Looking to enhance your wealth and safeguard your investments? Portfolio diversification might just be the key. In this article, we will explore the benefits of portfolio diversification and why it is considered a fundamental strategy for successful investors.

When it comes to investing, putting all your eggs in one basket can be a risky game. By diversifying your portfolio, you spread out your investments across different asset classes, sectors, and geographies. This approach helps to mitigate risk by reducing the impact of any one investment on your overall portfolio.

- The Importance of Diversification in Investment Portfolios

- Diversification Strategies for Different Types of Investors

- Benefits of Portfolio Diversification

- Historical Examples of the Impact of Diversification on Investment Returns

- How to Diversify Your Portfolio Effectively

- Common Mistakes to Avoid When Diversifying Your Portfolio

- Tools and Resources for Portfolio Diversification

- The Role of Professional Financial Advisors in Portfolio Diversification

- Conclusion

The Importance of Diversification in Investment Portfolios

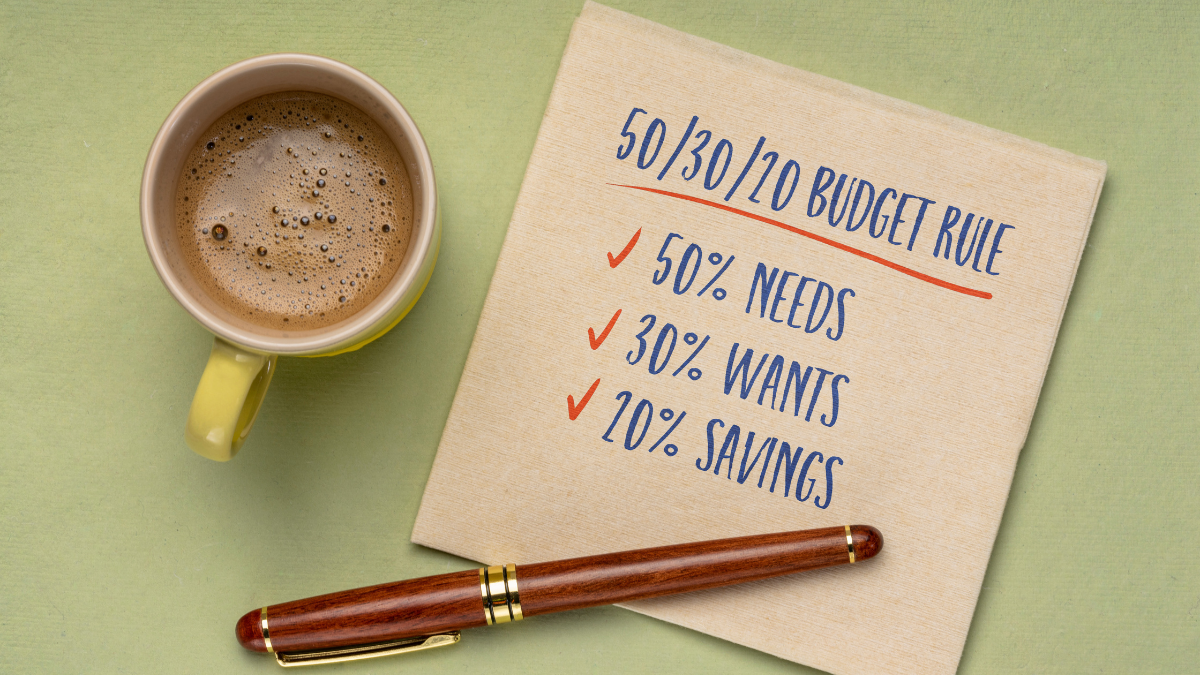

Portfolio diversification is the practice of spreading investments across various asset classes, such as stocks, bonds, real estate, and commodities. It is based on the principle that different assets perform differently under different market conditions. By diversifying your portfolio, you can reduce the risk of significant losses if one particular investment performs poorly.

Diversification can also be achieved within each asset class by investing in different sectors and geographies. For example, within the stock market, you can invest in companies from various industries and regions. This further reduces the impact of any one company or sector’s performance on your portfolio.

The key to effective portfolio diversification is finding the right balance between risk and reward. By investing in a mix of assets with varying levels of risk and return potential, you can create a portfolio that aligns with your financial goals and risk tolerance.

