Money can be a touchy subject. It’s important for daily living, but not having enough can lead to significant stress. The absence of funds or an overwhelming amount of debt can lead to negative and destructive thinking about finances. Once these thoughts take root, they can impact your financial situation in ways you may not even realize. Constant worry about money can cause you to unknowingly sabotage your ability to earn more or get out of debt. On the other hand, completely ignoring your finances can only worsen your situation. That’s why it’s crucial to shift your mindset. Below are some tips to help you develop having a money mindset.

1. Let Go of Past Financial Mistakes

Nobody is perfect, and chances are you’ve made a few poor financial choices over time. Maybe you overspent on rent for a dream home or indulged in too many shopping sprees, leading to maxed-out credit cards. Whatever those past decisions may be, they are in the past. While you might still be dealing with the consequences, it’s important not to dwell on them. Money can be tricky, and many of us are left to figure it out through trial and error. The key is to learn from past mistakes and practice self-forgiveness.

Shift your perspective on past financial missteps. If you’re dealing with debt, think about the experiences that led to it—nights out with friends, vacations, or an education you invested in. Yes, those decisions might have led to debt, but they also brought you joy and memorable experiences. While you shouldn’t romanticize it, remember that it served a purpose. It’s not an enemy to be feared, but something you can work towards eliminating while improving your financial future.

2. Examine Your Financial Thoughts and Feelings

You might think you understand your own money mindset, but a deeper look could reveal interesting patterns. Try this exercise: for a full day, note down your thoughts and feelings after every financial decision or purchase. How do you feel? What’s going through your mind? Be honest and thorough.

At the end of the day, review your notes with an open mind. You might realize that certain financial choices are stressing you out more than you thought, or that a purchase you expected to bring happiness left you feeling guilty instead. It’s important to assess how your spending habits are impacting your emotions and overall mental health.

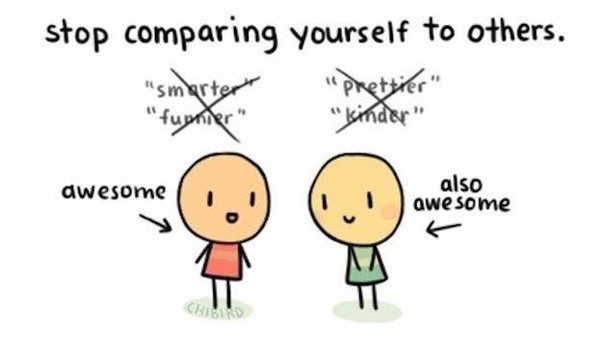

3. Stop Comparing Yourself to Others

Comparison is one of the most harmful things you can do in life, and that includes in the realm of finances. Comparing yourself to someone else, especially those you don’t truly know, can be misleading. Social media shows only curated highlights of others’ lives, leaving out the struggles, debt, and hard times. For example, you might see someone posting about lavish vacations or expensive items, but you don’t know if they’re deep in debt or struggling with overdue bills. It’s easy to be deceived by what others choose to share and overlook the parts they don’t. Comparing yourself to their highlight reel will only make you feel worse about your own financial journey.

Even when comparing yourself to friends or family, you’re still making assumptions. You can never fully understand their financial situation or decision-making process. And when you feel like you’re not measuring up, discouragement can set in, causing you to focus on your perceived failures instead of your progress. This negative thought pattern can hold you back from achieving your financial goals.

4. Build Healthy Financial Habits

Don’t shy away from confronting your finances. Set aside time each week to review your bills, budget, and spending habits. Identify areas for improvement and celebrate your wins, no matter how small. Avoidance will only make your financial issues more overwhelming. Instead, face them head-on with courage and determination.

Set achievable goals and reward yourself for reaching milestones. Your financial challenges didn’t arise overnight, and neither will your success. Breaking down your larger goals into smaller, actionable steps will help you feel more accomplished and motivated.

5. Create a Budget That Works for You

Many people view budgets as restrictive or limiting, but they don’t have to be that way. A flexible budget can help you stay on track with your spending while still allowing room for fun and rewards. As a general guideline, allocate half of your income to cover essentials like bills.

Set aside 20% for paying off debt or building savings. The remaining 30% is for personal spending. If this allocation feels difficult to maintain, it might be time to assess your expenses and consider cutting back where possible.