is active before you add items to your cart.

- Use the Rakuten browser extension to receive instant reminders about available cash back.

- Review your cart at checkout to ensure the offer has been applied.

An overview of how you can access your cashback options is shown in the table below:

| Access Method | Benefit |

|---|---|

| Browser Extension | Instant offer alerts |

| Mobile App | Quick and on-the-go activation |

| Desktop Website | Straightforward navigation |

Understanding Payment Methods

The way Rakuten pays you is straightforward. Typically, cash back is transferred into your account once your earnings hit a small minimum. There are two common methods:

- Check: A physical check is mailed to your address every few months.

- PayPal: For a faster option, earnings can be sent directly to your PayPal account.

- Keep an eye on your earnings; payment usually happens on a quarterly basis after you pass the threshold (around $5).

Tips for New Rakuten Users

Getting Started with Rakuten

To begin with Rakuten, start by registering on the site or app. The simple process involves creating an account with your email or social sign-ins. Once registered, add a few basic details and choose your payment method. Signing up takes only a few minutes.

It’s a good idea to install the Chrome extension which automatically applies available deals when you shop online. Here’s a quick step list:

- Visit the Rakuten site or use the app.

- Complete the registration form.

- Select your payment preference (check or PayPal).

- Activate any notifications to hear about new offers.

Avoiding Common Mistakes

New users sometimes run into issues by not reading the fine print or mixing coupons that don’t work well together. Keep these pointers in mind:

- Don’t use coupon codes from random sites; stick with the official listings.

- Watch out for deadlines on promotions.

- Review transaction terms to avoid any payment hitches.

Below is a short table outlining common errors and what you can do instead:

| Mistake | Correction |

|---|---|

| Using conflicting coupon codes | Use only store-official or Rakuten codes |

| Ignoring offer expiry dates | Check promotion periods before purchasing |

| Overlooking payment details | Verify if you’re using the right method |

Always remember to be careful when combining offers, and double-check everything before finalizing your purchase.

Making the Most of Your Membership

After setting up your account, maximize benefits by routinely checking the app for updates and special deals. Arrange your shopping so that you can combine different rewards and promotions as they come.

One tip to keep in mind: set aside a few minutes weekly to review your earnings and promotions. A little attention can turn your everyday spending into regular savings.

Remember that organized tracking and a clear plan are key. A mix of alert settings, a proper spending routine, and follow-ups ensures you never miss a deal. Stay proactive and enjoy watching your rewards add up over time.

Evaluating Your Earnings Potential

Factors Influencing Your Cash Back

Your cashback earnings aren’t just a roll of the dice. It comes down to where you shop, when you shop, and how much you spend. Different stores offer different rates, and promotions can change how much back you get over the year. Here are some factors to keep in mind:

- Store categories and seasonal deals

- Timing of purchases during special events

- Using special credit cards or bonus offers

Sometimes, a small adjustment like choosing a partner retailer during a promotional period can make a big difference in your overall earnings. This can even be a neat way to test out a few new spending habits or check out new deals you might otherwise miss.

Estimating Annual Returns

Figuring out your yearly cashback isn’t hard when you break down your spending. You can look at past purchases, current rebate offers, and even check out current company trends like growth trends. Below is a simple table that outlines different spending scenarios and what they might mean for your annual returns:

| Spending Type | Average Cashback Rate | Estimated Annual Savings |

|---|---|---|

| Budget Shopper | 1-2% | $10-$40 per $1000 spent |

| Moderate Spender | 2-4% | $20-$80 per $1000 spent |

| High Roller | 3-6% | $30-$120 per $1000 spent |

Your personal numbers will depend on your habits and the deals you use, so think of these as rough guidelines rather than guarantees.

Setting Realistic Expectations

When planning your cashback strategy, it helps to stay grounded. Remember that cashback returns vary widely and your results might not match the highest estimates.

To wrap up, carefully tracking your purchases and reviewing deals regularly can help you enjoy consistent extra savings over time. Adjust your approach as needed, and let your spending be guided by clear, realistic numbers.

Wrapping It Up: Your Path to Savings with Rakuten

So, there you have it. Using Rakuten can really help you save some cash while you shop. It’s not going to make you rich overnight, but those little bits of cashback can add up over time. Just think about all the stuff you buy regularly—groceries, clothes, gadgets. If you’re smart about it and remember to check Rakuten first, you could see some nice returns. Plus, it’s super easy to use. Just sign up, activate your offers, and start shopping. Before you know it, you’ll be getting money back on things you were going to buy anyway. So why not give it a shot? You might be surprised at how much you can save.

How can I earn cash back with Rakuten?

You can earn cash back by shopping through Rakuten’s links at partner retailers. Make sure to activate the offers before you check out.

Can I use Rakuten for in-store purchases?

Yes, you can link your credit or debit card to Rakuten and earn cash back when you shop at certain stores in person.

What types of stores are partnered with Rakuten?

Rakuten partners with many popular stores, including clothing, electronics, and travel companies, allowing you to earn cash back on a wide range of purchases.