Diversification Strategies for Different Types of Investors

Diversification is essential for investment portfolios for several reasons. First and foremost, it helps to reduce the overall risk of your investments. By spreading your investments across different asset classes, sectors, and geographies, you can minimize the impact of any single investment on your portfolio.

Another important aspect of diversification is its potential to improve investment returns. Different asset classes tend to perform differently under varying market conditions. By diversifying, you can take advantage of the growth potential of different assets and increase your chances of achieving higher returns.

Furthermore, diversification can provide stability and predictability to your investment performance. While some investments may underperform at a certain period, others may outperform. By diversifying, you can smooth out these fluctuations and potentially achieve more consistent returns over time.

Benefits of Portfolio Diversification

Diversification strategies can vary depending on an investor’s goals, risk tolerance, and time horizon. Here are a few common diversification strategies for different types of investors:

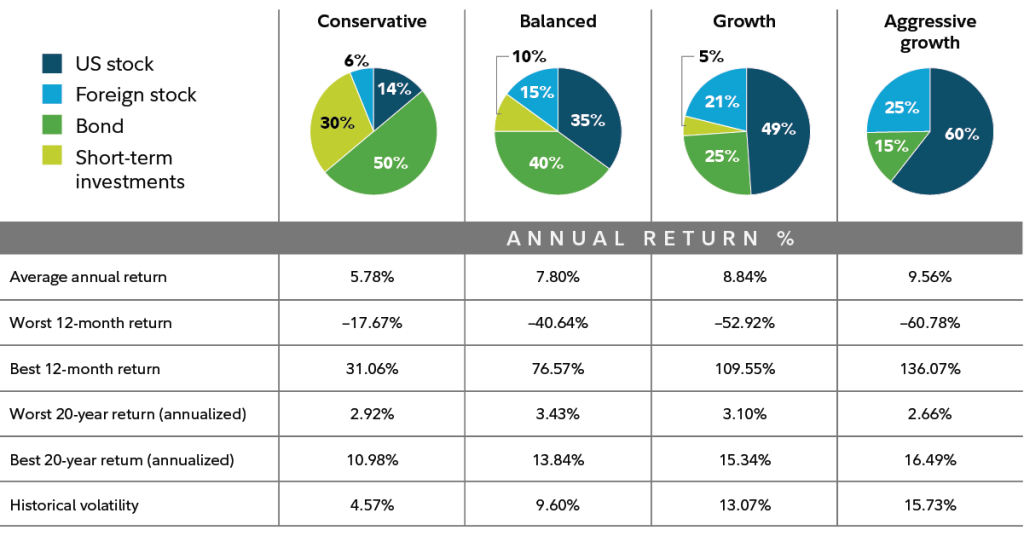

- Asset Allocation: This strategy involves dividing your investments among different asset classes, such as stocks, bonds, and cash. The allocation should be based on your risk tolerance and investment objectives.

- Sector Diversification: By investing in different sectors, you can reduce the impact of any one sector’s performance on your portfolio. For example, if you have a significant portion of your portfolio in the technology sector, you may consider diversifying into other sectors like healthcare or consumer goods.

- Geographic Diversification: Investing in different countries and regions can help reduce the risk associated with a particular country’s economic or political factors. By diversifying globally, you can take advantage of growth opportunities in different markets.

- Asset Class Diversification: This strategy involves investing in a variety of asset classes, such as stocks, bonds, real estate, and commodities. By spreading your investments across different asset classes, you can reduce the risk of being heavily dependent on one asset class.

Historical Examples of the Impact of Diversification on Investment Returns

There are several benefits of portfolio diversification that make it a crucial strategy for investors:

- Risk Mitigation: Diversification helps to reduce the risk of significant losses by spreading investments across different asset classes, sectors, and geographies. This can help protect your portfolio from the negative impact of any one investment.

- Potential for Increased Returns: By investing in a variety of assets, you can take advantage of different market conditions and capitalize on opportunities for growth. Diversification allows you to participate in the potential upside of different investments.

- Stable and Predictable Performance: Diversification can help smooth out the fluctuations in investment returns. While some investments may underperform, others may outperform, resulting in a more stable and predictable overall portfolio performance.

