In “I Will Teach You to Be Rich,” Ramit Sethi shares practical advice on managing money and living a fulfilling life. This book is not just about accumulating wealth; it’s about creating a financial system that allows you to enjoy what you love while minimizing unnecessary expenses. Here are some key takeaways that can help you on your financial journey.

Key Takeaways

- Focus on the big financial decisions that really matter, like increasing your income and reducing major expenses.

- Automate your savings and bills to make managing finances easier and stress-free.

- Spend on what truly brings you joy while cutting back on things that don’t matter to you.

- Invest early and wisely to make the most of your money over time.

- Build a financial plan that supports your goals and allows you to live a rich and meaningful life.

- Key Takeaways

- Understanding the Philosophy of ‘I Will Teach You to Be Rich’

- Optimizing Your Credit Cards for Maximum Benefits

- Mastering the Art of Conscious Spending

- Automating Your Finances for Stress-Free Management

- Increasing Your Income Through Strategic Career Moves

- Investing Wisely for Long-Term Financial Growth

- Final Thoughts

Understanding the Philosophy of ‘I Will Teach You to Be Rich’

Ramit Sethi’s book, I Will Teach You to Be Rich, is not just about making money; it’s about creating a rich life. This means focusing on what truly matters to you and spending your money accordingly. Sethi emphasizes that it’s more important to take action than to have all the answers.

The Concept of a Rich Life

A rich life is defined by your personal values and goals. It’s about enjoying your money while also being smart with it. Here are some key points:

- Define what a rich life means to you.

- Focus on experiences over things.

- Invest in your passions.

Behavior Over Information

Sethi argues that behavior is more important than just having information. Many people know what to do but don’t act on it. To change your financial situation, consider these steps:

- Start small. Make small changes that lead to bigger results.

- Automate your finances. Set up systems that work for you without constant effort.

- Learn from mistakes. It’s okay to make errors as long as you keep moving forward

Personalization and Flexibility

Everyone’s financial journey is different. Sethi encourages readers to personalize their approach:

- Adapt strategies to fit your life.

- Be flexible with your plans. What works for one person may not work for another.

- Focus on your unique goals.

Optimizing Your Credit Cards for Maximum Benefits

Setting Up Autopay

Setting up autopay for your credit card bills is a smart move. This way, you never miss a payment, and you avoid late fees. Here are some steps to follow:

- Log into your credit card account.

- Find the autopay option.

- Choose the amount to pay (minimum or full balance).

Negotiating Fees and APR

Don’t be afraid to negotiate with your credit card company. You can ask them to waive fees or lower your APR. Here’s how:

- Call customer service and explain your situation.

- Mention any competitor offers you’ve seen.

- Be polite but firm in your request.

Leveraging Credit Card Rewards

Using multiple cards can help you maximize your rewards. Split your spending across different cards to earn more benefits. For example:

| Card Type | Reward Rate |

|---|---|

| Flat-rate Cash Back | 2% |

| Category-Specific Card | 6% on groceries |

Mastering the Art of Conscious Spending

Spending on What You Love

To truly master conscious spending, focus on what brings you joy. Here are some tips to help you:

- Identify your passions and interests.

- Allocate more of your budget to these areas.

- Cut back on expenses that don’t matter to you.

By spending on what you love, you create a richer life.

Cutting Costs on Non-Essentials

It’s important to reduce spending on things that don’t add value to your life. Consider these strategies:

- Review your subscriptions and cancel those you don’t use.

- Limit dining out and cook at home more often.

- Avoid impulse purchases by waiting 24 hours before buying.

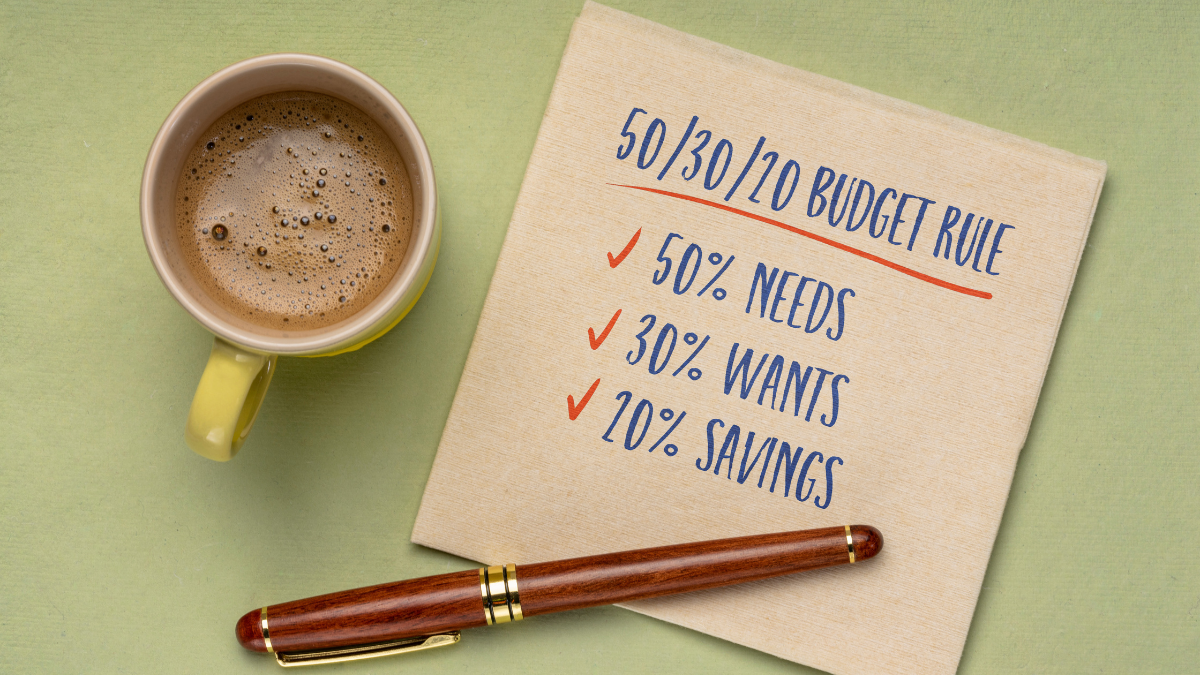

Creating a Conscious Spending Plan

A conscious spending plan helps you track your money and prioritize your spending. Here’s how to start:

- Use a budgeting tool to see where your money goes.

- Decide what you love enough to spend on.

- Cut costs on things that don’t matter to you.

Automating Your Finances for Stress-Free Management

Setting Up Automated Savings

Automating your savings is a smart way to ensure you are consistently putting money aside. Here are some steps to get started:

- Choose a savings account that offers a good interest rate.

- Set up an automatic transfer from your checking account to your savings account each month.