- Protection Against Market Downturns: During market downturns, losses in one asset class may be offset by gains in another. This provides a cushion for your portfolio and helps protect your investments during challenging market conditions.

- Flexibility and Adaptability: Diversification allows you to adapt to changing market conditions and adjust your portfolio accordingly. It gives you the flexibility to take advantage of new investment opportunities while managing risk.

How to Diversify Your Portfolio Effectively

History has shown the positive impact of diversification on investment returns. One famous example is the performance of the S&P 500 index compared to individual stocks. Over the long term, the S&P 500 index, which is a diversified portfolio of 500 large-cap U.S. stocks, has outperformed the majority of individual stocks.

Another historical example is the impact of diversification during the 2008 financial crisis. Investors who were heavily concentrated in real estate or financial stocks faced significant losses. However, those who had diversified portfolios that included other asset classes, such as bonds or international stocks, fared better during the crisis.

These examples highlight the importance of diversification in mitigating risk and potentially enhancing investment returns.

Common Mistakes to Avoid When Diversifying Your Portfolio

Diversifying your portfolio effectively requires careful planning and consideration. Here are some key steps to help you diversify your portfolio:

- Define Your Investment Goals: Determine your financial goals, risk tolerance, and time horizon. This will guide your diversification strategy.

- Assess Your Current Portfolio: Evaluate your existing investments and identify any concentration risks or gaps. This will help you determine which areas of your portfolio need diversification.

- Determine Your Asset Allocation: Decide how much of your portfolio you want to allocate to different asset classes, such as stocks, bonds, and cash. Consider your risk tolerance and investment objectives when making these decisions.

- Research and Select Investments: Research different asset classes, sectors, and geographies to identify investment opportunities that align with your diversification goals. Consider factors such as historical performance, risk profile, and correlation with your existing investments.

- Monitor and Rebalance: Regularly review your portfolio and make adjustments as necessary. Rebalance your portfolio periodically to maintain your desired asset allocation and ensure that it aligns with your investment goals.

Tools and Resources for Portfolio Diversification

While diversification can be beneficial, there are some common mistakes that investors should avoid:

- Overdiversification: Holding too many investments can lead to diluted returns and increased complexity. It’s important to strike a balance between diversification and maintaining a manageable portfolio.

- Lack of Research: Investing in unfamiliar assets or sectors without proper research can be risky. It’s essential to understand the fundamentals and risks associated with any investment before adding it to your portfolio.

- Neglecting Risk Management: Diversification alone is not enough to manage risk. Consider other risk management strategies, such as setting stop-loss orders or using hedging techniques, to protect your portfolio.

- Ignoring Changing Market Conditions: Market conditions can change rapidly. It’s important to regularly review and adjust your portfolio to adapt to new opportunities and mitigate risks.

The Role of Professional Financial Advisors in Portfolio Diversification

There are several tools and resources available to help investors diversify their portfolios effectively:

- Online Brokerage Platforms: Many online brokerage platforms offer tools and resources to help investors build diversified portfolios. These platforms often provide asset allocation models and investment screening tools.

- Financial News and Research Websites: Websites like Bloomberg, Morningstar, and Yahoo Finance provide valuable market insights and research reports that can help investors make informed investment decisions.

- Financial Advisors: Professional financial advisors can provide personalized guidance and recommendations based on your individual financial situation and goals. They can help you develop a diversified portfolio and manage it effectively.

- Investment Books and Publications: There are many books and publications available that cover the topic of portfolio diversification. These resources can provide valuable insights and strategies for building a diversified portfolio.

Conclusion

While investors can diversify their portfolios on their own, professional financial advisors play a crucial role in portfolio diversification. They have the knowledge and expertise to assess an investor’s financial situation, risk tolerance, and investment goals. They can provide personalized advice and recommendations on how to effectively diversify a portfolio.

Financial advisors can also help investors navigate complex financial markets and identify investment opportunities that align with their diversification goals. They can monitor and rebalance portfolios regularly, ensuring that they remain aligned with an investor’s objectives.

Ultimately, the role of a financial advisor is to provide guidance and support to investors, helping them make informed decisions and achieve their financial goals.