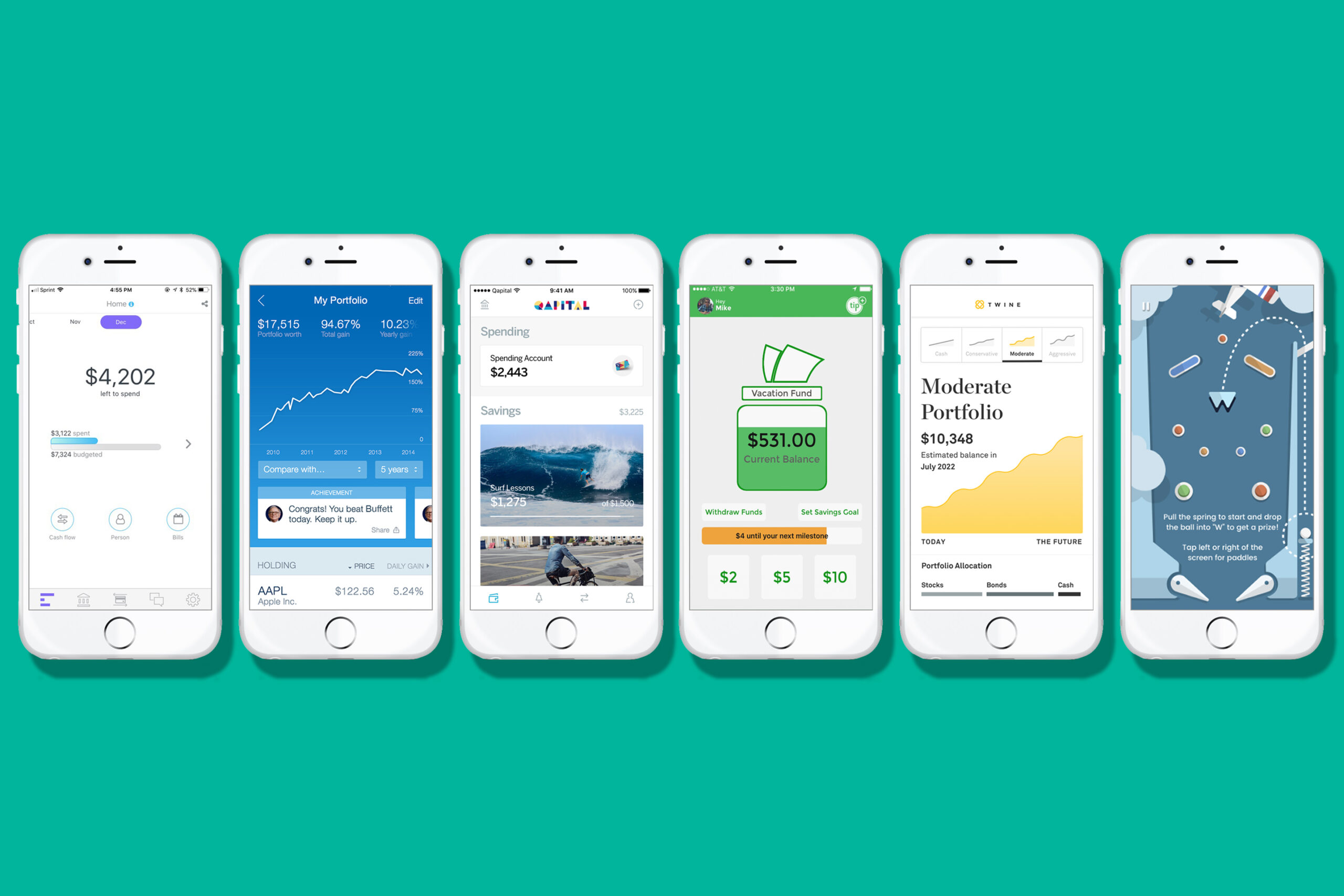

- Consider using the best budgeting apps of November 2024 to track your progress.

Automating Bill Payments

Paying bills on time is crucial to avoid late fees. Here’s how to automate this process:

- List all your monthly bills, including utilities, rent, and subscriptions.

- Set up autopay for each bill through your bank or the service provider’s website.

- Make sure to keep enough money in your account to cover these payments.

Investing Automatically

Investing can be daunting, but automating it makes it easier. Follow these steps:

- Open a Roth IRA or a 401(k) account if you haven’t already.

- Set up automatic contributions to these accounts each month.

- Use a robo-advisor to manage your investments automatically.

Increasing Your Income Through Strategic Career Moves

Negotiating a Raise

One of the quickest ways to boost your income is by negotiating a raise. Here are some steps to help you:

- Research your worth: Find out what others in your position earn.

- Prepare your case: List your achievements and contributions.

- Practice your pitch: Rehearse what you will say during the meeting.

Developing New Skills

Investing in yourself is crucial. Consider these options:

- Online courses: Websites like Coursera or Udemy offer many affordable classes.

- Certifications: Earning a relevant skill certificate can make you more marketable.

- Networking: Connect with professionals in your field to learn about new opportunities.

Exploring Entrepreneurship

Starting your own business can be a rewarding way to increase your income. Here are some ideas:

- Freelancing: Use your skills to offer services on platforms like Upwork.

- E-commerce: Sell products online through sites like Etsy or Amazon.

- Consulting: Share your expertise with others in your industry.

Investing Wisely for Long-Term Financial Growth

The Importance of Starting Early

Starting to invest as soon as possible is crucial. The earlier you begin, the more time your money has to grow. This is due to the power of compound interest, which means your money earns interest on itself over time.

Choosing the Right Investment Accounts

To invest effectively, you should open two main types of accounts:

- 401(k) Account: If your employer offers a match, contribute enough to get the full benefit. This is essentially free money!

- Roth IRA: This account allows your money to grow tax-free, which can be a significant advantage in the long run.

Diversifying Your Investment Portfolio

Diversification is key to reducing risk. Instead of putting all your money into individual stocks, consider investing in index funds. These funds track a market index and provide a safer way to invest. Here’s a simple table to illustrate:

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Individual Stocks | High | High |

| Index Funds | Medium | Medium |

| Bonds | Low | Low |

Final Thoughts

Investing wisely is about making informed choices and starting early. By setting up the right accounts and diversifying your investments, you can build a strong financial future.

Remember, money is a tool to help you achieve your goals. Start investing today to secure your tomorrow!